Product

July 26, 2013

Steel Imports Declined in June

Written by John Packard

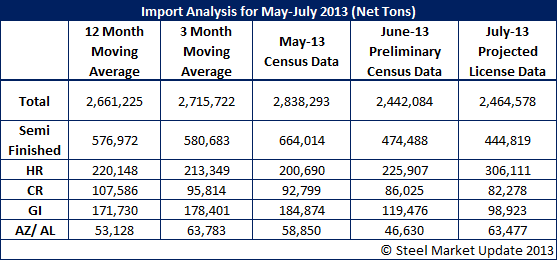

According to Preliminary Census Data, June imports into the United States were approximately 14 percent lower than what was reported for May 2013. The preliminary data has total imports at 2,442,082 net tons down from 2,838,293 tons in May. The June tonnage is below both the 3-month and 12-month moving averages. Compared to June 2012 imports will be approximately 11 percent lower this year.

The one item which impacted the total was semi-finished (slabs) was down to 474,488 net tons. The decline in semi-finished imports represented half of the decline for all steel products.

In the table below is an analysis of the flat rolled segment of the market. We also projected July’s imports based on license data received through this past Tuesday.

David Phelps, president of the American Institute for International Steel (AIIS) reported in their press release on the subject, “Imports continue to be negatively affected by weak demand in most products and market sectors, reflecting the overall weakness of the economy and steel intensive sectors as well as the reticence of many consumers to add to inventory levels given overall concerns about the direction of the economy — with the notable exception of auto-related shipments of steel, which of course are dominated by the domestic mills. Recent announced price increases provide some optimism, but it is unclear at this point whether the improvement in conditions is due primarily to consumers and distributors restocking, which of course would suggest that the improvement would be short-lived.”