Product

March 15, 2013

Hot Rolled Futures: Ferrous Markets Under Pressure

Written by John Packard

Written by: Andre Marshall, Crunchrisk LLC

The S&P 500 market today was higher still up to 1563 on the index. As I mentioned our long awaited target was 1542, but as the all time high was 1572 it was hard to imagine that the market would just turn back and correct being only 30 points from the high. And so here we are getting ready to test those highs it looks like. This means we are 5 percent higher already from the Feb 28th dip, 12 percent higher than the Dec 31st level and 16.7 percent higher than the mid-November correction. We had record inflows into the market in January and February, and this is clear sign that retail money is getting back in. The money left the market in the years ’09, ’11 and ’12 at a total monthly rate of those three years at approximately $35 billion per month. Well, it is now coming back in all at once at a rate of 40 billion per month. For the market, this re-entry of retail money is usually the last phase in a trend. Not sure whether the market takes 6 months or a year to re-invest, but we are definitely in that phase.

It will be interesting to see if we can take out the high in the S&P, which would be much more significant than the DOW having done so. Regardless, we are headed for a nice correction in the next two to three weeks. Take your pick on what causes it, they’ll use any headline to get spooked, and there are some good ones brewing, a crazy North Korean, a couple Freaky Italian Ministers, Dueling budget proposals, fickle Chinese government, and zany Iranian leadership transition, etc.

Copper meanwhile hasn’t moved except for a few cents in either direction. The range of late is $3.49 to $3.57/lb. Last trading either side of $3.535/lb. The Chinese just now sniffing around for seasonal metal in a market where over 100K MT was delivered into LME in February alone, increasing inventories by over 20 percent. Crude meanwhile has recovered a bit off its recent low and is now $93/bbl plus, having reached below $90/bbl on that last dip. Commodity prices generally are not seeing the investment dollars that equities are, suggesting again that we are seeing retail money and not institutional money coming in.

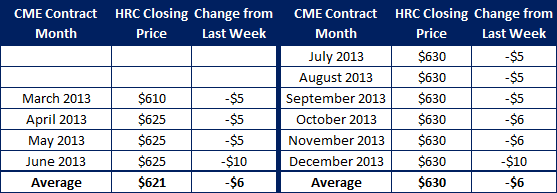

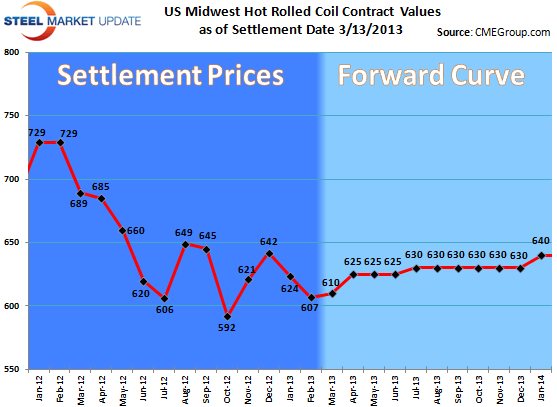

NYMEX HR:

This futures market is under serious pressure. The curve has dropped about $10/ST across the curve. It was another volume week in Hot Roll, having traded 1134 lots or 22680 short tons. Could this be a new trend? That activity brought April down from $630/ST to $615/ST and Q2 down $10/ST to either side of $620/ST, Q3/Q4 down $10 from $635 to $625/ST area. Additionally this week saw the beginning of trading in 2014 with Q1 and Q2 having traded in the $635-$645 zone. This is down from $650 mid market a week back. In steel it looks like the front end is coming down due to the spot market malaise and the back end is coming down due to Iron Ore’s demise.

IRON ORE:

This market is more than under pressure, it is taking it on the chin. Not really unexpected for a market that rose 81% in 4 months, but nonetheless where it lacked effect on its sister markets on the way up it is having a negative effect on them on the way down. Let’s call Q2 either side of $122/MT, Q3 either side of $117/MT, Q4 either side of $112/MT and Cal ‘14 either side of $100/MT.

Just attended the SBB/Platt’s conference in Chicago and there Timna Tanners put her forecasts out for Iron Ore with a target rate for Iron Ore at $95/MT. Looks like the forward curve in Iron Ore agrees with her. Interesting to note as well that the forecast for the average price in steel for this year is $610/ST and for next year $550/ST. Fasten your seatbelts people ominous clouds ahead. Time will tell if there is anything to them.

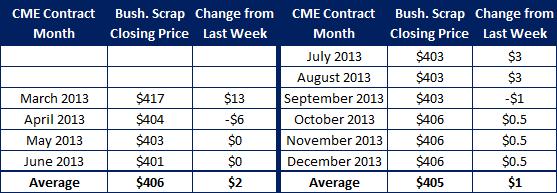

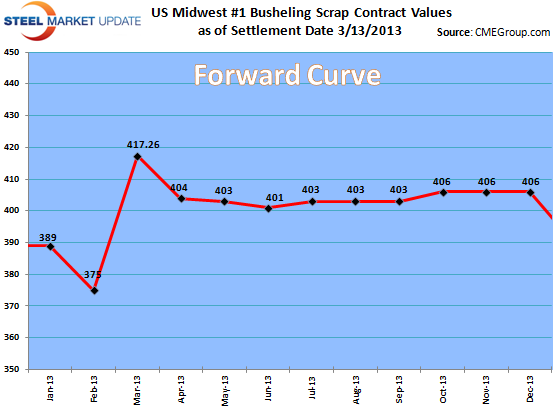

SCRAP:

Well, domestic scrap in March finished up just north of $417/GT which is up $42 from February! However, the picture wasn’t quite that simple. The market rushed in, paid up, got plenty and left early, by the 8th day you could barely find a bid in the market for bush at any level. It will be interesting to see how April materializes as mills clearly not happy with the way March turned out. Looks like flows weren’t as bad as some thought, and despite continuing snow storms in the Midwest and East, the weather is just too warm for them to matter. April always follows March and that is the problem with this rally, it was always doomed to be short term event. Mill orders will have to improve materially in three weeks for this to change.

On the futures in BUS, we traded Apr, July and Oct in the week for a total of 1940 GT. The market is in a wide range right now between $395 and $410 depending on the month. For CFR Turkey it has the same issue as BUS right now, few buyers, and is offered just below $400 pretty much right out the curve as well.