Nucor lifts HR spot price by $10/ton

Nucor has raised its weekly spot list price on hot-rolled coil by $10 per short ton (st) after keeping it unchanged since Aug. 25.

Nucor has raised its weekly spot list price on hot-rolled coil by $10 per short ton (st) after keeping it unchanged since Aug. 25.

US buyers want to drop pig iron prices to levels commensurate with the decline in prime scrap in their domestic market. Prime price shed $20 per gross ton (gt) in September and another $20/gt in October.

The steelmaker released updated extras to customers on Oct. 15, marking the second adjustment in just six weeks following their early September revision

What's on steel buyers' minds this week? We asked about market prices, demand, inventories, tariffs, imports, and other evolving market trends. Read on for buyers' comments in their own words...

Nucor kept its consumer spot price (CSP) for hot-rolled coil at $875 per short ton (st) for the ninth straight week.

After marginally rising in August and September, the premium galvanized coil carries over hot-rolled coil (HRC) coil has narrowed again in recent weeks. As of Sept. 16, the spread between these two products has shrunk to a two-and-a-half-year low of $125 per short ton (st).

Genuine demand, they stated, will return when the market feels stable again.

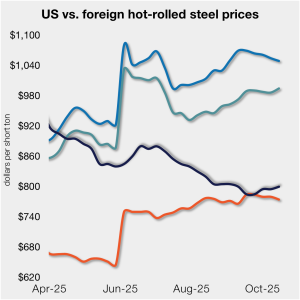

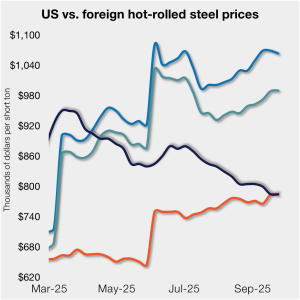

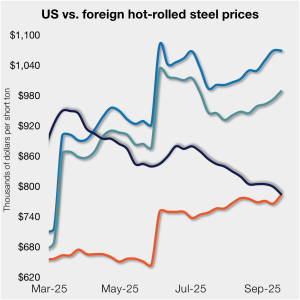

SMU’s average price for domestic hot-rolled (HR) coil was $800 per short ton (st) this week, up $5/st week on week (w/w). In offshore markets last week, prices were varied.

Participants in the domestic plate market say spot prices appear to have hit the floor, and they continue to linger there. They say demand for steel remains thin, with plate products no exception.

SMU has successfully completed an external review of all our prices. The review has concluded that they algin with principles set by the International Organization of Securities Commissions (IOSCO).

Nucor has left its consumer spot price for hot-rolled coil at $875 per short ton for the eighth straight week.

There are days when this feels like a “nothing ever happens” market. Don’t get me wrong. Plenty is happening in the world. It’s just that none of it seems to matter when it comes to sheet and plate prices.

Some sources also speculated that plate could see further price increases thanks to modest but steady demand, lower imports, mill maintenance outages, and end markets less immediately affected by tariff-related disruptions.

SMU’s sheet and plate prices see-sawed this week as hot-rolled (HR) coil prices held their ground while prices for galvanized product slipped.

Nucor is keeping hot-rolled (HR) coil prices unchanged again this week, according to its latest consumer spot price (CSP) notice issued on Monday, Oct. 6

Steel buyers say mills remain slightly more willing to negotiate spot prices for sheet and plate products than in mid-September, according to our latest market survey.

Following spot market plate price increase notices issued by domestic mills this past week, participants are contemplating the rationale behind the increases and whether they will stick. Some sources anticipate that current market conditions will shift in November and believe the increases may set a new "pricing floor."

We moved our pricing momentum indicators from “lower” to “neutral” for all sheet products this week. For those keeping score, we had been at “lower” for six weeks. And I know some of you think we should have been there for even longer.

Oregon Steel Mills has joined other producers in announcing a price increase of at least $60 per short ton on steel plate.

Nucor aims to increase prices for steel plate by $60 per short ton with the opening of its November order book.

Nucor is keeping hot-rolled (HR) coil prices unchanged again this week, according to its latest consumer spot price (CSP) notice issued on Monday, Sept. 29.

Most steelmaking raw material prices held steady or ticked higher over the past month

Market chatter from steel buyers this week: prices steady to slightly higher, demand weak, inventories slow, and tariffs clouding the outlook.

SMU’s average price for domestic hot-rolled (HR) coil held at $785 per short ton (st) this week, unchanged week on week (w/w). A similar dynamic was seen in offshore markets last week as well.

Nucor kept hot-rolled (HR) coil prices unchanged this week, according to its latest consumer spot price (CSP) notice on Monday, Sept. 22.

We’ve been talking about a potential inflection point for the past couple of weeks. And the market does appear to be nearing one.

Participants in the US carbon and steel plate market are frustrated by the lack of activity following the Labor Day holiday weekend.

With only a modest decline in US prices, HR imports, on a landed basis, remain much more expensive than domestic hot band.

Sheet and plate buyers say mills remain open to negotiating spot prices this week, though less so than in recent weeks, according to SMU’s latest market survey.

The premium galvanized coil carries over hot-rolled coil (HRC) coil has marginally widened in recent months. As of Sept. 16, the spread between these two products reached a three-month high of $175 per short ton (st), though it is still low by historical standards.