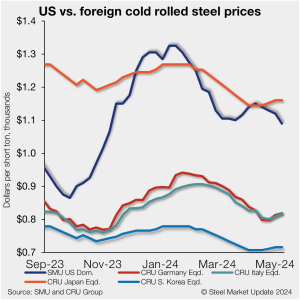

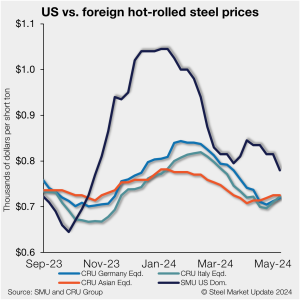

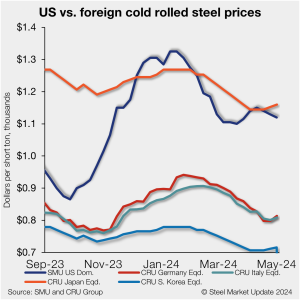

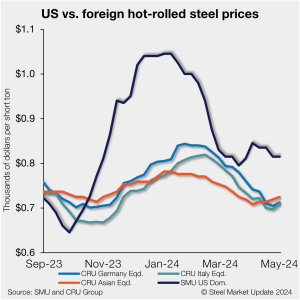

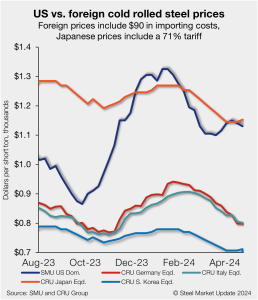

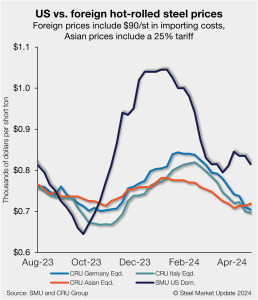

SMU price ranges: Sheet nears five-month lows

Steel prices were overall mixed this week, according to our latest check on the market. Sheet prices were flat to down, while plate prices inched up. SMU indices on hot rolled, cold rolled, and galvanized are now down to the lowest levels seen since November.