Trump taps former adviser Navarro for key trade, manufacturing role

President-elect Donald Trump announced that Peter Navarro will serve as his senior counselor for trade and manufacturing.

President-elect Donald Trump announced that Peter Navarro will serve as his senior counselor for trade and manufacturing.

“We are under constant threat from nonmarket economies who evade our trade laws," SMA said.

American and Canadian steel trade groups, as well as the government of Mexico, have responded to President-elect Trump's threat of imposing 25% tariffs on all US imports from Canada and Mexico and a 10% tariff on imports from China.

Are you still recovering from the election? If so, please get plenty of rest. Next year will require you to be awake and alert. Things are likely to change. We can’t be sure exactly how they will change yet.

The OECD Steel Committee convened its 96th session last week in Paris, along with the Global Forum on Steel Excess Capacity. The event brought together 250 government and industry delegates from 40 of the largest steel-producing countries. The Committee’s discussions and presentations were clear: Steel markets worldwide are in dire straits.

After a frenzied election cycle, Donald Trump will return to the White House with an amplified trade agenda.

September steel imports were 10% less than August levels, marking the lowest monthly import rate seen this year

Last week’s Community Chat with international trade attorney and regular SMU columnist Lewis Leibowitz was packed full of valuable perspectives on trade topics near and dear to the steel industry.

The Global Forum on Steel Excess Capacity (GFSEC) reaffirmed on Oct. 8 what domestic steel producers have long known—the threat of excess steel capacity never disappeared and is evolving. China’s steelmakers are boosting capacity and exports, echoing the 2016 global steel crisis. There is no doubt that China is successfully weaponizing excess capacity across many industries, and the fatal damage to domestic production and national security undermines the interests of all market-oriented countries. The question now is: How will GFSEC countries respond?

China is challenging Canada’s decision to put tariffs on imports of Chinese steel, aluminum, and electric vehicles.

Another day, another massive gap between the news and market sentiment. On the news side, we’ve got war in the Middle East. The devastation facing western North Carolina coming into tragic focus. And the outcome of the presidential election remains a coin toss, according to current polling.

All eyes are on the coastwide longshoremen's strike, with many scrambling to assess the situation and understand its implications for their businesses and the economy.

The International Longshoremen’s Association (ILA) launched a strike just after midnight on Tuesday at East Coast and Gulf Coast ports. The work stoppage spans from New England to New Orleans. It came after a last-ditch offer by the United States Maritime Alliance (USMX), which represents maritime employers, failed to meet union demands.

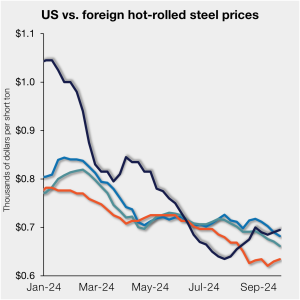

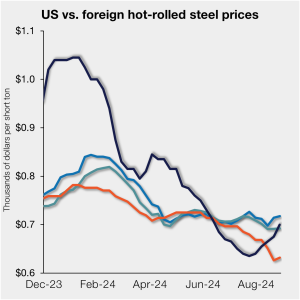

US hot-rolled (HR) coil prices inched up again this past week but remain just a touch more expensive than offshore material on a landed basis.

A potential labor strike is threatening to disrupt supply chains up and down the Atlantic and Gulf Coasts beginning next week.

Continued highly competitive steel exports from China, amid weakening global demand, have triggered a wave of trade protectionism across major markets.

The only way to achieve net zero goals worldwide is to significantly reduce the greenhouse gas emissions of the global steel industry. And emissions standards can play a key role in encouraging (or discouraging) steel decarbonization. In that spirit, earlier this year, the Biden administration established a climate and trade task force, aimed at a promoting “a global trading system that slashes pollution, creates a fair and level playing field, protects against carbon dumping, {and} supports good manufacturing jobs and economic opportunity.” These are ambitious and laudable goals. Across sectors, the United States has a significant carbon advantage over many of its economic competitors. This is certainly true in the steel industry, where American manufacturers are among the lowest emitting in the world. In other words, when it comes to steel, climate-focused trade policy can go hand-in-hand with US competitiveness.

Following May’s five-month low, US steel exports ticked higher in July, according to the latest US Department of Commerce data. The amount of steel exiting the country rose 6% month on month (m/m) to 818,000 short tons (st). This is back in line with trade levels seen in recent months.

Trade is always front and center in an election year. And 2024 is no different. There is no shortage of issues, with questions like the sale of U.S. Steel to Japan’s Nippon Steel, potential cracks in the USMCA, and Chinese overcapacity dominating the headlines. But how do you distinguish between issues that might just last until November, and what are the crucial questions that could affect your business for years to come?

CANACERO's General Director Salvador Quesada Salinas shares his thoughts on the Mexican steel trade 'myth' and what US trade data really shows.

Nippon Steel and other Japanese steelmakers are lobbying for the Japanese government to limit imports of Chinese steel, according to a report in Reuters.

This CRU Insight explores how decarbonization will play a significant role in redefining steel trade patterns by shifting regional competitiveness and increasing steel demand needs.

US hot-rolled (HR) coil prices continue to move higher, surpassing tags for offshore material on a landed basis. Domestic prices, improving on the heels of firmer US mill offers, pulled ahead of import tags as the stateside gains this week were sharper than the increases in overseas markets. SMU’s check of the market on Tuesday, […]

Canada has announced a 25% tariff on Chinese steel and aluminum, along with a 100% tariff on Chinese EVs.

Chinese steel export prices decreased for the eleventh week in a row, with all steel products recording losses of 2-3.7% compared to the previous week.

The Trade Remedies Authority (TRA) in the UK has proposed raising the tariff rate quota (TRQ) for imports of hot rolled sheet steel because of blast furnace closures at the Port Talbot works in south Wales. Tata Steel shut down one BF in July with the second to follow in September ahead of a switch […]

Canada’s steel and aluminum industries joined forces to call on the government for the imposition of tariffs on steel, aluminum, and electric vehicles.

A long-awaited reconsideration of the status of Vietnam as a “non-market economy” was completed by the Commerce Department earlier this month. Hundreds of companies, associations, and politicians weighed in on the question. On Aug. 2, Commerce released its conclusions in a 248-page memorandum, deciding that Vietnam remains a non-market economy (NME) under the US antidumping law. But what are the implications for Vietnam and for other countries with the same status?

The US Commerce Department on Friday released its determination confirming that the Socialist Republic of Vietnam continues to function as a non-market economy (NME). The department’s decision represents a significant victory for domestic manufacturing. It is also critical to leveling the playing field for US industries and will support greater opportunities for growth and fair trade in the United States. The government of Vietnam had requested that Commerce reconsider its NME designation. It argued that Commerce Secretary Gina Raimondo had pledged to support the changing of its status to a market economy.

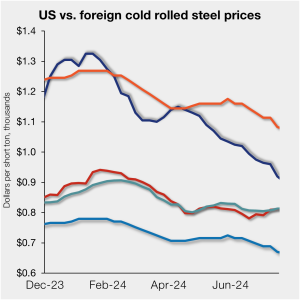

The price gap between US cold-rolled (CR) coil and imported CR tightened marginally after falling to a 10-month low in late July.