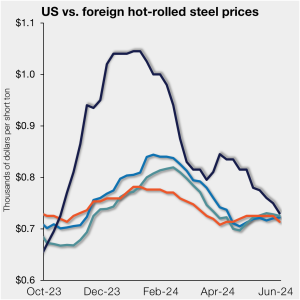

Nucor cuts weekly HR price by $60/ton

Nucor said on Monday that it would lower its weekly hot-rolled (HR) coil price effective immediately. In a letter to customers, the company said its consumer spot price (CSP) for the week of June 10 would be $720 per short ton (st), a $60/st cut vs. the prior week. This is not the first big […]