Final Thoughts: Survey says edition

It's can-kicking at its finest. And it’s been drawn out! Some are getting so good at it, they’re kicking cans and taking names.

It's can-kicking at its finest. And it’s been drawn out! Some are getting so good at it, they’re kicking cans and taking names.

On Oct.10, President Trump announced major increases in tariffs on Chinese goods. The trigger was a new regime of export controls on rare earth metals and products using those elements, including magnets, capital equipment, and catalysts for catalytic converters in cars and trucks.

Drilling activity increased in both the US and Canada last week, according to the latest oil and gas rig count data released by Baker Hughes.

After marginally rising in August and September, the premium galvanized coil carries over hot-rolled coil (HRC) coil has narrowed again in recent weeks. As of Sept. 16, the spread between these two products has shrunk to a two-and-a-half-year low of $125 per short ton (st).

Economic growth in some US regions in September was offset by challenges in others, causing the market to appear largely unchanged overall, according to the Federal Reserve’s latest Beige Book report.

ncreases through September, according to the latest Baker Hughes rig count data.

Although total HVAC shipments fell in August, YTD volumes remain relatively strong. Nearly 15 million units were produced in the first eight months of the year, the fourth-highest rate in our 19-year data history.

Canadian Prime Minister Mark Carney and US President Donald Trump told reporters at the White House on Tuesday that they’ll be formulating a trade deal that works for both nations.

Gerdau is repositioning its North American business to capitalize on a sharp shift in steel trade flows driven by elevated tariffs across the US, Canada, and Mexico.

US counts continue to hover just above historic lows, while Canadian figures remain comparatively healthy.

Jack Biegalski, former president and CEO of American Heavy Plates, has been named the new CEO of the Esmark Steel Group.

Oil and gas drilling activity increased this week in the US and Canada for the third consecutive week, according to the latest Baker Hughes rig count data. US counts continue to hover just above historic lows, while Canadian figures remain comparatively healthy.

August marked the second-lowest monthly production rate this year, down 13% from the two-year high of 166.6 million mt in March.

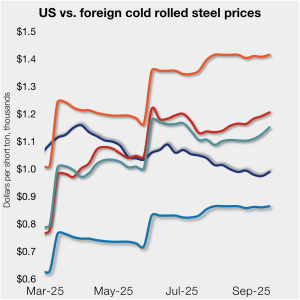

Cold-rolled (CR) coil prices ticked up in the US this week, matching a similar trend seen in offshore markets as well.

US rig counts continue to hover just above historic lows, while Canadian figures remain comparatively healthy.

Following a 3% decline in June, the amount of steel shipped outside of the US edged up 1% in July to 623,000 short tons. July was the sixth-lowest monthly export rate since the COVID-19 pandemic, and...

Drilling activity increased in both the US and Canada last week, according to the latest oil and gas rig count data released by Baker Hughes.

he US longs market remained stable this month despite ongoing challenges from tariff-impacted imports, even as end-use demand was relatively unchanged and scrap prices held flat in August.

Construction spending edged down slightly in July for a third straight month.

US manufacturing activity remained muted in August despite a marginal gain from July's recent low, according to supply executives contributing to the Institute for Supply Management (ISM)’s latest report.

Oil and gas drilling activity waned in the US and Canada this past week. Ticking own for the second straight week in both regions.

World crude steel output declined for a second straight month in July, falling 2% from June to an estimated 150.1 million metric tons (mt), according to recent data published by the World Steel Association (worldsteel).

Oil and gas drilling activity slowed in the US and Canada this past week. An unfamiliar trend after both regions saw repeated gains of late.

North American auto assemblies declined in July, down 16.4% vs. August. But, according to GlobalData, assemblies were 2.4% ahead year on year (y/y).

US light-vehicle (LV) sales increased to an unadjusted 1.37 million units in July, 8.7% over June and 6.6% above year-ago totals, according to US Bureau of Economic Analysis data.

Business activity in New York state improved modestly in August. It was just the second positive reading for the general business conditions index in six months.

Oil and gas drilling in the US was unchanged this past week following three straight weeks of declining activity. Canada saw another gain, reaching a 22-week high.

Oil and gas drilling in the US slowed for a third consecutive week, while activity in Canada hovered just shy of the 19-week high reached two weeks prior.

Both SMU Sentiment Indices continue to show that buyers remain optimistic for their company’s chances of success, though far less confident than they felt earlier in the year.

SMU’s August ferrous scrap market survey results are now available on our website to all premium members.