Product

August 12, 2013

Increased Consumer Spending & Confidence Will Take Years

Written by Brett Linton

By Peter Wright

We know that steel demand is related to GDP which is heavily influenced by consumer spending. Spending is driven by income and both the perception of current debt and willingness to take on more. The Federal Reserve reports of personal income and credit outstanding are important pieces of the jigsaw puzzle of steel demand, past present and future.

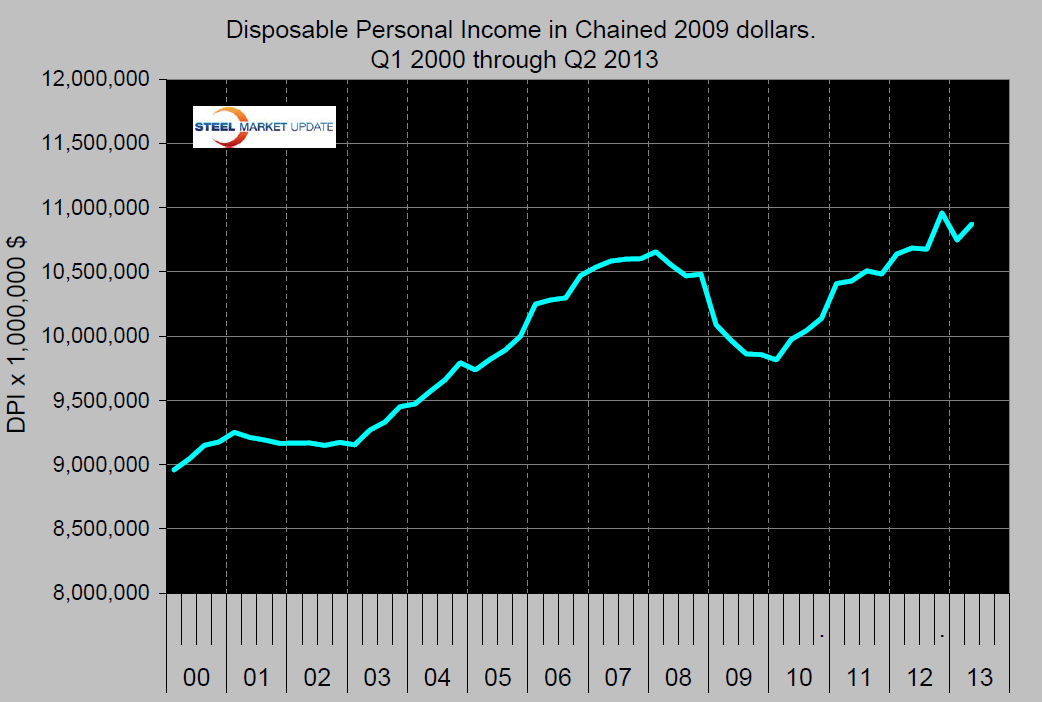

The first half of this year has seen some major swings in consumer’s credit behavior. As expected the federal employment tax increase took a bite out of consumer’s income in Q1 2013 which fell more sharply than at any time since the recession. The second quarter saw a partial recovery (Fig 1), but an examination of disposable personal income, (DPI) per capita shows a different story. If we look at the growth of DPI on a rolling five year basis, in the ten years before the recession consumers enjoyed an income growth per capita of over 10 percent.

