Final thoughts

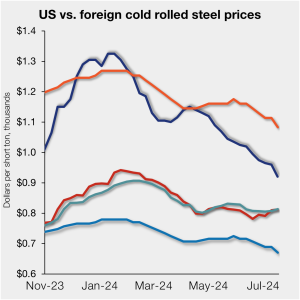

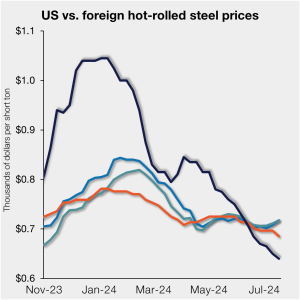

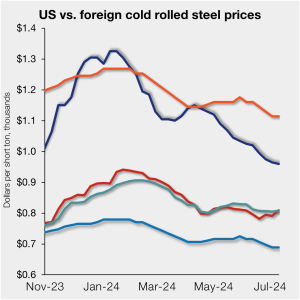

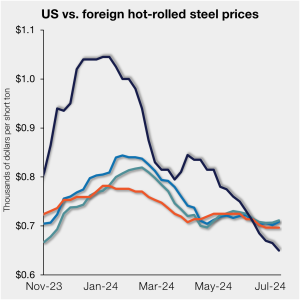

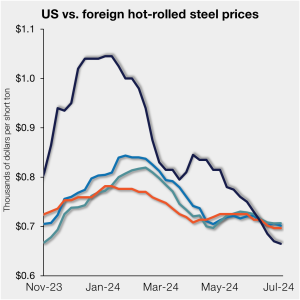

SMU has heard from some larger buyers who have stepped back into the market to buy at prices that, if not at a bottom, they assess to be close to one. Is it enough to stretch out lead times and send prices upward again? Or do we continue to scrape along the mid-$600s per short ton (st) as we have been doing for most of the last month?