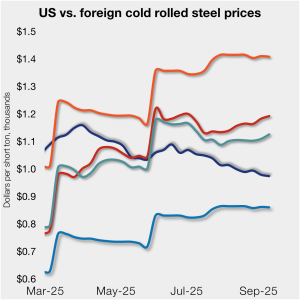

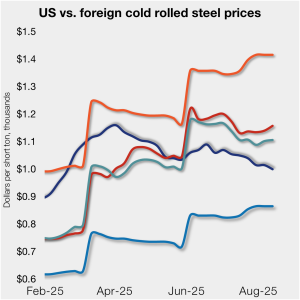

Price gap between US CR, most imports widens

Cold-rolled (CR) coil prices ticked lower in the US this week, while prices in offshore markets mostly diverged and ticked higher.

Cold-rolled (CR) coil prices ticked lower in the US this week, while prices in offshore markets mostly diverged and ticked higher.

Rising Midwest and European premiums are giving Canadian aluminum producers a rare boost, restoring pricing power just ahead of key 2026 negotiations.

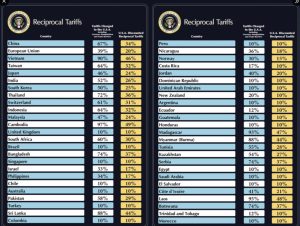

International trade law and policy remain a hot topic in Washington and beyond this week. We are paying special attention to the ongoing litigation of the president’s tariff policies and the administration’s efforts to heighten trade enforcement.

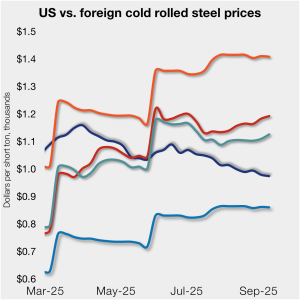

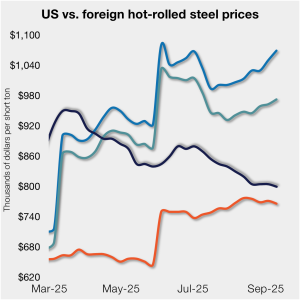

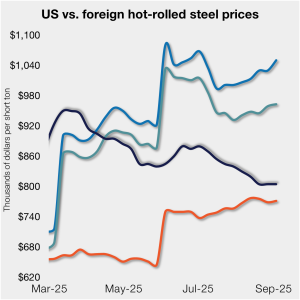

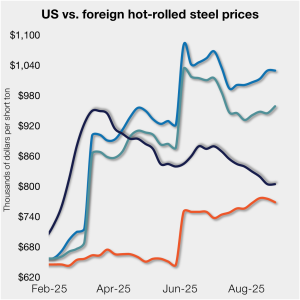

Domestic hot-rolled (HR) coil prices ticked down this week after holding flat since mid-August. Offshore prices largely all moved higher week over week (w/w), widening the margin between stateside and foreign product.

Mexico is considering imposing steep tariffs on imports of steel, automobiles, and over 1,400 other products. Its target? Countries with which it does not have free trade agreements, mainly China, India, Thailand, and other South Asian nations.

Participants in the hot-rolled steel sheet market expect the market to remain subdued through the end of the year.

Comments from participants of our Ferrous Scrap Market Survey.

A recurring theme in conversations with some of you and in the comments submitted in our surveys is concerns about demand and uncertainty around tariffs. Where does SMU’s latest opinion polling on President Trump’s tariffs stand? Let’s take a look at the numbers.

President Trump’s “reciprocal” tariffs under the International Emergency Economic Policy Act (IEEPA) were struck down again, this time on Aug. 29 by the Court of Appeals for the Federal Circuit (CAFC). The legal and policy mess continues, with the next stop being the US Supreme Court.

Repealing any reciprocal tariffs placed by President Donald Trump on US imports of direct reduced iron (DRI), iron ore, hot-briquetted iron (HBI), and pig iron would have only a nominal impact on the US steel market, market participants said.

The Brazilian-US pig iron market has remained quiet, market sources told SMU.

Domestic hot-rolled (HR) coil prices were flat this week for a third straight week. Offshore prices all moved higher w/w, widening the margin between stateside and foreign product.

Could an upcoming BRICS meeting spell trouble for President Trump's trade policy?

SMU’s hot-rolled (HR) coil price held steady this week while prices for other sheet and plate products declined.

Steel executives packed the main conference hall of the 2025 SMU Steel Summit on Tuesday, Aug. 26, to hear economist Dr. Anirban Basu lay out his blunt view of tariffs, inflation, and demand.

Another record-breaking SMU Steel Summit is in the books. Thanks to all of you – attendees, speakers, sponsors, and exhibitors – for making it possible it in what has been an uncertain year for steel.

Domestic hot-rolled (HR) coil prices were flat this week, while offshore prices varied week over week (w/w). The price margin between stateside and foreign product was little changed as a result.

Steel prices, end-use demand, inventory levels, tariffs, imports, and evolving market events... what is the steel industry talking about this week?

Canada has agreed to drop some retaliatory tariffs on US products, effective Sept. 1.

The big show is here again. SMU Steel Summit begins on Monday. This year, like last year, more than 1,500 people will be joining us. And I couldn’t be more excited to have everyone here in Atlanta.

As everyone surely knows by now, the SMU Steel Summit starts on Monday in Atlanta, Ga. So, this is a great opportunity to reflect on how much has changed since the 2024 Summit. Certainly, no one could have imagined the wholesale and transformative changes to U.S. and global trade policy.

With SMU Steel Summit starting in just a few days, I decided to go back and do a quick check on where things stand now compared to the week before Summit last year.

Australia-based global recycler Sims Ltd. has a rosy long-term outlook, while the company said tariffs are supporting US demand for ferrous scrap.

China has requested dispute consultations with Canada at the WTO about Canadian measures on Chinese steel and aluminum imports.

Is a pattern finally emerging in the post-Liberation Day tariff landscape?

The Commerce Department has added over 400 HTS codes to the list of steel and aluminum derivative products covered under the Section 232 tariffs.

The question of the new world order was on many minds last week when I spoke on another SMU Community Chat. The short answer is that nobody knows in detail what the effects of all the economic and geopolitical developments will be.

While boarding Airforce One on Friday, US President Donald Trump stated that he would be setting more steel tariffs and putting ~100% tariffs on semiconductors and chips.

Cold-rolled (CR) coil prices continued to decline in the US this week, while prices in offshore markets diverged and ticked higher.

Reporting and enforcing steel tariffs are two top–of-mind concerns for US manufacturers, the US Customs and Border Protection agency, importers, and others across the supply chain.