Product

February 8, 2013

Hot Rolled & Iron Ore Futures: Tale of Two Cities

Written by John Packard

Written by: Andre Marshall, Crunchrisk LLC

Financial Markets:

Big news today was that the Euro cratered on the back of Draghi’s comments about the Euro from, in USD terms, $1.357 to $1.34. Unless, of course, you think that ArcelorMittal losing $3.99 billion in the Quarter was bigger news. Ouch! I don’t think any of us are surprised about those results frankly. Grim times for steel companies today.

We are bull flagging on S&P, which means that we moved up end Jan up to the 1500 + area only to trade there in a sideways manner. A bull flag in technical chart terms means we should see another leg higher. That target, you might recall, is 1546. As I mentioned before, we will be only 30 some points from the all time high at that juncture and it’s hard to believe the market will just stop at 1546 and not take a run at 1572. We shall see. Regardless of whether the high gets taken out or not a big retracement is in store for the market, if I only knew exactly when.

Copper and Crude have also traded sideways since, with Copper now $3.7225/lb after having climbed to $3.78 area, and Crude now at $95.77/bbl after having climbed to $98.24/bbl. The investment money into the commodities and stock markets is impressive, we hit a record on Copper Comex open interest of 160K lots. This means that there is a lot of speculative length in the market likely paired up against large shorts hedging tons and tons of unwanted metal. Make sense? Sure it does. Stop your whining. Fundamentals couldn’t be more precarious the technicals couldn’t be more bullish. Yikes!

NYMEX HR:

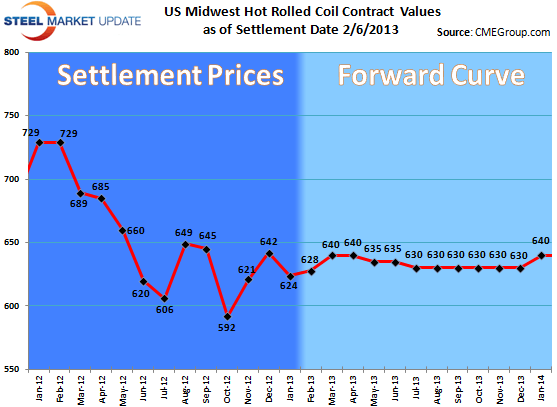

In this city, things couldn’t look more bleak. The Q1 normal rally is turning into a crater. Despite price rise announcements metal deals still abound, and that’s with very few asking. Scrap looks like it will finish down $15 in the month and that’s a good result. The CRU came in $612 or $6 higher as we expect when few spot deals are happening the CRU goes up, albeit slowly.

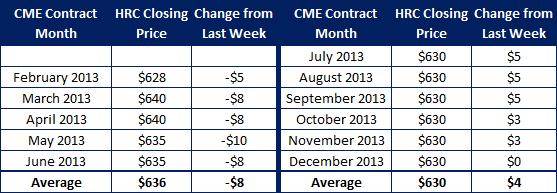

This week was a modest one in futures although price action abounds. We did 405 lots in the week or 8100 short tons. The week was characterized by falling front months with well supported back months. March started off the week at $645 and finished it at $630/ST. Q3 and Q4 meanwhile were up $5/ST. The curve is looking to shifting from slight backwardated/flat to contangoed. We will see how far it goes and if it’s the front that drops further or the back that increases.

Iron Ore:

In this city, things couldn’t be more bullish. After having peaked originally at $158/MT area on spot, we then retraced back to $145/MT in January only to now rally back up to $155/MT area. The typhoon season helped this a bit by curtailing supply, but there is no denying this good old fashioned inventory restocking here in China based on growth expectations over there. Inventories of import Iron Ore at mills stand at 35 days or so, just above normal and domestic inventories stand at 15 days or so just above normal. Meanwhile Port stocks, around 70 million MT are low, so looks like there is more room for the channel to keep re-stocking. The Chinese are on their New Year from the 10th until the end of February at which point many expect even higher prices. The Chinese are known to disappoint for their activity post New Year, we will see if this year is any different. At a minimum, this market looks intact for the next few weeks at least. It is interesting to note that the market appears to have very little connection to ours any more. As one said, ‘maybe a sign of a maturing market of their own”. Or maybe just Chinese optimism we have come to know so well.

The spot index is $155+.. The forward curve peaks in March at about $155/$156/MT with balance year either side of $140/MT and Calendar ’14 either side of $120/MT. I expect little to no movement in this market until the New Year concludes. Scrap:

Is the U.S the anomaly in the world market with its bleak first Quarter, or is China the anomaly in the world market with its strong first Quarter? Scrap might reveal the answer. It appears scrap is depressed in both domestic and international markets. The Turks and the Asians have had little appetite for our units. The Turks appetite is such that either European or U.S. units will meet their needs and our stronger currency decides that. Asia, both India and China have had only tepid appetite for containerized off our shores. The global scrap malaise suggests China might be the anomaly; or is it the leading indicator? We can only hope.

CFR Turkey has weakened as a result to $391-2/MT area from $396/MT at the end of last week. Futures have been quiet.

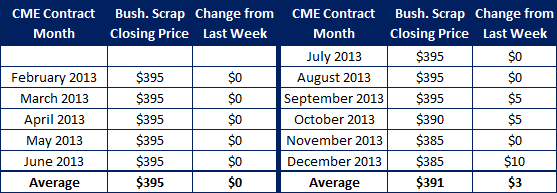

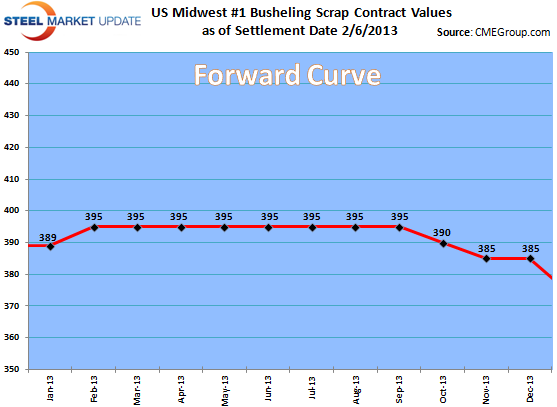

Domestic scrap has ranged from down $5/GT on the East Coast to down $30/GT in Detroit. It looks like it will settle MW index (Midwest) on Bush around $15 down when the dust settles. Similar results are expected for Shred. Let’s call it a range of $370-390/GT for both Bush and Shred depending on region (Bush = #1 busheling). On the Futures market, we have been bid $395/GT for most of the week through the balance of 2013, only to pare back $5/GT end week. Offers have been just below $400/GT.