Product

March 6, 2013

January Raw Steel Production Much Higher than Weekly Estimates

Written by Brett Linton

Written by: Brett Linton

The American Iron & Steel Institute (AISI) reported their final raw steel production numbers for the month of January 2013. This estimation is different than the weekly raw steel production as it is based on 75 percent of the domestic mills reporting vs. 50 percent for the weekly estimates.

The difference in the estimates can be quite dramatic and January is an excellent example. If you use the weekly raw steel production estimates provided by the AISI (and reported by SMU) the January numbers added up to 7.205 million tons which is 12.6 percent lower than the numbers released in their monthly report. This could well be a continuing problem with the weekly AISI numbers released to the public and providing less than accurate data.

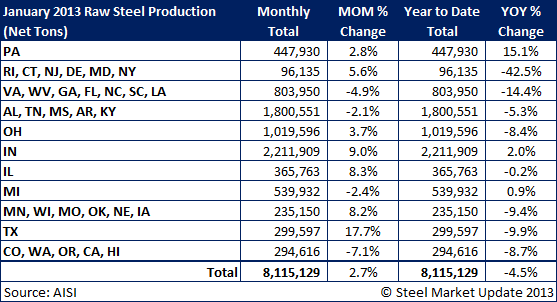

Total raw steel production for the month of January was reported to be 8,115,129 net tons with 58.4 percent or 4,739,936 NT being produced by electric arc furnaces, and, 41.6 percent or 3,375,193 NT produced by basic oxygen furnaces. There has been a significant and steady trend away from BOF steelmaking to electric arc furnaces in North American since the 1970’s when BOF ruled the industry. To give you a better feel for the changes we are including a graph which shows production by process since 1950 (note: OHF = open hearth furnace no longer used in North America).

January 2013 production was reported by the AISI to have been 2.7 percent higher than December 2012 raw steel production.

Total raw steel production for 2013 year-to-date is 8,115,129 NT which is 4.5 percent below that of 2012 through the same time period.

Capacity utilization rate for the month of January was reported by the AISI to be 76.5 percent. (Source: AISI)