Product

February 15, 2013

Iron Ore, Scrap, Billets Futures

Written by Bradley Clark

Written by: Brad Clark, Director of Steel Trading, Kataman Metals

U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Softens as Prices Drop 13.73 in February

The physical market came in this week down $13.73 to $375.24 in line with expectations. Mill order book’s remain weak for the most part outside of auto industry demand (the major generator for busheling). The market continues to break with historic seasonality coming in weaker in February after a couple of months of flat pricing. The market starts the month now at a standoff as to what will materialize for March as dealers are positive a bounce will occur while mill’s are already calling for a further softening in prices. It’s still too early to call this one.

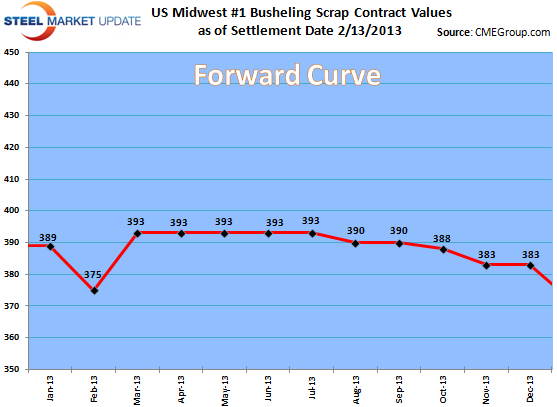

The futures market has seen the curve flatten out this week with bids and offers sitting at 380/390 down the curve. There appears to be a slight belief that prices will rebound and stabilize as we get into the summer. We are definitely seeing more weight on the offer and it is likely prices pull back in the short term as the entire steel complex looks to soften as we head into March. Open interest has increased indicating more market participants are taking an interest in this new futures market.

CME Busheling Closing Prices as of 2/13/2013 close:

Feb – $375

March – $393

Q2 – $393

Cal 13 – $385

OPEN INTEREST: 312 lots (1 lot = 20 gross tons)

CME Black Sea Billet / TSI Turkish Scrap Prices Stagnant as Demand Remains Lackluster

Very little to say regarding Turkish scrap and CME billet futures this week as prices have remained flat without any trading. It seems the lackluster demand for raw materials in Europe is continuing to weigh on sentiment however without may market participants using these futures markets prices are not very reflective of true sentiment in these underlying physical markets.

Forward curve TSI Turkish Scrap as of 2/13/2103 close:

Feb $390

March – $395

Q2 – $385

Cal 13 – $385

Forward curve CME Black Sea Billet as of 2/13/2013 close:

Feb – $525

March – $538

Q2 – $533

Cal 13 – $530

TSI Iron Ore Prices Steady amid China’s absence during the Lunar New Year Holidays

With the Chinese away for the Lunar New Year Celebration (the year of the Snake) the iron ore markets have been fairly subdued. The Physical market remains well supported at these levels. Demand out of China last week continued unabated driven by stronger domestic demand for steel. With that said, most market participants await the return of the Chinese to give direction as to the next move in the physical market.

The futures market while a bit more active than the physical market this past week has still experienced a lull in trading. Prices down the curve have traded in a tight range up or down $2.00 per ton over the past few days. While backwardated the forward curve still indicates a fairly strong first half for prices before taking a leg down in the second half of the year.

TSI Iron ore forward curve as of 2/13/2013:

Feb – $157

March –$ 155.50

Q2 – $147

Q3 – $140

Cal 13 – $122