Final thoughts

To the surprise of few if any, prices are in a holding pattern – a trend not seen since late December. The pause comes largely in response to a pricing notice blitz from mills late last week.

To the surprise of few if any, prices are in a holding pattern – a trend not seen since late December. The pause comes largely in response to a pricing notice blitz from mills late last week.

Prices of most steelmaking raw materials have moved lower over the last 30 days, according to Steel Market Update’s latest analysis.

Nucor said on Thursday afternoon it expects higher profits in the first quarter vs. the previous quarter but lower than a year earlier.

Steel buyers found mills more willing to negotiate spot pricing on the products SMU tracks with the exception of hot rolled, according to our most recent survey data.

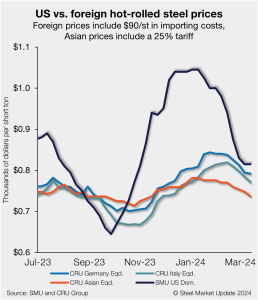

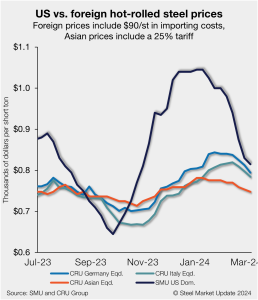

US hot-rolled coil (HRC) remains more expensive than offshore hot band, even as domestic prices remain under pressure. The premium domestic product had over imports for roughly five months now remains near parity as tags abroad and stateside inch down.

The spread between hot-rolled coil (HRC) and prime scrap prices has narrowed for the third consecutive month in March, according to SMU’s most recent pricing data.

The ferrous scrap market experienced a sharp decline for March shipments. Prime scrap fell $60-70 per gross ton (gt) while shredded and other obsolete grades declined $40-50/gt. It seems these prices were accepted in the trade by dealers across the continent.

Sheet and plate prices were mostly flat this week – largely in response to the mill price blitz from last week – pausing the downtrend they’d been on for the better part of 2024.

US ferrous scrap prices fell steeply in March for HMS, shredded, and prime scrap, sources told SMU.

Estelle Tran, prices lead at CRU, Michael Cowden, managing editor at SMU and Josh Spoores, principal analyst at CRU, will be the featured speakers on a special CRU webinar. It will take place on Thursday, March 21, at 10 a.m. ET. You can learn more and register here.

As I see it, the market looked to be a perfect storm for consumers this month while two large steel mills tried to put a floor on hot-rolled coil (HRC). One source speculated that “flat rolled mills coordinated their downtime and will take out 250,000 tons of capacity in April,” which made them attempt to put a bottom on flat-rolled product.

Reaction to the price announcements last week by domestic mills varied just a little depending on who you were speaking to. I heard rumblings before the announcements that a price hike of $100 per short ton (st) was coming. After the announcements were made, I had some questions as to whether they were increases at all.

The LME three-month price continued to strengthen through Friday, March 8, defending its position close to its five-week high and rising further to $2,262 per metric ton (mt), up 0.3%, on the day. Gains were also noted over the last week in other industrial metals, including copper, zinc, and lead. The price gains appeared to be due to weakness in the US dollar, which fell sharply against a basket of currencies after Fed Chairman Jerome Powell said on Wednesday that rate cuts were still expected this year.

A weak start for sheet demand this year has continued to weigh on global prices. European demand outside of the renewable energy sector was weak enough that market participants said mills are likely to cut output further after several furnace restarts earlier in the year. In China, demand has also failed to pick up after recent holidays, and even government announcements of more stimulus measures during the country’s “Two Sessions” meetings failed to boost market confidence.

The premium plate prices have held over hot-rolled coil (HRC) are nowhere near recent highs seen in 2022 but remain higher compared to historical levels.

The US plate market has been largely quiet over the past week since Nucor’s $90-per-ton price cut at the close of February.

ArcelorMittal is targeting a minimum base price for hot-rolled (HR) coil of $825 per ton. The Luxembourg-based steelmaker said the new floor price was effective immediately in a letter to its commercial team dated Friday, March 8.

A Detroit-area mill entered the scrap market on Thursday offering down $70 per gross ton (gt) on #1 busheling. And Nucor announced a minimum base price of $825 per short ton (st) for hot-rolled (HR) coil. What's the best way to interpret would could be read as contradictory trends?

Nucor and Cleveland-Cliffs on Thursday announced target minimum base prices for hot-rolled (HR) coil. Both said the moves were effective immediately.

The price premium cold-rolled coil (CRC) carries over hot-rolled coil (HRC) remains wide, according to our latest market check. Based on our steel price indices published Tuesday, the spread between these products is at the fifth-highest weekly level seen over the last 16 months.

US hot-rolled coil (HRC) is now just about 5% more expensive than offshore hot band. The premium domestic product had over imports for roughly five months is all but gone, and nearing parity.

A Detroit area steelmaker this morning announced its offers for scrap for March scrap shipments. The drop in its offer prices were larger than most industry observes forecasted, especially for shredded scrap. Many in the scrap community had predicted that prime scrap would drop $40-50 per gross ton (gt) with shredded only down $30-40/gt. But other market participants were skeptical about these predictions given bearishness in ferrous markets, both domestically and abroad.

What are folks in the steel industry talking about at present? Respondents to SMU’s mini-survey this week shared some of their thoughts with us about what's going on in the market. Rather than summarizing their responses, here’s some of what they had to say in their own words.

Consumer confidence in the US declined in February after accelerating to a two-year high the month prior, The Conference Board reported. Results came in amid ongoing concerns regarding the US economy. The headline Consumer Confidence Index declined to 106.7 in February from a downwardly revised 110.9 in January. The index, which measures Americans’ assessment of […]

Flat-rolled steel prices have been running downhill in a hurry since the beginning of the year. In some ways, it's no surprise because other indicators have also been pointing lower for some time. Lead times have been contracting since the beginning of the year and are now below the five-week mark for hot-rolled (HR) coil for the first time since September. Mills are more willing to negotiate lower prices, and early reports seem to indicate that scrap might settle lower again in March.

Sheet and plate prices this week continued the downward trend they’ve been on for most of 2024. Some market sources predicted that a wave of spring maintenance outages would help to stabilize lead times and prices in the weeks ahead – especially should service center inventories, high at the beginning of the year, come down meaningfully.

Steel prices continued to ease lower throughout February, following a loss of upwards momentum in the middle of January.

Turkish scrap import prices consistently declined over the past month due to persistently weak domestic demand and lower prices in main supplier markets in recent weeks.

Northwest Pipe posted lower earnings in the fourth quarter as the company said it faced significant challenges in its steel pressure pipe (SPP) and precast businesses in full-year 2023.

A clear consensus has emerged among respondents to SMU’s latest steel market survey that hot-rolled (HR) coil prices will bottom this month or in April. Seventy-five percent of respondents to our latest survey think that prices will find a floor before May as the chart below shows: