Product

February 11, 2013

December Imports Down 9% - January Imports Bounce Back to 2.666 Million Net Tons

Written by John Packard

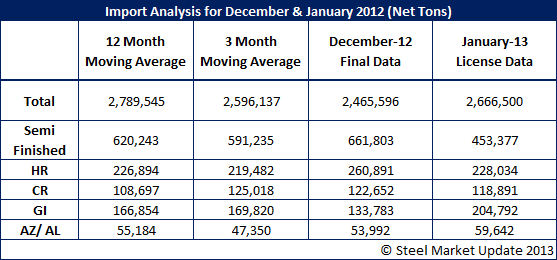

The U.S. Department of Commerce released final census data for the month of December and found that total steel imports were down 9 percent when compared to the previous month. Major drops were reported in hot dipped galvanized (HDG) which fell by 30 percent compared to November, cold rolled which dropped by 17 percent and plates in cut lengths which dropped by 12 percent. However, the news was not all good for the domestic steel producers as hot rolled sheet imports rose by 41.45 percent (although the domestic mills are major importers of this product themselves) and the single largest line item on the import chart continues to be semi-finished (slabs & billets) which are all imported by the domestic steel mills.

January License Data Forecast 2.666 Million Net Tons of Imports

December imports were below both the twelve month (12MMA) and three month moving averages (3MMA) while January imports appear will be above the 3MMA trend but below the twelve month moving average.

The December and January galvanized numbers, when averaged together, are right in line with the 3MMA and 12MMA. So, there does not appear to be any break in the trend line there. Cold rolled, which was lower in December than November, also appears to be within the 3MMA and above the 12 month moving average.

SMU Note: SMU expectation is for a slight reduction in flat rolled imports as we move into 2nd Quarter arrivals (April, May, June) as the price spread has shrunk between foreign and domestic steels.

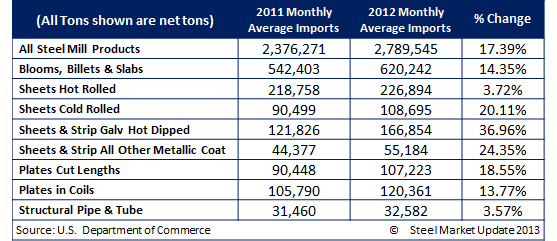

Total imports during 2012 rose by 17 percent and every product we watch on a regular basis was higher year-over-year (YOY). Hot rolled was the least affected product while hot dipped galvanized was the most impacted, up 37 percent YOY.