Steel market chatter this week

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market chatter.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market chatter.

Sheet prices varied this week. While hot-rolled (HR) coil pricing was largely flat, cold-rolled (CR) coil and tandem product pricing eased slightly reflecting the momentum shift seen last week for HR coil. SMU’s average HR coil price was flat from last week at $835 per short ton (st) – potentially emphasizing the tension between competing […]

Does the price of ferrous scrap depend on the price of finished steel product? And how much of an influence do billet and slab prices have on scrap prices?

Nucor said its spot hot-rolled (HR) coil price for the week of April 15 will be $835 per short ton (st), up $5/st from last week. The Charlotte, N.C.-based steelmaker said the new price would be effective immediately in a letter to customers on Monday morning. The exception again is California Steel Industries (CSI), Nucor’s […]

As the ISRI 2024 conference unfolds in Las Vegas, attendees are diving into crucial discussions shaping the future of the recycling industry. Here are the main topics being discussed: New steelmaking capacity coming online this year Export demand during this period Infrastructure spending Supply of pig iron and HBI Current logistics challenges May scrap prices […]

Last week was a newsy one for the US sheet market. Nucor’s announcement that it would publish a weekly HR spot price was the talk of the town – whether that was in chatter among colleagues, at the Boy Scouts of America Metals Industry dinner, or in SMU’s latest market survey. Some think that it could Nucor's spot HR price could bring stability to notoriously volatile US sheet prices, according to SMU's latest steel market survey. Others think it’s too early to gauge its impact. And still others said they were leery of any attempt by producers to control prices.

The Department of Commerce (DOC) has issued new rules to combat evolving "unfair" trade practice — including the unfair trade of steel products. They go into effect on Wednesday, April 24.

The latest SMU market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.” Historical survey results are also available under that selection. If you need help accessing the survey results, or if […]

The market appears to be taking a pause after the heavy buying that occurred in March.

Steel buyers said mills are more willing to talk price on spot orders on all the products SMU covers, according to our most recent survey data.

Steel prices continued to ease lower in early March – a trend seen since mid-January – before showing signs of bottoming and inflecting up. The SMU Price Momentum Indicator for sheet products shifted from lower to neutral mid-way through the month after Nucor, Cleveland-Cliffs, and ArcelorMittal all targeted new base minimums between $825-840 per short […]

For those of you old enough to remember The King and I, the April scrap market seems to be a puzzlement. While it is now clear that everything went sideways, one could clearly make an argument for prices to have been down.

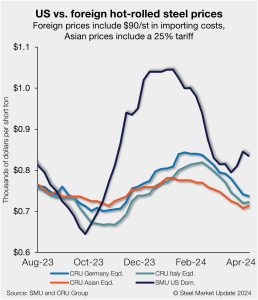

US hot-rolled (HR) coil has become increasingly more expensive than offshore hot band as stateside prices have moved higher at a sharper pace vs. imports.

The spread between hot-rolled coil (HRC) and prime scrap prices has widened this month after narrowing for three months, according to SMU’s most recent pricing data.

Over the last several years, I have noticed widening spreads between #1 Heavy Melting Steel (ISRI 201) and Shredded (ISRI 210,211), as well as Plate & Structural (ISRI 232).

Nucor made waves in the sheet market when it announced on Friday that it would begin publishing a weekly hot-rolled (HR) coil price. The Charlotte, N.C.-based steelmaker arguably made even bigger waves on Monday when it posted its first weekly HR number: $830 per short ton. That’s $70/st lower than the $900/st HR price Cliffs announced in late March. It’s also lower than prices in the mid-$800s that other mills were (less publicly) seeking.

Sheet prices saw a slight momentum shift this week after consecutive gains in the prior two weeks. Plate edged lower on greater competition off easing demand, according to our latest check of the steel market.

Nucor said its spot hot-rolled (HR) coil price this week will be $830 per short ton (st).

April scrap prices came in sideways in the US, sources told SMU.

Sheet prices continue to inch higher. That’s a welcome development for many. But it’s also a far cry from the price surge many predicted about a month ago. Remember the theory that supported a spring surge: Sheet prices would soar on a combination of mill outages, stable-to-strong demand, restocking, mill price increases, and (potentially) trade action against Mexico as well.

Nucor plans to publish a weekly spot price for hot-rolled (HR) coil beginning on Monday, April 8, according to a press release and letters to customers. The Charlotte, N.C.-based steelmaker said its published HR price would be derived from “both quantitative and qualitative data” in the letter to customers on Thursday, April 4.

Several large buyers in the North came into the market on a sideways basis from prices paid in March. The development comes after recent speculation about what prices US-based steelmakers would pay for scrap for April shipments.

On Monday and Tuesday of this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market chatter.

Sheet prices moved higher this week for the second consecutive week, while plate prices ticked lower, according to our latest canvas of the steel market.

Cleveland-Cliffs’ Lourenco Goncalves said the company is still interested in acquiring U.S. Steel, though no bid is currently on the table, according to a local report.

There is growing hope that the US scrap market has bottomed, according to industry sources. The steep price declines in March may have ushered in a floor because dealers say their stocks are a bit depleted. Their concern: that the flow of obsoletes could be cut severely with any further drop in prices. Is this wishful thinking, or do the fundamentals support the prediction of a market bottom? Let’s take a look!

Nucor intends to keep plate prices unchanged with the open of its May order book, according to a letter to customers dated Thursday, March 28. The Charlotte, N.C.-based steelmaker said the announcement would be effective with new orders received on Friday, March 29.

Steel Market Update will be taking time off in observance of Good Friday and Easter.

SMU latest' steel market survey paints the picture of sheet market that has hit bottom and begun to rebound. Lead times are extending again after stabilizing earlier this month. Mills are far less willing to negotiate lower sheet prices - even if there are still deals to be had on plate, according to the steel buyers we canvassed.

Steel buyers report that mills are less willing to talk price on new sheet orders than they were in weeks past, according to our most recent survey data. In contrast, mills’ willingness to negotiate on plate products remains relatively high, now at the second-highest rate of the year.