Product

August 16, 2013

Canadian MSCI Service Center Data

Written by Brett Linton

Canadian shipments for all steel products in the month of July were 459,400 net tons, an increase of 1.3 percent from the month before but a decrease of 2.5 percent from July 2012. Inventory at the end of the month stood at 1,462,600 tons, a decrease of 1.5 percent from last month and a decrease of 10.5 percent from the same month one year ago.

The daily average receipt rate for July was 19,895 tons (22 day month), down from 20,824 tons the month before (20 day month). July receipts were 21,160 tons higher than June totals. According to the MSCI, total months on hand stood at 3.2 months (unadjusted) or 3.1 months on a seasonally adjusted basis.

Flat Rolled

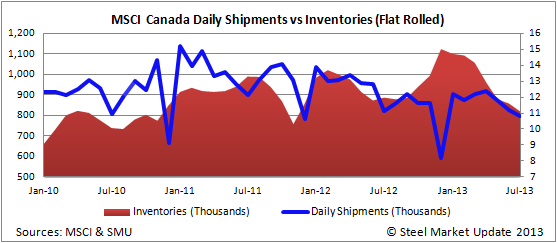

Canadian shipments of flat rolled products for the month of July were 237,200 tons, an increase of 6.1 percent from the month before and an increase of 2.0 percent from July 2012. Inventories at the end month were 820,000 tons, a decrease of 4.4 percent from last month and a decrease of 7.5 percent from the same month one year ago. The daily receipt rate for July was 9,070 tons, down from 10,128 tons the month before. Total tons received were 199,200, down from 202,100 the month before. Flat rolled inventories stood at 3.5 months (unadjusted) or 3.3 months on a SA basis.

Plate

Canadian shipments for plate products in the month of July were 87,000 tons, a decrease of 2.5 percent from the month before and a decrease of 5.5 percent from July 2012. Inventories at the month were 264,800 tons, an increase of 5.7 percent from last month but a decrease of 19.6 percent from the same month one year ago. The daily average receipt rate for July was 4,657 tons, up from 3,915 tons the month before. Plate inventories stood at 3.0 months on both an unadjusted and SA basis.

Pipe and Tube

Canadian shipments for pipe and tube products in the month of July were 49,900 tons, a decrease of 7.4 percent from the month before and a decrease of 7.2 percent from July 2012. Inventories at the end of the month were 130,300 tons, a decrease of 1.0 percent from last month and a decrease of 5.4 percent from the same month one year ago. The daily average receipt rate for July was 2,240 tons, down from 2,690 tons the month before. Pipe and tube inventories stood at 2.6 months (unadjusted) or 2.5 months on a SA basis.