Product

March 8, 2013

Hot Rolled Futures- Here We Go Again…

Written by Bradley Clark

Written by: Bradley Clark, Director of Steel Trading, Kataman Metals

Well it certainly is beginning to feel like déjà vu all over again. Last week’s price hike announcements come during the same last week of the month as they did the previous month. They came after the spot price was trending down and after deals were being cut below $600 per ton (seemingly a psychological level mill’s try to defend). They come at a time whereby they will filter into the market in time to support the 2nd CRU print of the month, the print contract business is priced off. They come at a time when end user demand is weak, the dollar is strengthening, global steel stocks are high, lead times are short and iron ore is reversing its upward trend. The saving grace for producers is that scrap is up this month, but how much of that is weather related supply constraint, mill willingness to pay a bit up for scrap to beat the drum of rising costs to help pass along their price hikes is yet to be seen. All in all it feels like we have seen this movie before. Until end user demand returns in a significant way the market feels like it is skating on thin ice.

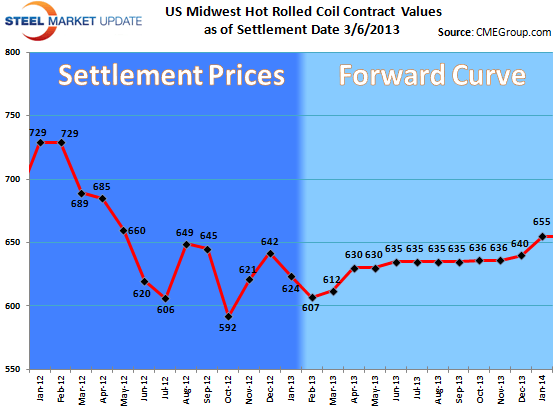

This uncertainty has been positive for futures market in terms of volumes. Last month was a record month for both HRC futures and HRC options trading on CME as traders look to protect margin, gain exposure and position their books for the coming months. While liquidity has been good, with over 100,000 tons trading, movement in prices has been stuck in a tight range. Q2 has traded between 635-640, q3 635-645 and q4 635-640. The market is definitely starting to take on the characteristics of a more mature market with decent volumes transacting daily on a variety of periods down the curve.

What lies ahead remains hard to call at this point. The forward curve remains in a steep contango with forward prices significantly higher than spot pricing. As we proceed through the month it will be interesting to see how much if any of the prices will stick. If demand picks up it feels the market may be set to spike as users and distributers are primed to push prices higher. With that said where does that demand come from? Despite some positive data coming out the past couple of weeks and the almost euphoric response by the media to the stock market hitting historic highs, anecdotally business feels slow. Very few buyers of steel are reporting robust demand for their steel based products. The feeling is that we are all muddling through; waiting for things to pick up….time will tell if this contango the market is pricing in materializes.

Below is a table with yesterday’s HRC futures settlement prices on the CME contract for each individual month through Q2 2013 as of 3/7/2013 close:

OPEN INTEREST: 11,169 lots (1 lot = 20 short tons)