Plate

August 9, 2013

Sheet & Plate Imports Moving Lower - Long Products Moving Higher

Written by John Packard

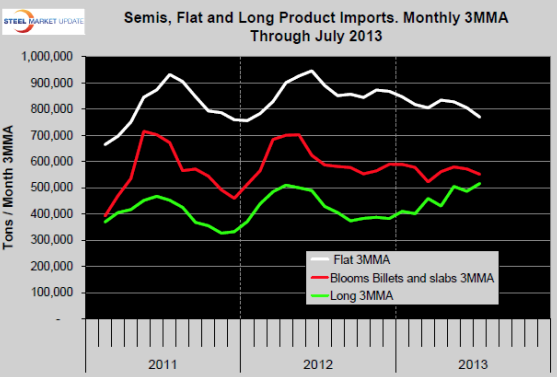

Imports of semi finished, and hot worked steel imports through July 2013

Imports of the combined tonnage of billets, blooms and slabs have been trending down for 12 months as have also the combined imports plate and sheet. Total long products have been trending up for all of 2013. These conclusions are based on a three month moving average and include July license data, June preliminary and May final data, (Fig 1). We believe it is valid to combine preliminary and license data in this way because both have a good track record of closely approximating the final data and at this macro level of analysis we are concerned more with direction that we are with absolutely accurate numbers.

Table 1 provides a detailed import analysis and compares the average monthly tonnage of the three months through July with both the same period last year and with three months through April 2013. The total tonnage of all hot worked products averaged 1,925,783 tons per month in three months through July. Year over year, the average monthly tonnage of semis in the last three months was down by 35,322 tons or 6.0 percent. On the same basis the imports of all hot worked products were down by 225,960 tons, 10.5 percent and flat rolled was down by 120,357 tons or 13.5 percent. Flat rolled combines sheet and plate. Detail for individual sheet products is included in table 1. Long product imports were up by 20.4 percent, pipe and tube was down by 23.8 percent and rail products were down by 8.5 percent.

Explanation: In order to reduce noise in the data it’s better to compare rolling three month periods which gives a real feel of trade flows. License data does not include district of entry so those details are delayed by an additional month. We believe that both a table and a graph are necessary because they provide a quite different but complimentary picture. The table is a snapshot of product detail with a short time element. The graph provides much less detail but gives a longer term perspective which is essential in understanding the current situation. SMU will continue the very detailed analysis of tonnage by source country and port of entry for individual sheet products when the final June tonnages are released next week.