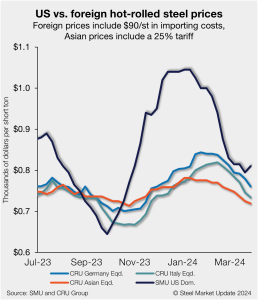

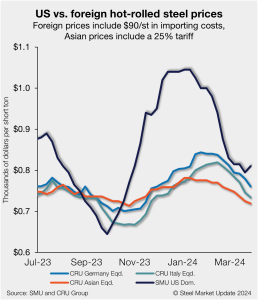

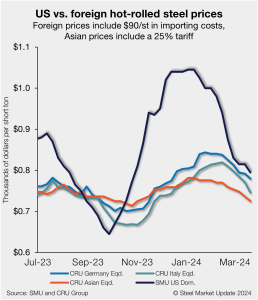

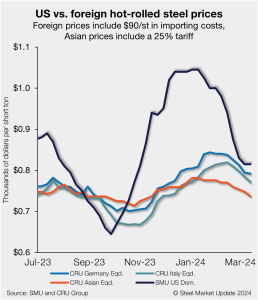

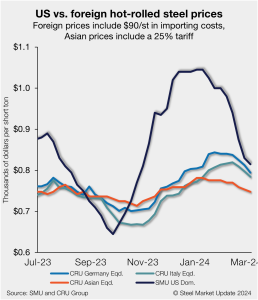

US HR prices rebound, no longer near parity with imports

US hot-rolled coil and offshore hot band moved further away from parity this week as stateside prices have begun to move higher in response to mill increases.

US hot-rolled coil and offshore hot band moved further away from parity this week as stateside prices have begun to move higher in response to mill increases.

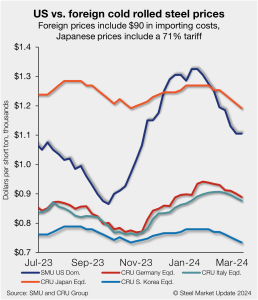

The dollar premium cold-rolled coil (CRC) carries over hot-rolled coil (HRC) continues to expand according to our latest scope of the market.

Cleveland-Cliffs aims to increase sheet prices by $60 per short ton (st) and is seeking a new target base for hot-rolled coil (HRC) of $900/st. That's according to a press release circulated on Wednesday morning, March 27.

Sheet prices reversed course and moved higher this week, while plate priced remained flat, according to our latest canvas of the market.

Algoma Steel said in guidance on Monday that an unplanned outage at its blast furnace in January will “significantly” impact its fiscal fourth-quarter results.

I’ve had questions from some of you lately about how we should think of the spread between hot-rolled (HR) coil prices and those for cold-rolled (CR) and coated product. Let’s assume that mills are intent on holding the line at least at $800 per short ton (st) for HR. The norm for HR-CR/coated spreads had been about $200 per short ton (st). That would suggest CR and coated base prices should be ~$1,000/st. Good luck finding anyone offering that.

2024 started with a $200 per short ton (st), one-week demon drop in the CME Midwest hot-rolled (HR) coil futures. Then, HR futures consolidated in the low $800s/st with the April future trading to as low as $770/st as the curve shifted into contango or upward sloping. A big move was expected, and a big […]

US hot-rolled coil (HRC) remains more expensive than offshore hot band but continues to move closer to parity as prices decline further. The premium domestic product had over imports for roughly five months now remains near parity as tags abroad and stateside inch down.

Sheet and plate prices mostly moved lower this week after little change was noted the week prior. Despite edging down, sentiment is mixed, and many suggest a bottom may be near.

Are we still looking for a bottom on sheet prices? In what direction are steel and scrap prices headed? How’s demand holding up at the moment?

Foreign cold-rolled coil (CR) remains significantly less expensive than domestic product even as US tags continue to decline in a hurry, according to SMU’s latest check of the market.

Steel Market Update’s Steel Demand Index recovered out of contraction territory on the heels of the pricing blitz from mills last week, according to our latest survey data.

Flat Rolled = 56.6 Shipping Days of Supply Plate = 58.8 Shipping Days of Supply Flat Rolled After weaker-than-expected shipments in January, US service center shipments of flat-rolled steel picked up in February, which caused supply to decrease. At the end of February, service centers carried 56.6 shipping days of flat-rolled steel supply on an […]

To the surprise of few if any, prices are in a holding pattern – a trend not seen since late December. The pause comes largely in response to a pricing notice blitz from mills late last week.

Steel buyers found mills more willing to negotiate spot pricing on the products SMU tracks with the exception of hot rolled, according to our most recent survey data.

US hot-rolled coil (HRC) remains more expensive than offshore hot band, even as domestic prices remain under pressure. The premium domestic product had over imports for roughly five months now remains near parity as tags abroad and stateside inch down.

The spread between hot-rolled coil (HRC) and prime scrap prices has narrowed for the third consecutive month in March, according to SMU’s most recent pricing data.

Sheet and plate prices were mostly flat this week – largely in response to the mill price blitz from last week – pausing the downtrend they’d been on for the better part of 2024.

As I see it, the market looked to be a perfect storm for consumers this month while two large steel mills tried to put a floor on hot-rolled coil (HRC). One source speculated that “flat rolled mills coordinated their downtime and will take out 250,000 tons of capacity in April,” which made them attempt to put a bottom on flat-rolled product.

The latest steel import license data from the US Commerce Department shows 2.39 million short tons (st) of steel entered the country in February 2024, down 6% from the month prior.

The premium plate prices have held over hot-rolled coil (HRC) are nowhere near recent highs seen in 2022 but remain higher compared to historical levels.

The US plate market has been largely quiet over the past week since Nucor’s $90-per-ton price cut at the close of February.

US steel mill shipments increased in January vs. December but fell from a year earlier,

Hot rolled (HR) futures have been on a bit of a hot streak recently, while busheling futures have been more in the “not” category.

Nucor and Cleveland-Cliffs on Thursday announced target minimum base prices for hot-rolled (HR) coil. Both said the moves were effective immediately.

The price premium cold-rolled coil (CRC) carries over hot-rolled coil (HRC) remains wide, according to our latest market check. Based on our steel price indices published Tuesday, the spread between these products is at the fifth-highest weekly level seen over the last 16 months.

US hot-rolled coil (HRC) is now just about 5% more expensive than offshore hot band. The premium domestic product had over imports for roughly five months is all but gone, and nearing parity.

Flat-rolled steel prices have been running downhill in a hurry since the beginning of the year. In some ways, it's no surprise because other indicators have also been pointing lower for some time. Lead times have been contracting since the beginning of the year and are now below the five-week mark for hot-rolled (HR) coil for the first time since September. Mills are more willing to negotiate lower prices, and early reports seem to indicate that scrap might settle lower again in March.

Sheet and plate prices this week continued the downward trend they’ve been on for most of 2024. Some market sources predicted that a wave of spring maintenance outages would help to stabilize lead times and prices in the weeks ahead – especially should service center inventories, high at the beginning of the year, come down meaningfully.

Steel prices continued to ease lower throughout February, following a loss of upwards momentum in the middle of January.