Product

March 13, 2013

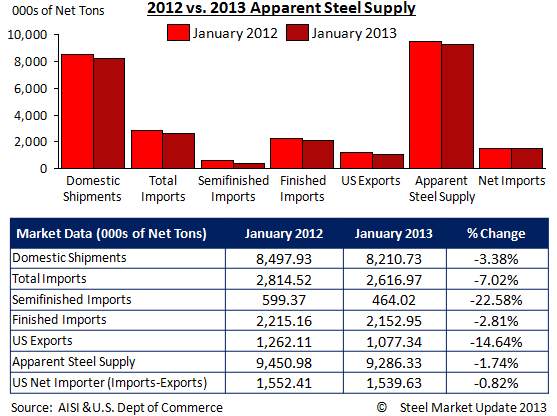

January Apparent Steel Supply Down 1.74% Over Prior Year

Written by John Packard

Domestic mill shipments declined in January 2013 compared to the same month one year earlier. Shipments fell by 3.38 percent. Imports also declined in January 2013 versus January 2012 by 7 percent, led by a 22 percent drop in semi-finished (slabs, billets). Exports during the month of January were 14.64 percent lower than last year. Apparent steel supply came in at 9,286,330 tons which was 1.74 percent lower than last year. The U.S. continues to be a net importer by slightly more than 1.5 million tons.