Product

January 14, 2013

2012 Imports Up 17%

Written by John Packard

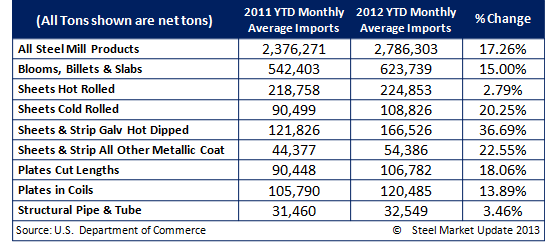

On Friday, the U.S. Department of Commerce released final census data for the month of November and preliminary census data for the month of December. Based on that data, SMU forecast 2012 imports will be 17 percent higher than what was imported one year earlier. A large portion of those tons were imported by domestic steel mills. The domestic mills imported almost 7.5 million tons of semi-finished (mostly slabs)

When looking at flat rolled, only hot rolled did not add double digits to its import totals compared to the prior year. Flat rolled growth was led by galvanized which grew its penetration by almost 37 percent averaging 166,526 tons per month.

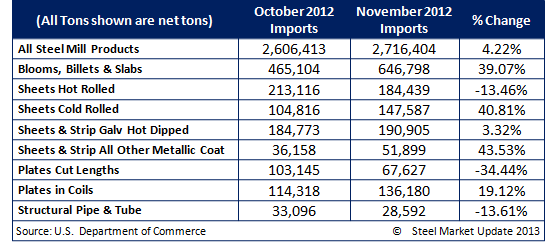

November Imports Up 4%

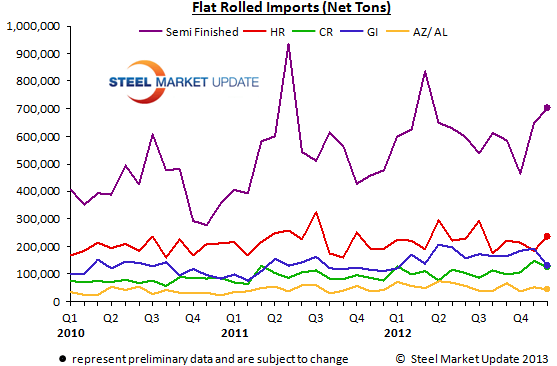

Total November imports rose by 4 percent led by a 39 percent surge in domestic mill imported semi-finished (mostly slabs). Having a surge of semi-finished is normal based on past historical trends (see graph below).

Flat rolled products were mixed with hot rolled coil down 13 percent and cut length plates down 34 percent compared to the previous month. On the flip side, cold rolled imports rose close to 41 percent, Galvalume by 43.5 percent, plates in coil form by 19 percent and galvanized by 3 percent.

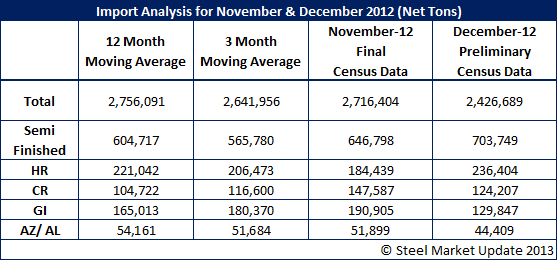

December Projected Down 289,000 Tons

Total tonnage for December is projected to be down 289,000 tons compared to November. December tons are also expected to be lower than both the 3-month and 12-month moving averages. Two items imported by the domestic steel mills continue to surge during the month of December – semi-finished broke through 700,000 tons and hot rolled rose to 236,404 tons. All of the other flat rolled items dropped below November and the 3-month and 12-month moving average.

OCTG and Line Pipe Affected by “Dumping” Talk?

Not shown in our tables was an easing in the imports of oil country tubular goods (OCTG) and line pipe as the threats of dumping suits begin to sink in with foreign suppliers. November imports on both products were down slightly on both products. Imports of OCTG dropped from 266,127 metric tons in October to 222,649 metric tons in November and 137,607 metric tons for December. The bad news on OCTG is for the first 11 days of January there are already 140,835 metric tons of import licenses of OCTG.

Line pipe imports dropped from 193,336 metric tons in October, 167,320 metric tons in November before rising to 214,462 metric tons in December.