SMU survey: Mills more open to price talks on sheet products

Sheet steel buyers found mills more willing to negotiate spot pricing this week, according to our most recent survey data.

Sheet steel buyers found mills more willing to negotiate spot pricing this week, according to our most recent survey data.

Most longs prices in the US were unchanged this month, except for rebar, which declined by $1.50/cwt ($30/short ton) m/m. While end-use demand is stable, inventories are well-stocked, keeping purchases limited. Domestic availability is sufficient to meet current demand, hindering the appetite for imported material. Meanwhile, prices for scrap remained under pressure in June, with […]

US sheet prices moved lower again this week, continuing a trend seen since early April. The slowdown aligns with the typical summer doldrums, when lax demand and shorter lead times often take center stage. The current market is also characterized by ample supply and concerns about restocking – especially with few signs of a bottom […]

It’s been a slow start to the week as far as news goes, something you’d expect ahead of a shortened Independence Day week. That said, it’s not as if transactions have completely ground to a halt. (Prices continue to drift lower.) And while news might be slow, rumors of low-priced deals, price hikes, and trade cases seem to have filled that void.

Nucor Corp. announced that its plate mill group would cut prices for as-rolled, discrete, and normalized plate with the opening of its August order book.

Domestic plate prices have been on a historic run since they began surging in January 2021. Tags reached an all-time high of $1,940 per short ton (st) in May 2022, though they have mostly trended lower over the past two years.

July is less than a week away, which means SMU’s Steel Summit in August is just around the corner.

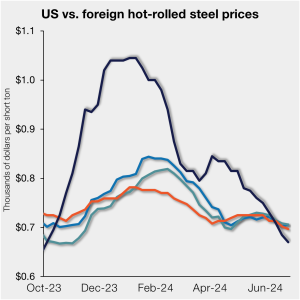

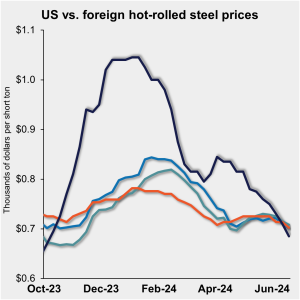

Low global sheet demand continued to weigh on prices around the world this week. In the US, mills were forced to remain aggressive to secure orders during this period of demand weakness. And compounded by recent new capacity ramp-ups, has forced US hot rolled (HR) coil prices down closer to levels seen in offshore markets. […]

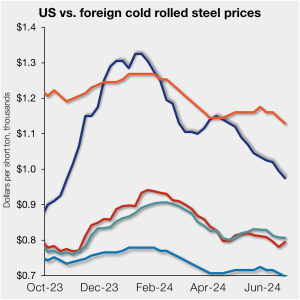

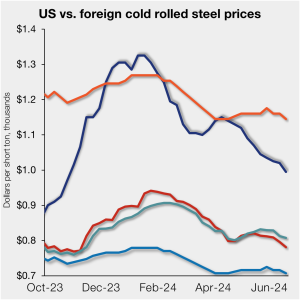

Offshore cold-rolled (CR) coil remains cheaper than domestic product pricing even as US CR coil prices slip to an eight-month low. Domestic CR coil tags stood at $975 per short ton (st) on average in our check of the market on Tuesday, June 25, down $20/st from the week before. Domestic CR prices are, on […]

Sources contacted by RMU have delivered a bleak forecast for the market’s direction in July, potentially extending into August.

It was great to have Gary Stein, CEO of Triple-S Steel, join SMU for a Community Chat earlier this week. (Btw, you can find a record of the webinar here.) We covered a lot of ground. From Andrew Carnegie and the Johnstown Flood to the current steel market and the state of domestic manufacturing broadly speaking. One thing that stuck with me was how unevenly construction spending appears to be on “green” initiatives and other key items funded by infrastructure spending, the Inflation Reduction Act, and the CHIPS Act.

