Product

August 19, 2013

Iron Ore Spot Prices (China) Defying Forecasts

Written by Sandy Williams

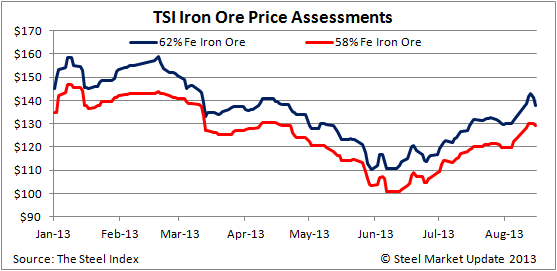

Iron ore prices continue to rise this month despite forecasts for a sharp correction in the last half of the year. The Steel Index reported 62% iron ore fines at Tianjin Port on August 14 was at a five month high of $142.8—a meteoric rise of more than 28 percent from $110.9/dry tonne on June 12. June 16 prices dipped slightly lower to $137.9/dry ton but, despite day-to-day fluctuations, the trend has been overwhelmingly upward.

One of our Asian Trading Company sources had the following to say about the increases:

No one has any freaking idea why the prices are being generated upwards. There was 1-2 Tenders taken and the Indices used those to exaggerate the market for the past 3-4 days. Now, the real cooling off is transpiring as no more tenders are being taken. Those taken were Trading Houses/Importers and not Mills, so here we see that Traders were the culprits of the past 3-4 days, not Mills. Platts was down USD2/dmt yesterday and expected downwards for the next week as there is NO REASON for the increases. Yes, Port stocks are down and some transactions were for early Sept. cargos by Traders and like the Stock Markets today, any little breathe of optimism is taken as a REBOUND and LIGHT AT THE END OF THE TUNNEL, but it just ain’t happening.

Despite forecasts for a slowdown in China, recent announcements of increased public projects to meet a 7.5 percent GDP goal in 2013, translates to higher industrial activity and raw materials demand. In July, a record 73 million tons of iron ore was shipped to China indicating steel is still in strong demand. After keeping ore inventories lean in hopes of better pricing, restocking is pushing prices even higher.

The upward pricing trend has analysts revising predictions that increased capacity at iron ore mines will drive a supply glut that will drop prices back into the $100 range before the end of the year. New forecasts see a softer drop to around $120/tonne.