Prices

March 23, 2013

U.S. Ferrous Scrap, Iron Ore & Billet Futures

Written by Bradley Clark

U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Prices Drop as an April Pullback Looks Likely

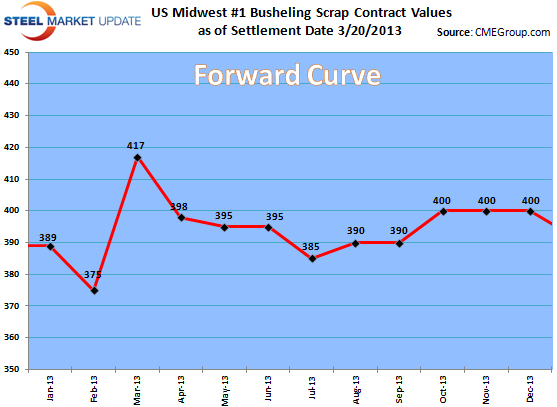

After prices for March settled up $40+ the market for April already is starting to shape up significantly weaker. Dealers succeeded in pushing up prices last month but currently it looks like April will be down at least $20 t as mill appetite in the face of continuing weak steel demand is set to be small.

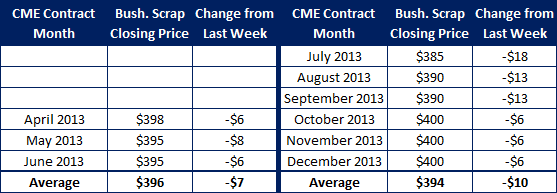

The futures market has experienced a few new trades this week with May and June trading on the CME Globex screen at $395 per gross ton and July and August trading at $385 per gross ton. These prices are down $10-15 from the previous week and indicate sentiment is worsening for the busheling market as we get into the summer months. The overall softness in the steel sector is weighing heavily on prices throughout the supply chain.

CME Busheling Closing Prices as of 3/20/2013 close:

April – $398

May – $395

June – $395

Q3 – $398

Cal 14 – $392

OPEN INTEREST: 232 lots (1 lot = 20 gross tons)

CME Black Sea Billet / TSI Turkish Scrap Prices Falls on Lower Exports

Turkish scrap looks to be softening with export deals being done $10 lower as appetite for scrap in Europe remains anemic. Steel fundamentals in Europe remain weak coupled with renewed macro uncertainties arising out of Cyprus have combined to weigh on steel demand and scrap consumption. On top of this domestic scrap consumption in the US looks to be waning as prices are already shaping up to be down at least $20 in April from March so that much more material is floating around on the East Coast.

The futures market for each contract have experienced no trading the past week as it seems many market participants are uninspired by these low volatility and sluggish nature of the underlying physical markets.

Forward curve TSI Turkish Scrap as of 3/20/2103 close:

April – $393

May – $390

June – $388

Q3 – $385

Cal 14 – $393

Forward curve CME Black Sea Billet as of 3/20/2013 close:

Q2 – $530

Cal 14 – $530

TSI Iron Ore Prices Consolidate Recent Losses

The iron ore market in Asia appears to be consolidating recent losses as prices have been trading in a about a $5 range down the curve. After the recent drop in prices began a few weeks ago the market appears to have quieted down a bit with mixed signals coming out of Beijing and a mixed bag of economic news coming out. While the steel complex in China looks to be oversupplied with high levels of finished stocks, ore stocks look less healthy. This mixed picture has led to the current malaise in prices stuck in this recent trading range. A positive note is that volumes remain strong with nearly 1 million tons trading daily on SGX.

The outlook over the next 3-9 months looks to be negative for prices as oversupply in finished steel will weigh heavily on the need to consume greater amounts of ore; the forward curve has this view priced in already as the backwardation persists.

TSI Iron ore forward curve as of 3/20/2013:

April – $131.50

May – $126.75

June – $123.25

Q3 – $120.25

Cal 14 – $110.75