CRU aluminum: Trade continues to be hot topic

The Mexican federal government backed down on the application of tariffs on raw non-alloyed and alloyed aluminum decreed on April 22.

The Mexican federal government backed down on the application of tariffs on raw non-alloyed and alloyed aluminum decreed on April 22.

The Inflation Reduction Act (IRA) appropriated more than $4 billion to the General Services Administration (GSA) and Federal Highways Administration (FHWA) for “Buy Clean” programs. The statute makes clear that GSA and FHWA purchases under these programs are limited to those with “substantially lower” emissions. There is no ambiguity in that requirement. The Environmental Protection Agency (EPA) has defined “substantially lower” to mean products with the lowest 20% of embodied emissions when compared to similar materials.

In this Premium analysis we cover North American oil and natural gas prices, drilling rig activity, and crude oil stock levels.

A vote on Friday by the International Trade Commission (ITC) ensures that antidumping duties on certain steel sheet imports from Japan will continue for the mid-term.

Steel Market Update’s Steel Demand Index fell eight points, and back into contraction territory, an indication demand might be slipping as prices have trended lower, according to our latest survey data.

Japanese steelmaker JFE Holdings will invest abroad as part of a drive to lift income, says group president Yoshihisa Kitano.

Triple-S Steel Holdings has acquired Houston-based plate distributor Griffin Trade Group.

SMU’s Steel Buyers’ Sentiment Indices both declined this week, with Current Sentiment tumbling over 10 points, according to our most recent survey data.

Last week we wrote about a brief lull in price movement, labeling it a period of wait and see. It did, in fact, turn out to be pretty brief. This week... things are little bit different. Perhaps right now we are more in a period of "hope and pray" or "Here we go, hold on to your hats."

Three vocal Republican senators are demanding that President Joe Biden block the sale of U.S. Steel to Japan’s Nippon Steel.

Steel prices trickled lower across the month of April for both sheet and plate products.

Stelco reported a positive start to 2024 in its first-quarter earnings report on Thursday. And with steady demand and a stable market, the Canadian flat-rolled steelmaker is optimistic for the remainder of the year.

CRU Senior Analyst Ryan McKinley will be the featured speaker on the next SMU Community Chat on Wednesday, May 15, at 11 am ET. You can register here. Note that the live webinar is free for all to attend. A recording will be available only to SMU members.

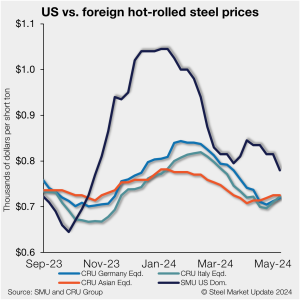

US hot-rolled (HR) coil prices declined again, tightening their premium over offshore hot band, and moving closer to parity.

Hot rolled, cold rolled, and plate buyers said mills are more willing to talk price on spot orders this week, while the overall negotiation rate for products SMU surveys remained level, according to our most recent survey data.

Tariffs on unfairly traded steel and other products help to stabilize America’s most important industries, safeguard tens of thousands of jobs, and protect national security. My union, the United Steelworkers (USW), never seeks these remedies lightly. And presidents, Republican and Democrat alike, implement them only after diligent investigations documenting the harm that foreign adversaries intentionally inflict upon our country with dumping, overproduction and other kinds of trade cheating. I don’t think Lewis Leibowitz considered these points while criticizing tariffs in his excessively pro-free-trade column, “Where is the voice of the consumer?” on May 5.

Most steel products tracked by SMU saw lead times contract this week from two weeks earlier, according to SMU’s most recent survey data.

Brazil-based Gerdau has announced it will carry out a feasibility study into the greenfield development of a 600,000 metric-ton-per-year (mt) special steel plant in Mexico.

Klöckner & Co. logged a wider net loss in the first quarter on-year, but the Duisburg, Germany-based service center group expects higher shipments and sales in the upcoming three months.

Thyssenkrupp Materials Services is continuing its expansion in North America. It announced the opening of a new steel service center in Sinton, Texas, to primarily serve the automotive, HVAC, and construction markets.

Majestic Steel announced the completion of its flagship Majestic Steel Arkansas facility in Blytheville on the campus of Nucor Steel Hickman.

The amount of new steel available to the US market, dubbed apparent steel supply, rebounded 7% in March, according to SMU calculations on Department of Commerce and American Iron and Steel Institute (AISI) data.

Unless you've been under a rock, you know by know that Nucor's published HR price for this week is $760 per short ton, down $65/st from the company’s $825/st a week ago. I could use more colorful words. But I think it’s safe to say that most of the market was not expecting this. For starters, US sheet mills never announce price decreases. (OK, not never. It has come to my attention that Severstal North America rescinded a price increase back on Feb. 14, 2012. And it caused quite the ruckus.)

United Steel Supply plans to invest up to $10 million to open a steel processing and painting facility at the Ports of Indiana-Jeffersonville near Louisville, Ky.

When we were asked to provide some additional commentary to SMU about the futures markets for flat rolled, our only reluctance to contribute was rooted merely in the fact that SMU (1) already offers an excellent array of authors on this topic and (2) a concern regarding what new ground could be covered that hasn’t already been discussed to death on this issue. Thankfully, however, Nucor has offered up something we can describe, without hyperbole, as simply revolutionary for spot pricing in flat rolled - a development that we simply could not resist commenting on with respect to its probable impacts on the futures market.

US steel exports eased through March but remain healthy, having reached a six-month high in February

US raw steel output ticked up last week, according to the latest American Iron and Steel Institute (AISI) data.

The EU has approved Tokyo-based Nippon Steel Corp.’s (NSC’s) proposed buy of U.S. Steel, a report in Reuters on Monday said.

Nucor started off May with a bang, dropping its weekly base spot price for hot-rolled (HR) coil by $65 per short ton (st) this week.

Is it just me, or does it seem like the summer doldrums might have arrived a little early? I could be wrong there. It’s possible we could see a jump in prices should buyers need to step back into the market to restock. I’ll be curious to see what service center inventories are when we update those figures on May 15. In the meantime, just about everyone we survey thinks HR prices have peaked or soon will. (See slide 17 in the April 26 survey.) Lead times have flattened out. And some of you tell me that you’re starting to see signs of them pulling back. (We’ll know more when we update our lead time data on Thursday.)