Product

March 6, 2013

Initial Reaction to Price Increases Raise Questions about Supply and Demand

Written by John Packard

“No demand- it is like raising ticket prices to see a last place team.” – Service Center

Domestic mill price increases have a way of touching the nerve of the steel community. Whenever there is a price increase announcement and Steel Market Update (SMU) conducts our next steel market survey – we tend to gather an abundance of comments from those responding to our questions. The latest increase comes just six weeks after a previous price increase which, at best managed to stem the slide in the spot market for only a short couple of weeks. The latest increase announcements will have some short term support based on scrap prices moving higher for the month of March in many markets. However, steel buyers and sellers out in the daily market continue to point to excessive supply as the big elephant in the room which needs to be addressed before prices have a chance of moving appreciably higher from here.

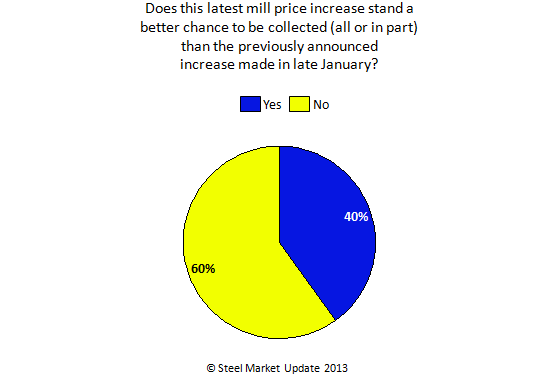

Steel Market Update began our early March steel market survey on Monday morning. One of the areas we probed was that of the recent price increases and if they would be collected (all, or in part) from steel buyers. We wanted to know if the new price increase stood a better chance at being collected than the previous announcement. After two days our survey has been running a very consistent response ratio with 60 percent of those taking our survey responding the mills would not be more successful in collecting this increase than the last and 40 percent believing they will.

The comments left behind were many and had one primary focus – there is too much supply for the tepid demand many are seeing in their businesses right now.

“They will only get a portion somewhere between .50 to 1.00 cwt. 4 price increases since Nov and the shark has rubber teeth.” Manufacturing company (construction related products)

“Demand is not strong enough to sustain increase announcement.” Manufacturing company (containers)

“I think Jan ruined it for March. What has changed in the marketplace to justify the price increase? Shut down capacity, surge in economic activity, some quantifiable event is needed to give the mills the credibility they need to move prices upward.” Service Center

“Iron Ore coming down and demand not there. Mills have not stood firm and continue to undermine their own announcements.” Manufacturing company (roofing, siding)

“The only factor that might swing it in their favor is the need to buy for the second quarter. The mills still need to address the supply side because the demand side is not improving enough to absorb the current production capacity.” National Service Center

“In jan’13 $50 was announced but what happened is prices for March actually dropped some. This is another attempt to stop the slide. It is too bad that the mills do not have the ability to just tell the truth and have prices go up when they need to, stay flay when they need to, etc.. This will be another failed attempt that just encourages more deals under the table.” Manufacturing company (metal buildings)

Not everyone felt the mills would be swimming against the tide and pointed to scrap as being the key for the mills to be able to collect higher spot prices in the coming weeks.

“The mills will get support from the increase in scrap prices in March. Probably get HRC back to $620 or so.” Manufacturing company (industrial, agricultural & construction products)

“Scrap pricing may give this increase an opportunity to succeed.” Manufacturing company (heating equipment) Manufacturer provides his outlook on scrap

SMU received the following comment from a large manufacturing company this morning, “The fundamentals haven’t changed much with the exception of scrap. I still think there is a lot of uncertainty in how much scrap is available. Although the recent spate of storms has probably restricted collection, the low export numbers and low mill demand have probably offset it. It’s March and by the end of this month more obsolete should come into the market, and if the weather has really held things back, we should see strong flows into the yards in a few weeks. Most of the mills I have spoken with want to talk up increased scrap costs, but all of them are concerned with buying at a high price today, when they know it is likely to come down by the end of the month.”

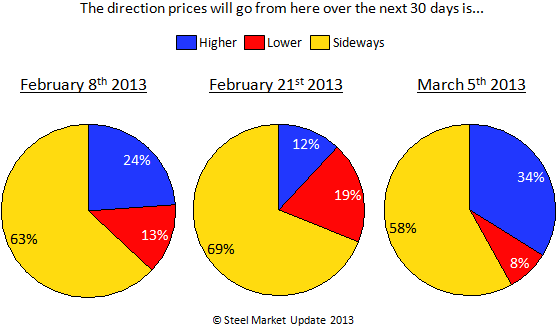

SMU Survey Found an Uptick in Confidence that Prices Could Move Higher over Next 30 Days

Steel Market Update did see a slight uptick in confidence in prices moving higher so far this week than when compared to the survey taken after the late January price announcements. At least a solid one-third of those responding to our survey feel that prices will move higher over the next 30 days.