Product

August 13, 2013

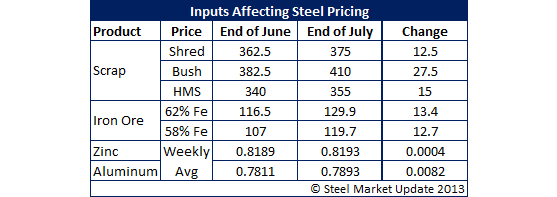

Input Costs Affecting Pricing: Iron Ore, Scrap, Zinc, Aluminum

Written by John Packard

The domestic steel mills paid more for their scrap during the month of July than the month prior. The higher scrap inputs were one reason behind the domestic mills announcing more price increases as the month progressed.

Spot iron ore (China) pricing rose during the month of July and ended the month with 62% Fe fines at $129.9/dmt up $13.4 for the month.

Zinc and Aluminum prices, which impact coated steel products, had minimal movement during the month of July and should not impact prices as we move into August.

.png)