Steel Summit: Analysts say demand likely to struggle until 2027

Steel industry analysts at this year's SMU Steel Summit said they see lackluster demand through this year and next.

Steel industry analysts at this year's SMU Steel Summit said they see lackluster demand through this year and next.

SMU’s hot-rolled (HR) coil price held steady this week while prices for other sheet and plate products declined.

Another record-breaking SMU Steel Summit is in the books. Thanks to all of you – attendees, speakers, sponsors, and exhibitors – for making it possible it in what has been an uncertain year for steel.

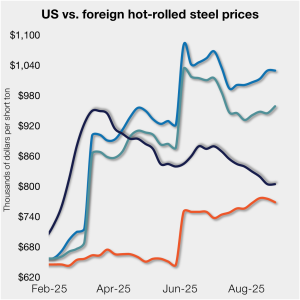

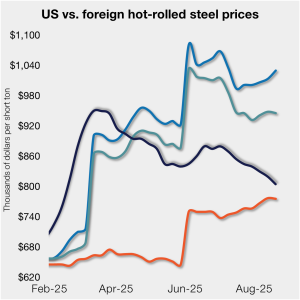

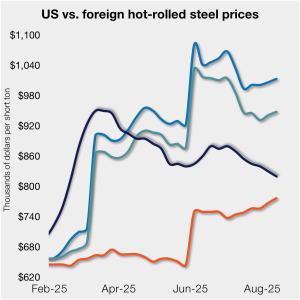

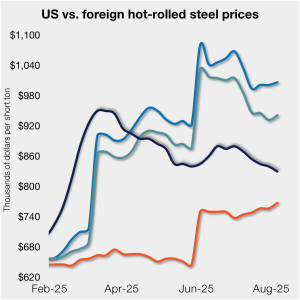

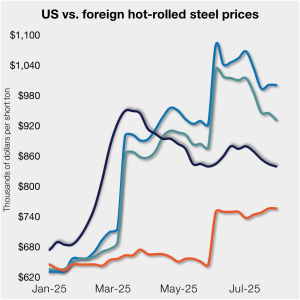

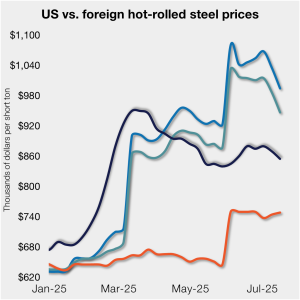

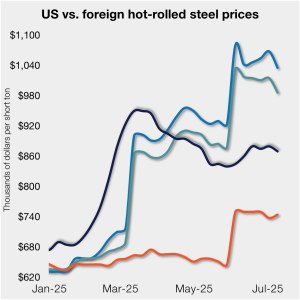

Domestic hot-rolled (HR) coil prices were flat this week, while offshore prices varied week over week (w/w). The price margin between stateside and foreign product was little changed as a result.

The big show is here again. SMU Steel Summit begins on Monday. This year, like last year, more than 1,500 people will be joining us. And I couldn’t be more excited to have everyone here in Atlanta.

As everyone surely knows by now, the SMU Steel Summit starts on Monday in Atlanta, Ga. So, this is a great opportunity to reflect on how much has changed since the 2024 Summit. Certainly, no one could have imagined the wholesale and transformative changes to U.S. and global trade policy.

HRC prices in the US eroded further last week, while offshore prices varied week over week (w/w), widening the price margin between stateside and foreign product.

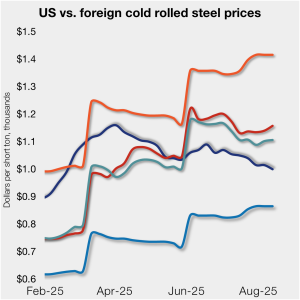

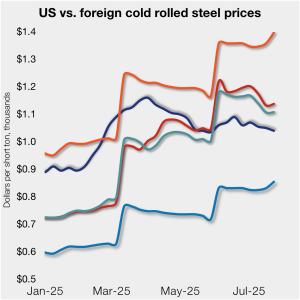

Cold-rolled (CR) coil prices continued to decline in the US this week, while prices in offshore markets diverged and ticked higher.

