CRU: Countries start protecting steel in world of 25% US tariffs

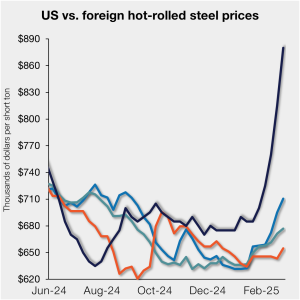

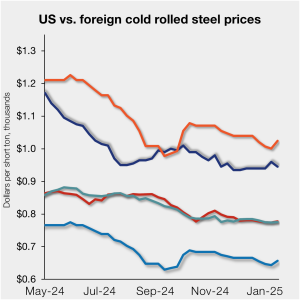

These developments come at a time when the global trading system has been shaken up by US President Donald Trump’s greater use of tariffs, including employing Section 232 legislation to impose a 25% levy on steel from all countries to protect national security.