Product

January 28, 2013

December Imports Down 15%

Written by John Packard

December Imports Down 15%

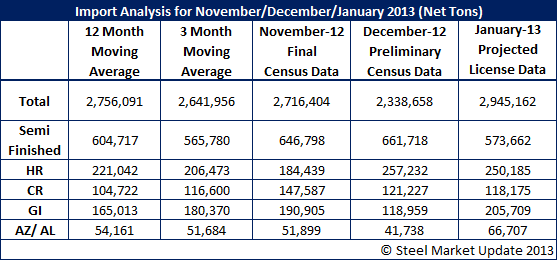

Imports dropped by 377,746 net tons compared to the prior month. On a day’s adjusted basis December imports were 15 percent lower than November. Based on preliminary license data January imports are projected to be approximately 2.9 million net tons – well above both the 3-month and 12-month moving average.

Semi-finished (slabs) continued their strong showing during the month of December at 661,718 net tons. Hot rolled coil and cold rolled were also above their 3-month and 12-month moving averages while galvanized and Galvalume were not during December. However, for January all four flat rolled products are forecast to be above their 3-month and 12-month moving averages based on early license data (subject to revision).