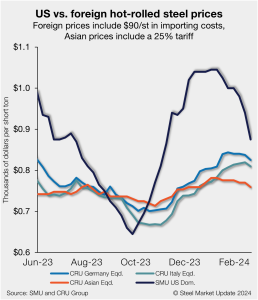

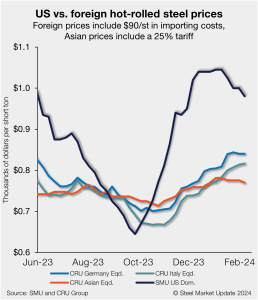

CRU: US sheet price falls and puts Brazilian slabs under pressure

Falling US sheet prices have reduced the attractiveness of hot-rolled (HR) coil imports as domestic mills price competitively to secure limited business. However, tightness in the CR coil market has extended delivery to June or July in some cases, and buyers may consider to import given competitive prices and arrival times.