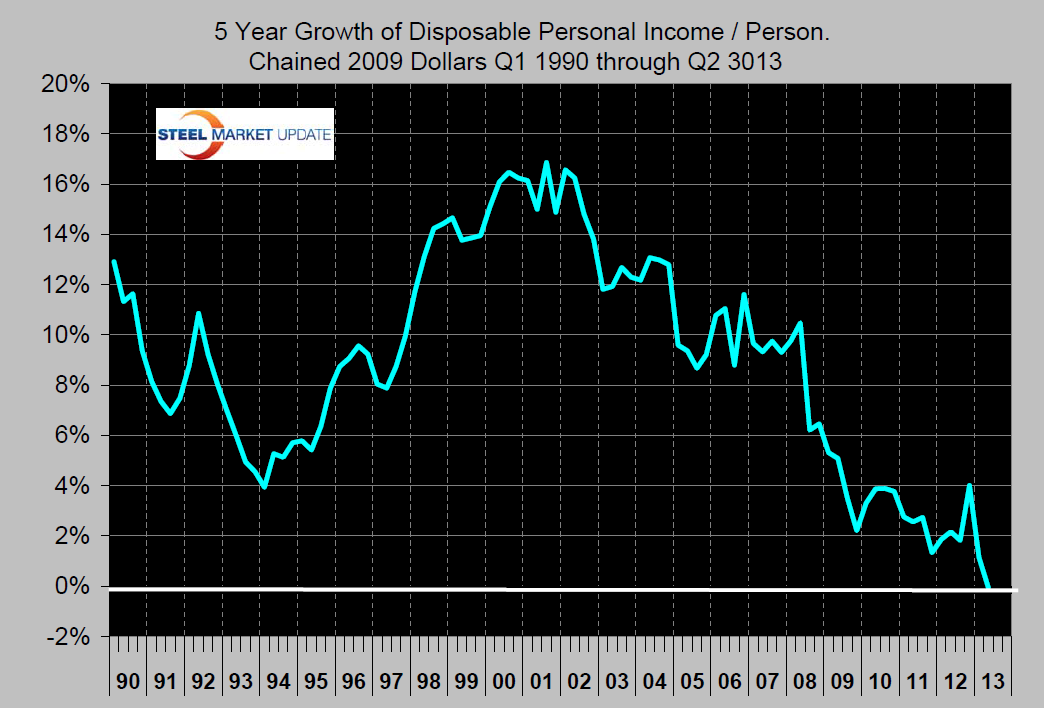

In the five years since Q2 2008 this measure went negative for the first time since our records begin in 1975 (Fig 2). This statistic is affected strongly by the type of jobs being created. The headline improvement in non-farm employment growth is encouraging but underlying those numbers is the ratio of full time/part time job creation and the low paying nature of a high proportion of the new jobs in service industries.

In the five years since Q2 2008 this measure went negative for the first time since our records begin in 1975 (Fig 2). This statistic is affected strongly by the type of jobs being created. The headline improvement in non-farm employment growth is encouraging but underlying those numbers is the ratio of full time/part time job creation and the low paying nature of a high proportion of the new jobs in service industries.

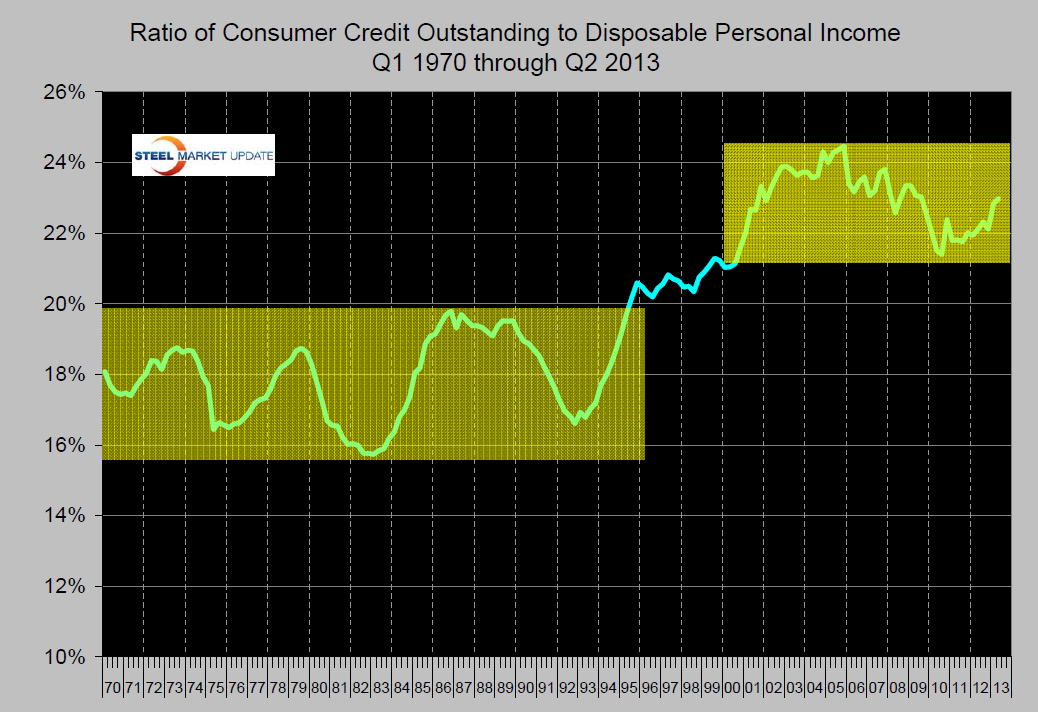

Consumers are struggling to maintain their lifestyles and are increasing the ratio of debt to DPI (Fig 3). The debt considered here is revolving credit card and installment loans, it does not include mortgages. In 25 years from 1970 to 1995 the ratio of revolving plus installment debt ranged from 16 to 20 percent of DPI. The low points were always in times of recession. In the recession of 2001 the pattern changed and instead of reducing short term debt, consumers increased it. Since then the ratio of installment and revolving debt has ranged from 21 to 25 percent of DPI. During the great recession consumers reverted to their past practice of reducing debt during recessions and it looked as though the debt to income ratio would revert to the long term range that presided in the years 1970 through 1995. In Q3 2010 the ratio reversed course and now stands at 23.0 percent.

