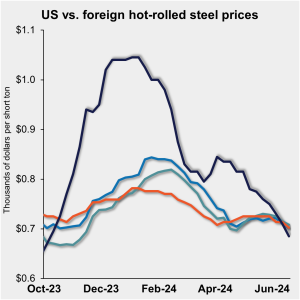

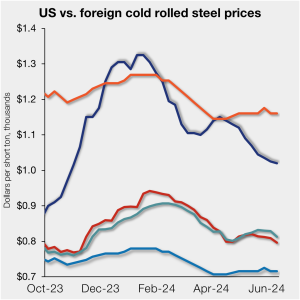

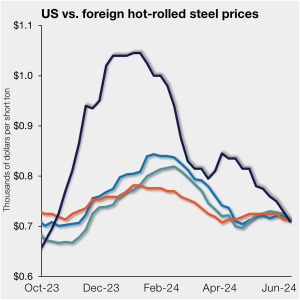

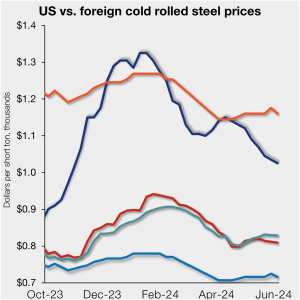

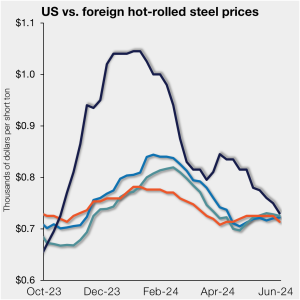

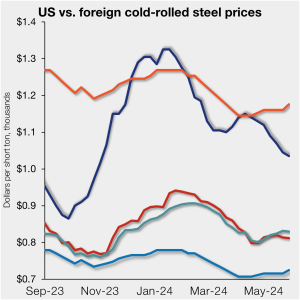

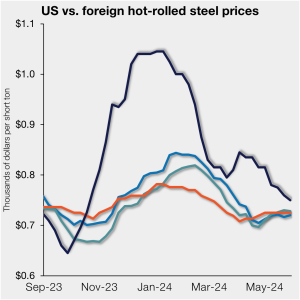

SMU survey: Lead times remain short, HR and plate at 8-month lows

Steel mill lead times remain short for all steel products tracked by SMU, according to our latest market survey. Service center and manufacturers continue to report short to normal lead times for sheet and plate products.