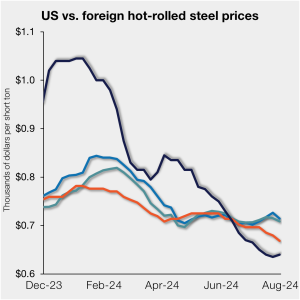

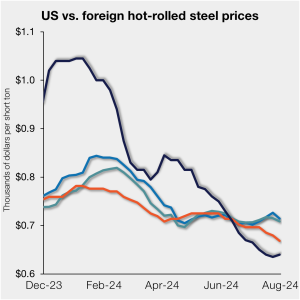

US HRC premium over imports narrows

The premium between US hot-rolled (HR) coil and offshore hot band prices narrowed this week as it appears domestic tags might have reached a bottom.

The premium between US hot-rolled (HR) coil and offshore hot band prices narrowed this week as it appears domestic tags might have reached a bottom.

Six steel industry organizations have urged House Speaker Mike Johnson to include the Leveling the Playing Field 2.0 Act in any proposed package of legislation against China’s "unfair" trade practices.

Both iron ore and coking coal prices fell this week because of resistance from buyers. Iron ore prices have continued to fall throughout the past week, following sharp declines in steel prices in China, given no new policy announcement from the ‘Third Plenum’ meeting.

The prices for the July market weren’t settled until July 8 and now we are approaching the formation of the August market.

High levels of steel imports, especially from China, in recent months are worrying steel makers in India and Vietnam.

Nucor’s top executive expressed concerns over unfair trade practices, highlighting increased steel imports from Mexico and Canada.

Cleveland-Cliffs Chairman, President and CEO Lourenco Goncalves had some insightful things to say today about the steel market and about a conference we suspect might be Steel Summit.

Cleveland-Cliffs expects its acquisition of Canada’s Stelco to close later this year, which will help the the Cleveland-based steelmaker as a bottom to steel tags nears.

Cleveland-Cliffs is starting a new electrical distribution transformer production plant in Weirton, W.Va.

The United Kingdom and other countries are using the “green” label to subsidize bailouts of obsolete, inefficient, and excess capacity that should exit the market. US steelmakers have invested billions of dollars in technologies that curb greenhouse gas output. These investments have been market-based and led by EAF producers such as Nucor, Steel Dynamics, and CMC.

I thought we’d have more clarity this week on Section 232, Mexico, and a potential carve-out for steel melted and poured in Brazil. As of right now, the only official comment I have is from the Office of the United States Trade Representative (USTR).

Steel Dynamics Inc. executives provided further insight into operations at the company’s Sinton, Texas, flat-rolled steel mill on a second-quarter earnings conference call on Thursday morning. Despite a series of start-up woes, the company recently commissioned two new coating lines there, and the mill continues to ramp up production. The execs were also bullish on […]

There are just 40 days left until the 2024 SMU Steel Summit gets underway on Aug. 26 at the Georgia International Convention Center (GICC) in Atlanta. And I’m pleased to announce that it's official now: More than 1,000 people have registered to at attend! Another big development: The desktop version of the networking app for the event has officially launched!

There are a lot of rumors swirling around the steel market over the last couple of weeks. Chief among them was that we might see a price hike after Independence Day. Another concerns a key detail in the new Section 232 agreement with Mexico. Namely, steel imported from Brazil into Mexico. Of particular interest is its potential implication for slabs imported from Brazil, rolled in Mexico, and then exported to the US.

Steel is, mostly for historical reasons, a bellwether of international policy. No longer an industry of primary importance, its advocates still proclaim that it is. And steel still continues to punch above its weight in Washington, DC. Below are a few recent examples.

A month ago, when we last presented this column, there was a surprising amount of optimism in the presumably imminent reversal of the downtrend in hot-rolled steel prices in the second half of this year.

A roundup of CRU aluminum news.

Renewable energy infrastructure, including wind turbines, solar farms, and electric-vehicle charging stations, requires substantial amounts of steel. The domestic steel industry, with its capacity to produce world-class steel with the world’s smallest carbon footprint, should be at the forefront of this supply chain. Yet the United States is increasingly importing steel from abroad to meet its renewable energy needs.

The US and Mexico announced measures on Wednesday to prevent tariff evasion and protect North America’s steel and aluminum industries.

Three steel trade groups and United Steelworkers (USW) union held an event on Capitol Hill urging action on strengthening legislation against unfair trade.

Steel trade associations applauded the introduction of the “Prove It Act” into the House of Representatives on Monday.

The volume of steel shipped into Vietnam more than doubled in May to 1.1 million (mt), with China’s share above 70%, according to customs’ statistics. In the first five months, Chinese imports were more than 4.7 million mt, an increase of 91% year on year.

North America has one of the most robust steel scrap markets in the world. The continent has a long history of steel production, significant imports of steel and steel-containing products, and mature steel consumption. Due to this, the reservoir of scrap available to be recycled each year in the US and other North American markets is substantial and growing.

It’s been a slow start to the week as far as news goes, something you’d expect ahead of a shortened Independence Day week. That said, it’s not as if transactions have completely ground to a halt. (Prices continue to drift lower.) And while news might be slow, rumors of low-priced deals, price hikes, and trade cases seem to have filled that void.

Antidumping and countervailing duties (AD/CVDs), in place for more than twenty years on imports of hot-rolled (HR) steel from six countries, are up for their fourth sunset review.

Looking out over the American economy, Triple-S Steel Holdings CEO Gary Stein believes what is required doesn’t fundamentally have to do with government policy. “Rather, it’s a mind shift.”

At the end of every Supreme Court term there are a few big cases. This year, there are more. The last day for releasing opinions comes July 1. On Friday, the Court issued a long-awaited and long-expected decision about interpreting statutes that give powers to administrative agencies, including (among many others) the Commerce Department, the […]

July is less than a week away, which means SMU’s Steel Summit in August is just around the corner.

The Congressional Steel Caucus have expressed concern regarding the US government’s potential trade status change for Vietnam.

U.S. Steel and Nippon Steel explained their position on USS’ participation in US trade cases should their proposed nearly $15-billion merger deal go through. The companies hope to close the deal by the end of the year.