Product

February 11, 2013

Capacity Cuts Needed Says Eurofer President Eder

Written by Sandy Williams

“’Europe’s steel mills face obsolescence and steelmakers may quit the region if politicians continue to prevent restructuring and capacity cuts in the sector’ said Wolfgang Eder, the chief executive of Austrian specialty steelmaker Voestalpine and president of the European Steel Association, or Eurofer.” (Wall Street Journal)

Eder’s comment comes on the heels of the announcement by ThyssenKrupp that it will cut 2000 jobs at its Steel Europe operations, with an additional 1800 more possible, in an effort to reduce overcapacity and save $670 million. ArcelorMittal has struggled with closings at its Florange and Liege plants in France and Belgium and finished 2012 with a net loss of $3.73 billion. Friday, Swedish specialty mill reported an operating loss of $104 million for the fourth quarter—its second negative posting in a row due to decreased demand.

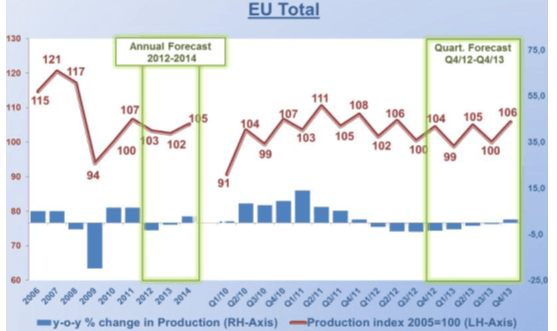

Over capacity is the problem. Europe has the ability to produce 210 million metric tons but since 2008 the most it has produced is 170 million tons, according to Eurofer. Demand is down and restructuring efforts have been met with opposition by governments loathe to see businesses lost and unemployment rise.

“Shutting down a steel operation is still a very emotional and politically sensitive issue, and it seems much easier to shut down larger operations in other industries,” said Eder in the Wall Street Journal interview.

Mergers and acquisitions, said Eder, are not the solution either since the sites remain operational and contributing to the over capacity issue.

“Always when we see recovery in the economy, partially idled blast furnaces go back into operation. Any major recovery is interrupted by this additional capacity coming back,” said Eder.

In the past few years, government intervention has stymied efforts by mills to realign their capacity with demand and restore profitability.

ArcelorMittal faced possible nationalization after announcing its intention to close the Florange mill in France. Police fired water cannons at protesters at a demonstration over job losses at the Liege plant. The Italian government, desperate to save 20,000 jobs, reversed a court ordered shutdown of ILVA despite known environmental hazards.

In December, 2012, the European Parliament adopted a resolution that urged the EU Commission to “ensure that EU state aid rules take account of steel industry needs, keep an eye on threatened plants and deliver its promised action plan to help the sector as soon as possible.” The resolution also calls for the Commission to monitor restructuring of plants and ensure that those plans act in a “socially responsible” manner.

Eder told Wall Street Journal that he is pleased that the EU Commission has started discussions about the European steel industry but was “adamant that ‘the EU should not interfere in structural questions,’ and shouldn’t have a say in deciding which plants to shut down.”

Eder said that low steel prices are delaying the start of European recovery and taking a toll on technology upgrade—two or three years is the maximum companies can afford to restrain from investing before losing ground technologically and quality-wise. European economic conditions are not expected to make much headway in the first half of 2013.

“The EU steel market in 2013 looks set to remain fragile. There is continued risk of supply and demand distortions. The stronger Euro could attract more imports, even though real steel consumption is to remain subdued,” said Eurofer Director-General Gordon Moffat in the Q1-2013 Economic & Steel Market Outlook.

“We do expect a more supportive economic environment towards the end of the year. But it will take most of 2013 before our customers in industry and the steel distribution chain will notice any improvement in business conditions,” said Moffat. “Confidence may be rising, but only from a depressed level. Financing and credit are still tight. Companies remain highly risk aversive. Steel market conditions will remain difficult for the time being”.

“The EU steel market in 2013 looks set to remain fragile. There is continued risk of supply and demand distortions. The stronger Euro could attract more imports, even though real steel consumption is to remain subdued,” said Eurofer Director-General Gordon Moffat in the Q1-2013 Economic & Steel Market Outlook.

“We do expect a more supportive economic environment towards the end of the year. But it will take most of 2013 before our customers in industry and the steel distribution chain will notice any improvement in business conditions,” said Moffat. “Confidence may be rising, but only from a depressed level. Financing and credit are still tight. Companies remain highly risk aversive. Steel market conditions will remain difficult for the time being”.