Final Thoughts

The US steel market has gotten off to a fast start. Prices are up as lead times extend. And the news is coming in hot too.

The US steel market has gotten off to a fast start. Prices are up as lead times extend. And the news is coming in hot too.

Sources in the domestic hot-rolled sheet market say they are standing by for an uptick in customer demand. These service center market participants, located in various regions of the US, expect to handle an influx of customer orders this month.

Steel sheet and plate prices rose across the board to start the year on limited spot availability at some mills, expectations of higher scrap prices, and hopes of stronger demand in 2026.

The Institute for Supply Management’s (ISM) latest report finds that December 2025’s market conditions in the manufacturing sector continued to soften.

Nucor kept its consumer spot price (CSP) for hot-rolled coil unchanged at $950 per short ton (st) for a third week.

Oregon Steel Mills has joined other producers, announcing a price increase of at least $40 per short ton (st) for steel plate. The Portland, Ore.-based company told customers on Monday that the minimum increase was effective immediately with all new orders. It applies to all carbon, HSLA, hot-rolled coil, normalized, and quenched and tempered products, […]

Nucor kept its consumer spot price (CSP) for hot-rolled coil unchanged at $950 per short ton (st).

SSAB Americas aims to increase prices on all its products by at least $40 per short ton (st).

Nucor Plate Group notified customers it was aiming to increase all plate product prices by $40 per short ton (st).

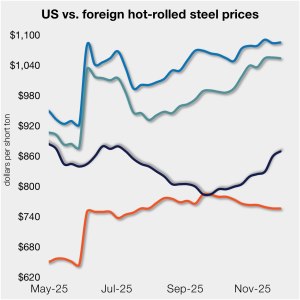

It's that time of year, when we look back at where we've been and forward to what the new year might bring. So, before we look forward to 2026, let’s take a quick look back at 2025.

An SMU Community Chat with Timna Tanners.

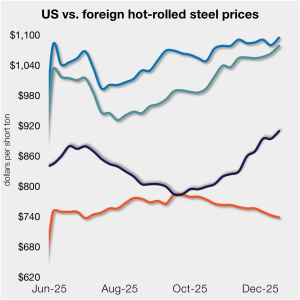

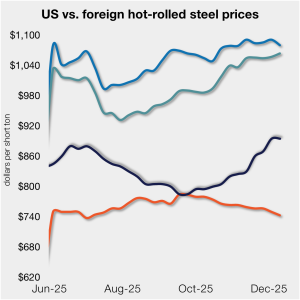

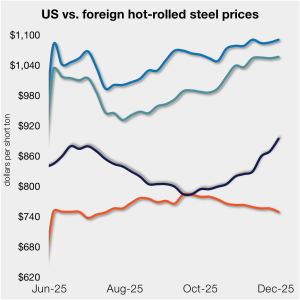

The price gap between stateside hot band and landed offshore product continues to narrow, inching closer toward parity. The premium is now, on average, at its lowest level since July.

Most buyers expect prices to rise slightly in the short term or remain flat. But many qualify this view as transitory or dependent on demand improvements.

Following last week’s pause, SMU’s price indices were overall steady to higher this week, holding at or near multi-month highs.

The latest SMU’s Steel Buyers’ Sentiment Indices showed mixed results.

Less than half of the steel buyers who responded to our market survey this week reported that domestic mills are willing to talk price on new spot orders

The price gap between stateside hot band and landed offshore product continues to narrow toward parity, now at its lowest level in five months.

Nucor has announced new base prices for galvanized steel products as of Wednesday, Dec. 10.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

Sources expect the recent spot market price hikes on domestically produced plate products to be accepted by the market.

The price gap between stateside hot band and landed offshore product has inched closer to parity, now at its lowest level since the summer.

All of SMU’s sheet price indices rose this week, climbing to new multi-month highs. At the same time, our plate index held steady.

Oregon Steel Mills has joined other producers, announcing a price increase of at least $40 per short ton for steel plate.

The price gap between stateside hot band and landed offshore product tightened further this week, as the average price for domestic hot-rolled was $10/st higher w/w.

All five of SMU’s sheet and plate price indices increased this week for the second week in a row, with all products inching up to new multi-month highs. Prices are now up by $30-70/st compared to those seen four weeks ago.

SSAB Americas aims to increase prices on all its products by at least $40 per short ton (st).

Nucor plans to increase prices for steel plate by $30 per short ton (st). The move coincides with Charlotte, N.C.-based steelmaker opening its plate orderbook for January.

Nucor increased its weekly hot-rolled coil spot list price by $5 per short ton (st) on Monday, Nov. 24. This was its fifth increase in as many weeks.

You may have heard about traders “canceling” metal on the London Metal Exchange and shipping it out. Here's a guide to understand that process.

The downward trend in Chinese steel export prices continued over the past month, as domestic demand in the country failed to recover following the Golden Week holidays.