Product

February 25, 2013

Manufacturers Report Stable to Declining Prices out of Service Centers

Written by John Packard

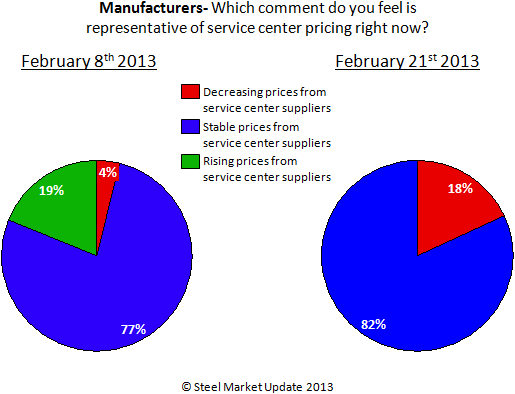

Manufacturing companies reported service center spot prices as either stable (82 percent) or decreasing (18 percent) during our most recent SMU steel market survey. When compared to the results taken at the beginning of February we found no longer were any of the manufacturing companies reporting any attempts by the distributors to raise prices. In early February 19 percent of the manufacturers were reporting rising prices by their service center suppliers. The percentage of service centers reported to be lowering spot prices rose from 4 percent during the first week of February to 18 percent this past week.

Manufacturing companies reported service center spot prices as either stable (82 percent) or decreasing (18 percent) during our most recent SMU steel market survey. When compared to the results taken at the beginning of February we found no longer were any of the manufacturing companies reporting any attempts by the distributors to raise prices. In early February 19 percent of the manufacturers were reporting rising prices by their service center suppliers. The percentage of service centers reported to be lowering spot prices rose from 4 percent during the first week of February to 18 percent this past week.

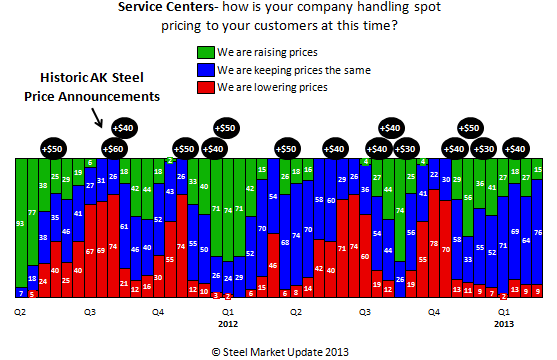

As we reviewed the historical data we found the manufacturing companies reported 50 percent of the service centers were raising prices in November but the percentage has been dropping. The number of service centers lowering prices had been fairly consistent averaging less than 8 over the past three months.

Service Centers Report Spot Prices as Stable with Some Increases/Decreases

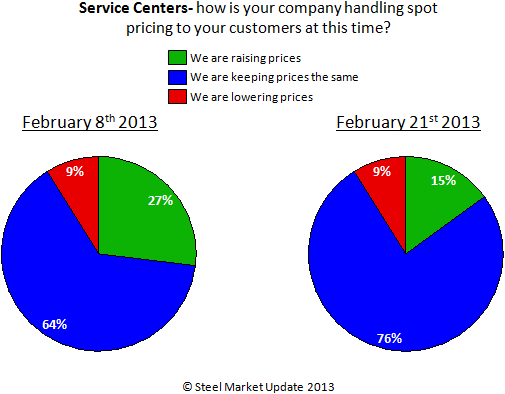

Service centers admitted, albeit to a lesser degree, to erosion in their efforts to increase spot prices between the first week of February and this past week. We saw the percentage of service centers reporting raising prices drop from 27 percent to 15 percent while those lowering prices remained at 9 percent. SMU does not find it unusual for service centers to lag the manufacturing companies in reporting the demise of spot price increases.

Service centers admitted, albeit to a lesser degree, to erosion in their efforts to increase spot prices between the first week of February and this past week. We saw the percentage of service centers reporting raising prices drop from 27 percent to 15 percent while those lowering prices remained at 9 percent. SMU does not find it unusual for service centers to lag the manufacturing companies in reporting the demise of spot price increases.

Service Center Responds to Our Assertion Regarding Spot Pricing Support Levels

Service Center Responds to Our Assertion Regarding Spot Pricing Support Levels

Steel Market Update has been developing a theory regarding service centers spot pricing and steel mill’s ability to collect price increases based on the past few years of data collected from our surveys. We have discussed the theory on a number of occasions in the past (most recently SMU published on Sunday, February 10th – dated 2/11) so we won’t go into detail again here. What we will do is allow one of our readers who represents one of the larger service center chains out there to comment:

I’m not sure the perspective of the Service Center “support” for announcements is a realistic view for analyzing price movement.

Inventory holders are inclined to favor rising markets, and act to create this direction. Memos to the market dictating its direction are not why prices rise. Viewing the marketplace in the context of the memo forgets to consider the market’s fundamentals, and even its emotional momentum. This is significantly more apparent in an age of extreme visibility with terminal markets in HRC, Scrap, and Iron Ore. Industry media coverage seems to revel in content regarding “will it stick”, or “how much has stuck”. It seems the Wall Street coverage of public companies has caught on to this too. Immediately on the heels of the recent AK announced increase, Wall Street rejected the idea of higher prices and called its clients to sell.

Service Centers need to remain viable within our highly dysfunctional channel system. Without viability in the eyes of our clients, we also (paradoxically) loose viability with our suppliers. Regardless of the hopes of steel producers, Service Centers must maintain their business levels, or they won’t have product to buy. Therefore, the merchants in the business must understand inventories, lead-times, demand, capacity, and manufacturing costs. Most importantly, Service Centers know what they are actually paying, and how that affects how they price.

It is the last statement made by our service center executive which is the key to the reason why service center spot prices are important – they know what they are actually paying – and they understand how what they are paying then affects the prices they charge. They must also maintain their business levels in order to buy steel (they must compete) which means they cannot lose orders just to make a point – they have to be committed to the process.

For those who might have forgotten what our graphic looks like with the AK Steel price increase announcements here it is again: