Product

January 23, 2013

NW Australian Storm Shuts Ports – Affects Iron Ore Trade

Written by Sandy Williams

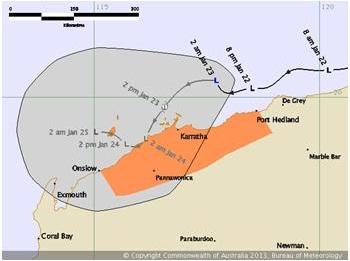

A tropical storm shut down ports in Australia on Tuesday stopping shipment of nearly half of the world’s iron ore trade. Port Hedland, Dampier and Cape Lambert shut down operations as vessels moved out to sea and away from the area. The ports service the mines Rio Tinto, BHP Billiton, Fortescue Metals Group and Atlas Iron. The Bureau of Meteorology is warning that the storm may develop into a Category 3 cyclone on Wednesday with wind gusts to 62 miles per hour between Port Hedland and Dampier.

The a region of northwest containing the majority of Australia’s iron ore mining companies, is in the “cyclone alley” which produces seven or more cyclones per year. Fear of weather related reduced iron ore supply from Australia has contributed to fluctuations in iron ore prices.