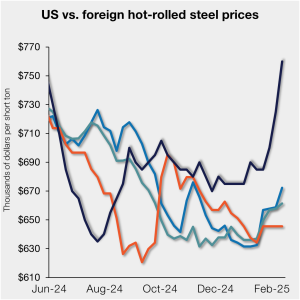

Cliffs to open April spot order book at $900/ton HR

Cleveland-Cliffs said it will open its April order book for spot material at $900 per short ton (st). The Cleveland-based steelmaker said the increase was necessary because of “rapidly changing market conditions” in a letter to customers dated Friday, Feb. 21.