Hot-rolled (HR) coil prices in the US declined again last week, while offshore prices ticked higher again week over week (w/w).

US President Donald Trump extended the US and China’s 90-day pause on planned reciprocal tariffs on Monday.

Hot-rolled (HR) coil prices in the US declined again last week, while offshore prices increased week over week (w/w).

Veteran trade attorney Lewis Leibowitz will join SMU for a Community Chat on Wednesday, Aug. 13, at 11 am ET.

Sheet and plate prices were either flat or modestly lower this week on softer demand and increasing domestic capacity.

Hot-rolled (HR) coil prices in the US edged lower again this week, while offshore price were little changed. Stateside prices continue to trail imports from Europe, supported by Section 232 steel tariffs.

ArcelorMittal expects less demand growth across most of the markets it operates in, including the US, because of President Donald Trump’s tariffs. But the Luxembourg-based steelmaker also thinks it stands to benefit from an increasingly regionalized world thanks to investments like the new EAF at its mill in Calvert, Ala.

The Steel Demand Index now stands at 42, up from 38.5 in early July, but off from a four-year high of 65.0 in late February.

US and European steel trade groups were at odds over their reaction to the recent trade deal President Trump brokered with the EU.

Is this just a severe case of the summer doldrums? Will demand improve in the fall, as it often does? Or has uncertainty around tariffs and the economy created a more lasting impact?

President Trump said a negotiated deal with Canada might not occur, and all existing tariffs, along with those set to take effect soon, will stay in place, according to media reports.

Cold-rolled (CR) coil prices continued to decline in the US this week, while prices in offshore markets ticked higher.

Hot-rolled (HR) coil prices in the US edged lower again this week but have remained in a tight band for roughly four months. Stateside prices continue to trail imports from Europe, supported by Section 232 steel tariffs that were doubled in early June.

Cleveland-Cliffs lost more than $400 million for the third consecutive quarter but predicted results would improve in the second half of the year. And shares of the Cleveland-based steelmaker surged after company executives said during its Q2 earnings call on Monday that they could make billions by courting foreign investors or selling assets.

Industries that use steel in manufacturing employ many more workers than steel production. Raising the cost of steel for these customers will not increase manufacturing employment. In fact, it will probably hit employment hard.

Tariff threats on Brazil aren't just hitting steel products. Aluminum is also feeling the heat.

Cold-rolled (CR) coil prices continued to tick lower in the US this week, with a similar trend seen in offshore markets.

Chinese steel export prices are expected to rise and support prices across most of Asia in the coming month. In Europe, buyers are likely to frontload import orders ahead of CBAM imposition, while new trade agreements are likely to emerge in the US. Steel prices in the APAC are expected to rise, except in India […]

Stateside prices continue to trail imports from Europe, supported by Section 232 steel tariffs that were doubled in early June.

SMU’s Steel Buyers’ Sentiment Indices moved in opposite directions this week. After rebounding from a near five-year low in late June, Current Sentiment slipped again. At the same time, Future Sentiment climbed to a four-month high. Both indices continue to show optimism among buyers about their company’s chances for success, but suggest there is less confidence in that optimism than earlier in the year.

The difference: The spat with Turkey was a big deal for steel. This time, the 50% reciprocal tariff for Brazil – if it goes into effect as threatened on Aug.1 – hits everything from coffee and to pig iron. It seems almost custom-built to inflict as much pain as possible on Brazil.

Hot-rolled (HR) coil prices in the US ticked down this week but have fluctuated little over the past month. Stateside tags continue to trail imports from Europe, supported by Section 232 steel tariffs that were doubled in early June.