Consumers are struggling to maintain their lifestyles and are increasing the ratio of debt to DPI (Fig 3). The debt considered here is revolving credit card and installment loans, it does not include mortgages. In 25 years from 1970 to 1995 the ratio of revolving plus installment debt ranged from 16 to 20 percent of DPI. The low points were always in times of recession. In the recession of 2001 the pattern changed and instead of reducing short term debt, consumers increased it. Since then the ratio of installment and revolving debt has ranged from 21 to 25 percent of DPI. During the great recession consumers reverted to their past practice of reducing debt during recessions and it looked as though the debt to income ratio would revert to the long term range that presided in the years 1970 through 1995. In Q3 2010 the ratio reversed course and now stands at 23.0 percent.

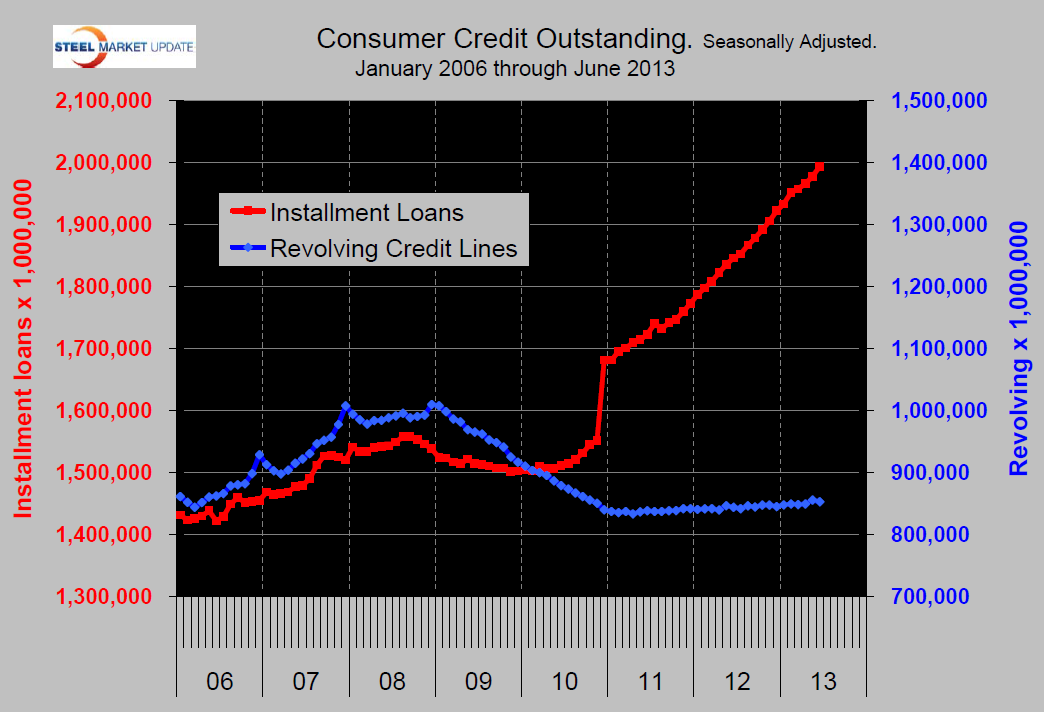

The post recession period has seen a major shift in the type of debt that consumers are willing to absorb. June’s consumer credit report showed a reacceleration in total nonmortgage debt accumulation in Q2. Wealth effects from rising house prices and stock portfolios are helping push installment balances to new highs. Consumers are able to take advantage of extremely low interest rates and easier access to credit to finance spending on big-ticket items such as education and vehicles. Revolving credit lines have stagnated as consumers have recognized the predatory nature of credit card interest rates (Fig 4).

The post recession period has seen a major shift in the type of debt that consumers are willing to absorb. June’s consumer credit report showed a reacceleration in total nonmortgage debt accumulation in Q2. Wealth effects from rising house prices and stock portfolios are helping push installment balances to new highs. Consumers are able to take advantage of extremely low interest rates and easier access to credit to finance spending on big-ticket items such as education and vehicles. Revolving credit lines have stagnated as consumers have recognized the predatory nature of credit card interest rates (Fig 4).

It seems to us at SMU that the situation is fragile. Consumers are facing severe headwinds that will continue to retard economic recovery. The bottom line for steel is that we believe current demand to be depressed by the uncertainty of both public and personal deficit reduction. The end of quantitative easing and an increase in long term interest rates is on the horizon. There is not likely to be any real growth in underlying steel demand until the positive economic trends gradually emerging translate into increased consumer confidence and consumer spending. This will take several years.