Product

March 4, 2013

Imports Up in January but Below 2012 Levels

Written by John Packard

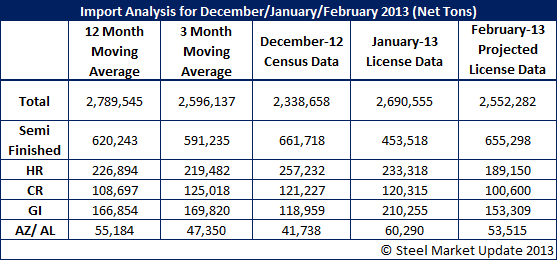

Falls Church, VA, March 1, 2013 – Steel imports increased 4.6 percent in January 2013 compared to December 2012 according to preliminary government data. “Import levels improved in January in a normal seasonal rebound from end of the year declines as many consumers and distributors delay purchases to January due to inventory tax costs at the end of December. On the other hand, imports remained almost 8.4 percent below January 2012, reflecting the lower levels of demand as a result of uncertainty at the time these imports are ordered caused by concerns related to the then looming fiscal cliff. The normal first quarter seasonal improvement in demand has apparently delayed as a result,” said David Phelps, president AIIS.

Total Steel imports in January 2013 were 2.579 million tons compared to 2.466 million tons in December 2012, a 4.6 percent increase, and an 8.4 percent decrease compared to January 2012. The data show that imported semifinished products decreased by 2.8 percent in January 2013 compared to January 2012, from 487 thousand tons in 2012 to 473 thousand tons in 2013, based on preliminary reporting. (Source: American Institute for International Steel)