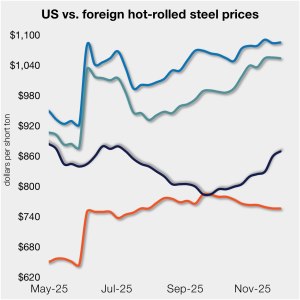

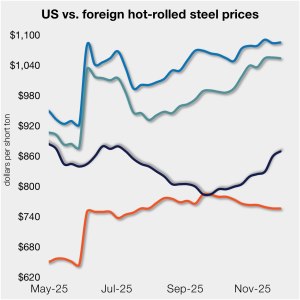

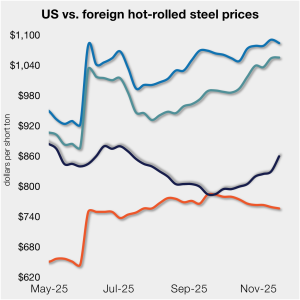

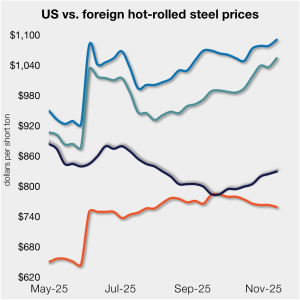

Price gap between US HRC, imports narrows again

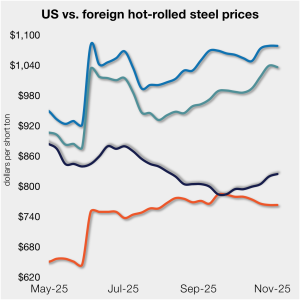

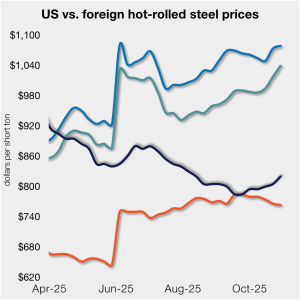

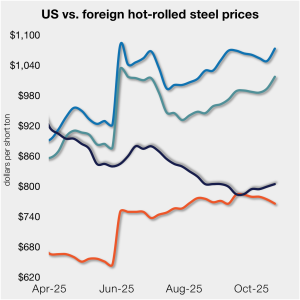

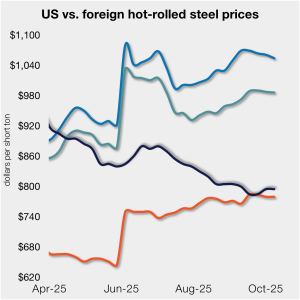

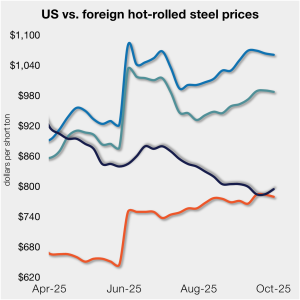

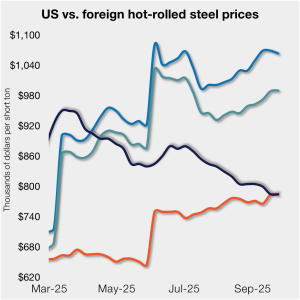

The price gap between stateside hot band and landed offshore product tightened further this week, as the average price for domestic hot-rolled was $10/st higher w/w.

The price gap between stateside hot band and landed offshore product tightened further this week, as the average price for domestic hot-rolled was $10/st higher w/w.

Wiley attorneys Alan Price and Ted Brackmeyer argue that significant changes to the USMCA and continued Section 232 tariffs on Canada and Mexico are needed to support American steelmaking.

The price gap between stateside hot band and landed offshore product shrank week over week (w/w).

The SMU Steel Demand Index slackened from late October, remaining below expansion territory, according to SMU's mid-November indicators.

The whole world waits for the Supreme Court to rule on the validity of President Trump’s International Emergency Economic Powers Act (IEEPA) tariffs. Meanwhile, the ground is shifting. Just this past week, the president changed the direction of tariff policy. He belatedly concluded that taxes on imports of products that we don’t make in the United States are inflationary

The price gap between stateside hot band and landed offshore product has marginally widened week over week.

