Product

January 4, 2013

Hot Rolled Futures – Bring in the New Year!

Written by John Packard

Financial Markets

Who knew it was so easy, all the Republicans had to do was to agree to over $600 bln in tax increases, kick the can down the road on spending cuts by 2-3 months and voila!; No Fiscal Cliff! And with that the markets were off. The SP has gained 60 points in 2 days or 4.25%, Copper has risen 11 cts or 3.1%, and Crude has risen $2.70/bbl or 3%. Upside target for SP on futures is 1491 or another 2+% before our next retracement. It is important to note that at current levels we are merely 100 points away from all time highs in the U.S. stock market. Looks like all we had to do was print money, hmm.

The reaction upward was not surprising considering that the suppression mechanism had lifted with the resolution, however, now the key will be what drives growth from here because taxes increases and spending cuts don’t help. Auto and OCTG look intact, other manufacturing apparently looks less robust, but there is dissension on that reality. Construction, although it’s mentioned as improving, is doing so at such a pace that it is unlikely to affect supply demand for some time. Further, with tax increases, and likely spending cuts, the economy here is expected to suffer. Economists Q1 estimates of growth are coming in somewhere around 1%. Although the tax increases were focused on the “rich”, the fact is everyone got tax increases between the roll back of the Payroll tax ($1000 less annual per avg family), Obamacare 3.8%, elimination of deductions above $300K and dividend tax increases up 5% (affects retirees spending). So we will have to wait and see what orders can do in this environment of constrained consumption.

NYMEX USHR

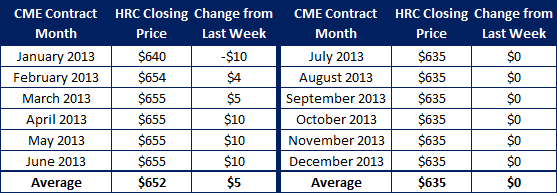

Can anyone say flat! It’s the prevailing opinion out there that the market will remain flat. Hmm. When does steel ever stay flat?! I have seen scrap go flat, but not steel. This will be interesting if proves true. The last three CRU weekly prints have been flat, now at $639/ST. We are headed into an historically bullish time in the cycle, but demand is not robust when it normally would be, and mills, especially EAF’s, are having trouble filling each months book. Is there pent up demand that waited for the fiscal cliff to end? Will auto really sell 15 mln units in the year, will other manufacturing improve (white/yellow goods)? The former will be affected by Americans willingness to buy new cars and that latter will be our ability to export more. Both are unknowns at this point. Also how will the mid-west river levels affect pricing for both scrap and steel, or will it simply cause regional differences? And how long will it disrupt?

The week has been quiet on HR futures, which were broken up by the holidays. Last week we did a couple Q2 deals and that’s looks like the bulk of what transpired in the week except for some screen trades in Feb ‘13. We had a total of 265 lots trade in the week or 5300 ST. There is upward pressure on the forward curve now about $5-10/ST stronger than we had a couple weeks back.

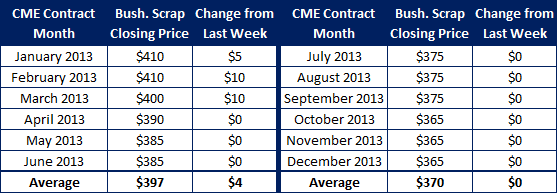

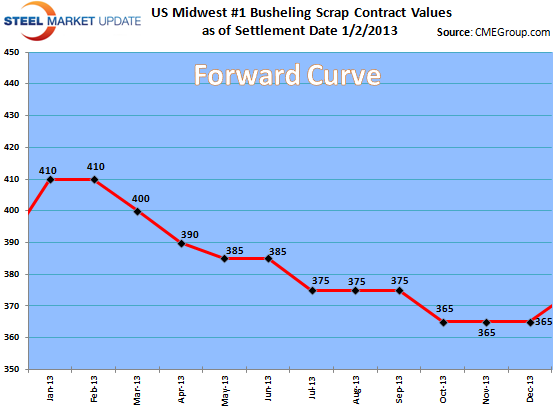

NYMEX BUS

Very quiet here. We have seen small screen trades lift prices in the nearby months by about $10/GT in the week to $410/GT. We had only 20 Lots trade total or 400 GT.

It’s still early yet on the physical scrap market, but early indications are a flat market with some expectation of regional price increases where the river levels have affected shipments. Possibly up $10 or more in those regions. Mini mills order books will drive this of course so the next week to 8 days will be critical to see how buyers operate here in the New Year with the fiscal cliff behind them. Inventories remain modest to healthy with current ship rates. Ship rates will be the key to how buyers likely behave.

Iron Ore

Holy cow! This market has gone on a tear, and continues to do so. Up again today we are now north $150/MT on spot month. A cargo of PB fines traded $151+ for Jan delivery. The forward market in Cal ’13 months is now in the $130-$135 zone.

Iron Ore has put in a 70%+ retracement off its lows that was not even 3 months back. It’s true that the PMI numbers in China and in Southeast Asia generally have risen again slightly, showing improving manufacturing activity. Whether that’s worth an almost doubling of value in this raw material is another matter. For now, one can assess that those close to the situation are optimistic about China’s growth in the near term. At a level, that is now above the average of last year’s entire range, I say good luck to them and hope they are right for all our economic sakes.