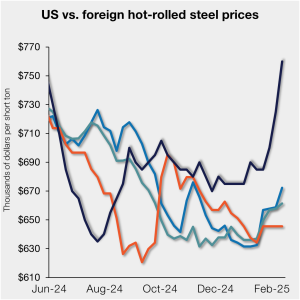

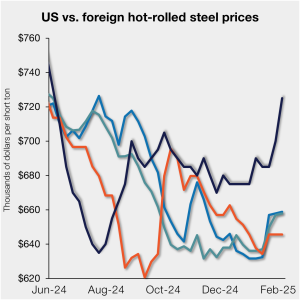

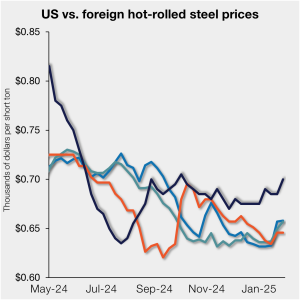

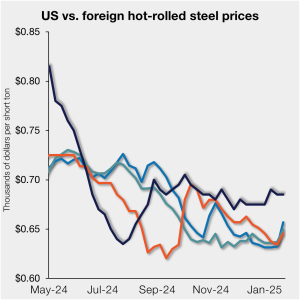

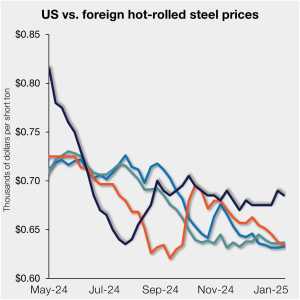

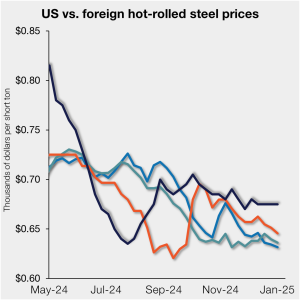

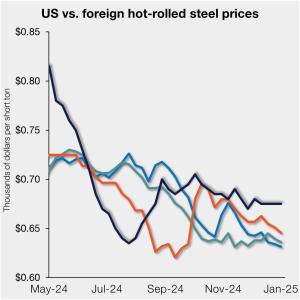

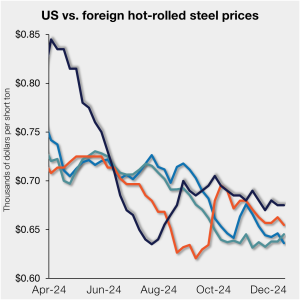

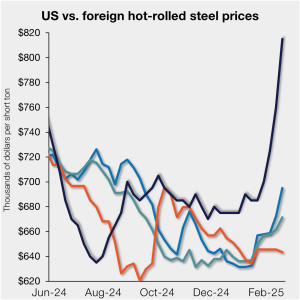

US HR prices surge above offshore tags

Hot-rolled (HR) coil prices leaped in the US this week, while tags abroad saw more measured gains. The result: US hot band prices have become even more expensive than imports on a landed basis. In fact, the premium US HR prices carry over HR prices abroad now stands at a 12-month high.