Final Thoughts

Sheet prices mostly ticked higher again this week. And the reasons shouldn’t come as a big surprise to anyone who has been reading SMU lately.

Sheet prices mostly ticked higher again this week. And the reasons shouldn’t come as a big surprise to anyone who has been reading SMU lately.

The European Commission is aiming to have Section 232 tariffs eased on steel and aluminum, with a special eye towards derivative products as well, as it negotiates with the Trump administration, according to a report in Politico on Dec. 15.

SMU and AMU are pleased to announce that Wells Fargo Managing Director Timna Tanners will be joining us for a Community Chat webinar on Wednesday, Dec. 17, at 11 am ET.

In our opinion, it is striking that for all the bold talk about establishing a "common external tariff" — or "Fortress North America" — the solutions being proposed fail to live up to their promises. As we have commented recently, USMCA certainly needs a rethink. But we have serious concerns about Canadian and Mexican proposals that suggest common trade policies that are, as we see it, more illusory than effective.

There was a palpable sense of optimism among folks at the HARDI conference about demand from data centers. In other words, around the physical infrastructure – which also includes energy transmission - needed to feed the AI boom. The big question: Could demand from data and AI be far stronger than the market yet realizes?

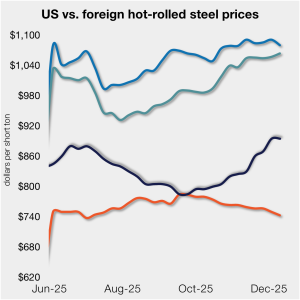

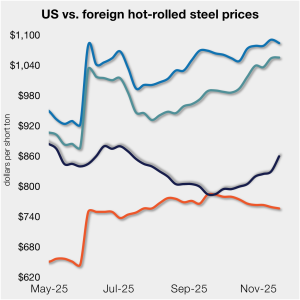

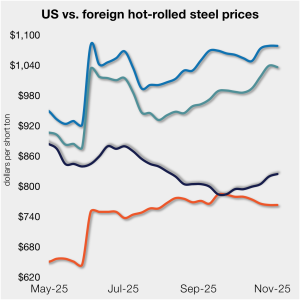

The price gap between stateside hot band and landed offshore product continues to narrow toward parity, now at its lowest level in five months.

We can be grateful for some things. One is the regional agreement between the US, Canada, and Mexico that is currently undergoing review. A decision is expected by July 2026 on whether to extend the agreement, which is set to expire in 2036, for another 16 years (to 2052). Three days of hearings just concluded with comments of five minutes’ duration from more than 50 witnesses.

The American Iron and Steel Institute’s (AISI's) Kevin Dempsey gave a series of policy proposals ahead of the review of the USMCA trade agreement next year.

It's important to keep in mind - maybe especially for those of us in the US - that the rest of the world can act too. And I think we're already seeing signs of that action, or at least that's been my takeaway from some of SMU's recent reporting and from Community Chat webinars for both SMU and AMU.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

The price gap between stateside hot band and landed offshore product has inched closer to parity, now at its lowest level since the summer.

Deere & Company's latest earnings report put a spotlight on the mounting costs of tariffs across the agricultural and heavy machinery sectors.

Canada’s Algoma Steel announced ~1,000 layoffs on Monday as a result of disruptions from the US tariff situation.

Canadian Prime Minister Mark Carney announced new measures on Wednesday to strengthen the country’s domestic steel industry, which include a tariff on some downstream steel-intensive goods.

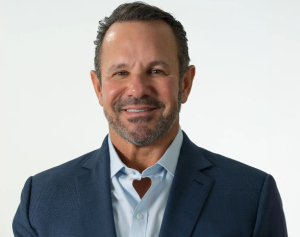

Algoma Steel CEO Michael Garcia has been recognized by Canada’s The Globe and Mail newspaper as “CEO of the Year: Corporate Citizen.”

Republic Steel’s shuttered facilities in Lorain, Ohio, could find new life as international steelmakers, citing US tariffs, explore restarting operations there.

German Economy Minister Katherina Reiche expressed frustration with US levies on steel and aluminum products. The US contends the EU is unfairly targeting its big tech firms.

Wiley attorneys Alan Price and Ted Brackmeyer argue that significant changes to the USMCA and continued Section 232 tariffs on Canada and Mexico are needed to support American steelmaking.

SMU sits down with Barry Zekelman to talk North American trade and the state of the US and Canadian steel industries.

The price gap between stateside hot band and landed offshore product shrank week over week (w/w).

The whole world waits for the Supreme Court to rule on the validity of President Trump’s International Emergency Economic Powers Act (IEEPA) tariffs. Meanwhile, the ground is shifting. Just this past week, the president changed the direction of tariff policy. He belatedly concluded that taxes on imports of products that we don’t make in the United States are inflationary

Wiley Law trade attorneys, Alan Price and Robert DeFrancesco, offered legal expertise to steel and aluminum market participants on Thursday’s SMU Community Chat.

US steel and manufacturing industries say they face a new set of uncertain market factors due to the government’s shutdown and the potential repeal of “reciprocal” tariffs.

Want to know the latest on Trump, tariffs, and trade policy – and the impact on both steel and aluminum? Join Steel Market Update (SMU), Aluminum Market Update (AMU), and leading law firm Wiley for a Community Chat on Thursday, Nov. 13, at 11 am ET.

The gap between US hot band prices and imports narrowed slightly. But with the 50% Section 232 tariffs, most imports remain more expensive than domestic material.

The Canadian Steel Producers Association (CSPA) applauded the passage of the Canadian federal budget, which includes several measures that aid their domestic steel industry.

US President Donald Trump and Chinese President Xi Jinping on Thursday had a much-anticipated meeting. Is it only a hiatus in the trade war, or did it really change the situation? I suspect the former, I but hope for the latter.

Gerdau’s North American profits rose in the third quarter, boosted by a decline in imports due to Section 232 steel tariffs.

President Trump’s decision to suspend trade negotiations with Canada has crushed short-term expectations of any relief for Canadian producers or the US Midwest P1020 premium.

North American auto assemblies declined in September, down 5.1% vs. August. And assemblies were also down 1% year on year.