Final thoughts

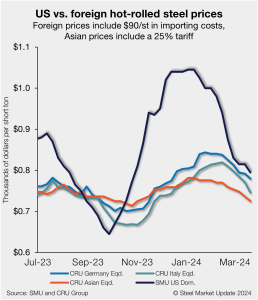

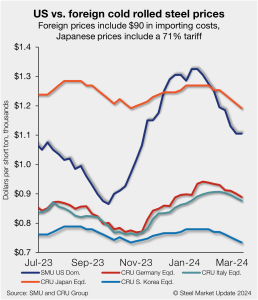

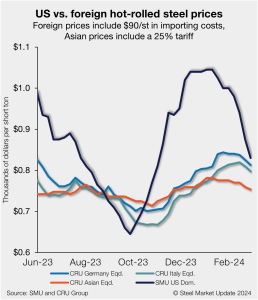

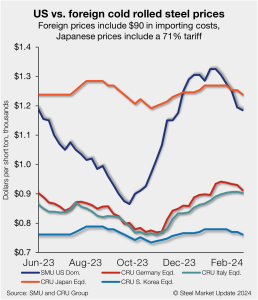

I’ve had questions from some of you lately about how we should think of the spread between hot-rolled (HR) coil prices and those for cold-rolled (CR) and coated product. Let’s assume that mills are intent on holding the line at least at $800 per short ton (st) for HR. The norm for HR-CR/coated spreads had been about $200 per short ton (st). That would suggest CR and coated base prices should be ~$1,000/st. Good luck finding anyone offering that.