Want to know the latest on Trump, tariffs, and trade policy – and the impact on both steel and aluminum? Join Steel Market Update (SMU), Aluminum Market Update (AMU), and leading law firm Wiley for a Community Chat on Thursday, Nov. 13, at 11 am ET.

The gap between US hot band prices and imports narrowed slightly. But with the 50% Section 232 tariffs, most imports remain more expensive than domestic material.

Cleveland-Cliffs on Thursday said it had signed a memorandum of understanding (MoU) with POSCO to forge a strategic partnership, one Cliffs bills as "transformative."

In dollar-per-ton terms, US product is on average $141/st less than landed import prices (inclusive of the 50% tariff). That’s down from $148/st last week.

Below are some other issues that should be on your radar. Because while prices have been steady, a lot is going on when it comes to news that could impact them.

SMU’s average price for domestic HR coil moved $5 higher this week, while price movements in offshore markets varied. This dynamic...

Want to know the latest on Trump, tariffs, and trade policy - and the impact on both steel and aluminum? Then join SMU, AMU, and leading law firm Wiley for a Community Chat on Thursday, Nov. 13, at 11 am ET.

It's can-kicking at its finest. And it’s been drawn out! Some are getting so good at it, they’re kicking cans and taking names.

Our average HR coil price increased $5/short ton from last week, marking a second consecutive week of modest gains. Market participants generally attributed the increase to...

Medium- and heavy-duty trucks (MHDV) and buses imported to the US will start being charged Section 232 tariffs beginning Nov. 1.

There are days when this feels like a “nothing ever happens” market. Don’t get me wrong. Plenty is happening in the world. It’s just that none of it seems to matter when it comes to sheet and plate prices.

Any steel imports into the EU that exceed the new, lower quota level would be subject to a 50% tariff, which represents a major increase from the EU’s current 25% out-of-quota tariff. This move would largely align the EU’s steel tariff rate with Canada and the United States.

More liberal access to the Northwest Passage could play into trade negotiations between Canada and the United States.

SMU’s average price for domestic hot-rolled (HR) coil was $795 per short ton (st) this week, sideways week on week (w/w). The move was different in offshore markets last week, as prices eased marginally.

U.S. Steel is suing Algoma over the Canadian flat-rolled producer's rejection of iron pellet shipments, arguing it has breached its contract.

The price gap between stateside hot band and landed offshore product narrowed this week. Still, with the 50% Section 232 tariff, most imports remain much more expensive than domestic material.

Trade groups cautioned that a prolonged shutdown could strain US industry.

Market participants predicted that prices should be at or near a bottom. But while most seemed to agree on that point, many also said they saw little upside given a quiet spot market and ongoing concerns about demand.

How can the U.S. government block U.S. Steel’s Granite City rolling mill closure without harming other American steelmakers? Reducing imports should be the first step. Foreign producers continue to aggressively target the U.S. market, especially now as they find themselves displaced by Chinese exports.

Algoma Steel has publicly confirmed that it might scale back its presence in the US market. It's no secret why: 50% Section 232 tariffs remain in place against Canada, which has traditionally been one of our closest allies.

SMU’s average price for domestic hot-rolled (HR) coil held at $785 per short ton (st) this week, unchanged week on week (w/w). A similar dynamic was seen in offshore markets last week as well.

Canadian flat-rolled steelmaker Algoma Steel is reconsidering its presence in the US market after the doubling of US Section 232 tariffs on imported steel to 50%, a company spokeswoman said.

But, for better or worse, there is not a major political party championing unfettered free markets. While Democrats and Republicans don’t agree on much, both have cheered tariffs on steel. And so if you’re going to handicap any future decision on Granite City’s operations, including its blast furnaces, you’d better factor in politics at least as much as economics.

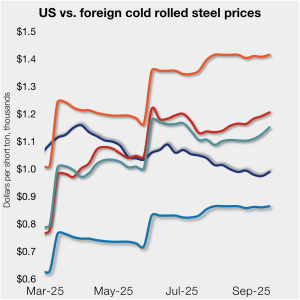

Cold-rolled (CR) coil prices ticked up in the US this week, matching a similar trend seen in offshore markets as well.