Product

January 18, 2013

Hot Rolled Futures- Backwardated Markets

Written by John Packard

Written by: Andre Marshall, Crunchrisk LLC

Financial Markets

On the equities markets we hit a new 5 year high reaching 1485 on SP 500 today. In this current rally you might recall our target point for this move is 1488 and so we may be near a point for a little retracement. If this current move has any legs we will see 1546 before it’s over, but we also have to put into perspective that we are only now 85 pts or so from the all time high in the stock market at 1572. If this high were broken it would be significant because it would erase any possibility of a head and shoulders pattern that would have been established from the 2000 and 2007 peaks with this one. Incredible really as well as we are in a fundamentally poor global market with very levered balance sheets. The next 85 pts could be quite a climb.

Meanwhile this week the positive housing starts 984K in the prior month have also caused some optimism in Copper and Crude. We are up $10 in crude off of recent lows in mid December, and Copper is still a healthy $3.65. It might be interesting to know however that Copper has not seen wider Contangos through July in its history. Clearly the price is not holding up due to fundamental beliefs of construction or otherwise. It is also interesting to note that there is little appetite from Asia for Copper scrap, or ferrous scrap for that matter.

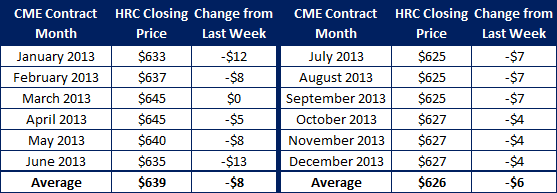

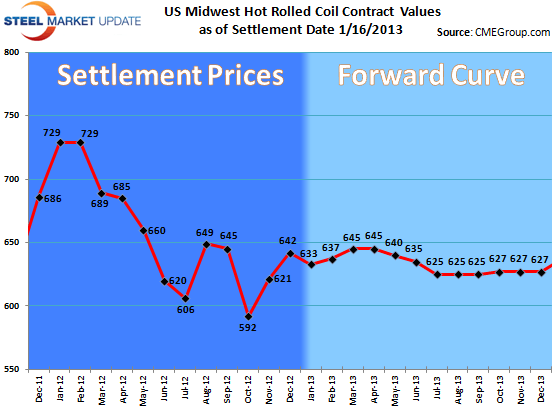

HR NYMEX

We had a healthy week in the Futures market having traded 916 lots or 18,320 ST. Most of the activity has been for the first three months all of which have been bid. This activity appears to have little to do with the underlying steel market in the US and more to do with financial trading strategies. While the nearby months have traded a touch higher by about $5/ST, the Q3 period has traded about $5/ST lower. The CRU this week came in at $624 down $11/ST. Expectations are that we will see at least a couple more prints lower if not a few before any recovery. The mills will want to try and raise prices, but the inventories at 3.4 months of inventory on hand is not helping the situation as buyers look to be back in control for now.

TSI Iron Ore

The incredible rise of Iron Ore may be at an end. After climbing to a high of $158.60, the current spot TSI price is now $145. It was flat today from yesterday, but it had dropped 5% the day before. The forward prices are steeply backwardated, with Q2 either side of $132 and Q4 either side of $122. Steel mills in China have clearly replenished inventory ahead of their New Year, but it may be dawning on some now that there could be limited follow through from here. It might be interesting to note that almost every year in all commodities everyone speculates how the Chinese will come back in after the New Year and buy the market wholeheartedly. They almost always disappoint. If so again this year then we have likely seen the highs of 2013 in Iron Ore with only pressure on prices from here.

CFR Turkey

On what also is purportedly inventory replenishment the Turks have booked a number of cargos over the past two weeks bringing the price up to $409 on the index. We saw a number of cargos leave the east Coast and Southern ports as high as $411-412 for various mixes of grades. One even left of the west coast for China at reported $417, but for a purer mix of shred. This inventory replenishment and price action may well have been influenced by the Iron Ore price movements in Asia. For those who are close to this market they sense that the inventory rebuild is near to finished, if not already complete. We will see if this translates into a few week pause from the Turks on their buying off our East Coast.

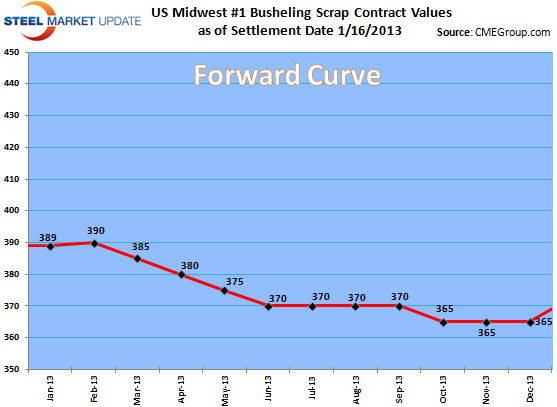

AMM Bush

Sandy supply probably contributed to the lack of bid pressure into the Mid-west from East Coast yards in January, but the quite warm winter certainly didn’t help. After a sideways January its loks more likely that February will struggle as Mills efforts to reach down and book orders probably won’t come quick enough to repair their lack in scrap needs. Some feel we will see $20-30 down at this juncture assuming the weather doesn’t change quickly. Steel inventories downstream make this process that much more difficult. Meanwhile flows in primary are reported to be quite healthy, particularly in auto, and secondary flows have never been constrained with the warm weather. The winter looks like it might come and go with a whimper. This won’t help hold up pricing here.