This chart of the rolling second-month CME hot-rolled coil (HRC) future dating back to the start of 2022 has been as volatile as a herd of “Wild Horses.”

US hot-rolled (HR) coil prices have continued to drift lower, pushing them further below offshore hot band prices on a landed basis.

Worthington Steel’s earnings slipped in its fiscal fourth quarter while sales ticked up.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market events.

US sheet prices continue to fall, with SMU’s average hot-rolled (HR) coil price now at $670 per short ton (st). Prices for cold-rolled and coated products are now in the mid/high $900s/st. As I noted in my last Final thoughts, the consensus among our readers is that prices will bottom out in July. And that makes intuitive sense. Lead times in mid/late July should be stretching into the typically busier fall months. The question then is where prices bottom.

US sheet prices continued to drift lower this week on lackluster demand, short lead times, and ample supply. SMU’s hot-rolled (HR) coil price now stands at $670 per short ton (st) on average, down $15/st from last week. Hot band is down $175/st from a recent high of $845/st in early April. It is also […]

Cleveland-Cliffs on Tuesday announced its monthly hot-rolled (HR) coil price of $720 per short ton (st) with the official opening of its August order book. The rate is down from last month’s price of $800/st.

Nucor's weekly hot-rolled (HR) coil price registered a notable decline this week.

Many of our contacts remain bearish about the very short-term direction of steel prices. But a consensus seems to be forming, according to our latest survey results, that a bottom will occur in July. Consensus is also that hot-rolled (HR) coil prices won't fall below $600 per short ton (st).

Offshore cold-rolled (CR) coil prices are cheaper than domestic product despite US CR coil prices ticking lower. Domestic CR coil tags stand at $995 per short ton (st) on average, down $25/st vs. our prior check of the market on Tuesday, June 18. (We will update prices again on Tuesday, June 25.) All told, US […]

Summer has officially begun, and the countdown to SMU Steel Summit is on. More than 800 steel industry professionals from nearly 350 companies have already registered to attend the Summit on Aug. 26-28 at the Georgia International Convention Center (GICC) in Atlanta. Are you one of them? If so, we’re looking forward to seeing you […]

Steel Market Update’s Steel Demand Index ticked down 2.5 points last week, slipping further into contraction territory, according to our latest survey data. SMU’s Steel Demand Index now stands at 38.5, down from 41 at the beginning of June. The decrease puts the index at its lowest measure since November 2022. The reading – down […]

Steelmaking raw material prices have generally declined over the past month according to SMU’s latest analysis.

SMU’s Current Steel Buyers’ Sentiment Index tumbled this week, while Future Sentiment ticked up slightly, according to our most recent survey data.

Demand has remained persistently weak across the globe for sheet steel, weighing on prices. US HR coil prices fell the furthest this week as high-volume, low-priced deals were transacted as mills looked to fill order books and competed with one another amid relative demand weakness. Meanwhile, European prices were also down due to low demand […]

Please enjoy this roundup of recent news from the aluminum industry from our colleagues at CRU. EU to hit Chinese electric cars with tariffs up to 48% The European Commission notified carmakers on June 12 that it would provisionally apply additional duties of 17-38% on imported Chinese EVs from next month. The duties will be […]

The US scrap market is quiet as we pass through June. Speculation about the direction of July is mixed, with most sentiment neutral or bearish. The concerns are about demand during the summer months. There are still several planned outages and other cutbacks at various mills that could limit overall demand for recycled steel scrap.

The summer doldrums are here. That means lazy days at the office, or behind the computer. Perhaps heading over to the water cooler to chat, maybe stare at a fly buzzing on a windowsill. There is work to be done, product to be made or shipped, but there’s no hurry. And around lunchtime, you hang that classic sign on the front door: Gone fishin’.

US hot-rolled (HR) coil prices fell further this past week, pushing them below offshore hot band prices on a landed basis.