SMU survey: Mills more willing to talk price on spot deals

Steel buyers said mills were much more willing to negotiate spot pricing this week on all products SMU surveys, according to our most recent survey data.

Steel buyers said mills were much more willing to negotiate spot pricing this week on all products SMU surveys, according to our most recent survey data.

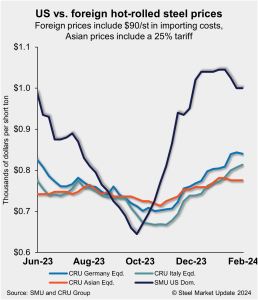

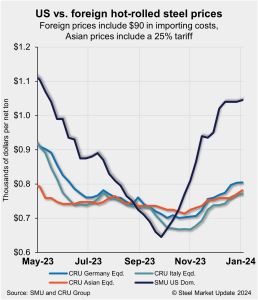

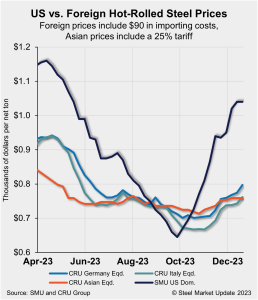

US hot-rolled coil (HRC) prices law little movement this week, a similar trend seen in offshore markets. Thus, the price premium domestic hot band carries over imported products was largely unchanged vs. the prior week.

Sheet prices were mixed this week, with hot-rolled (HR) coil unchanged but cold-rolled and coated prices down.

With rising steelmaking capacity and relatively flat demand, industry analysts are predicting lower prices for sheet products this year.

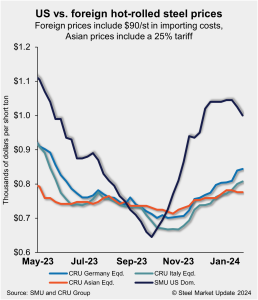

US hot-rolled coil (HRC) prices declined further this week, easing to their lowest level since late November. And while domestic tags remain notably more expensive than offshore product, the premium has declined as imported hot band tags have moved higher.

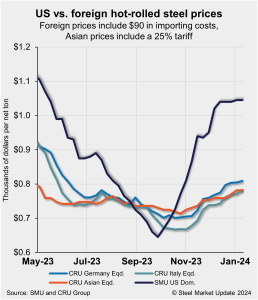

Domestic sheet prices slipped again this week, marking the first week of consecutive declines for hot-rolled (HR) coil since September. SMU’s HR price now stands at $1,000 per short ton (st) on average, down $25/st from last week and down $45/st from the start of the year.

Canadian flat-rolled steelmaker Algoma Steel said its blast furnace could be down for approximately two weeks following an incident at its coke batteries over the weekend. “We expect some impact on shipments, the extent of which will depend on the timeline to resume blast furnace operations,” the Sault Ste. Marie, Ontario-based company said

The premium plate has held over hot-rolled coil (HRC) has been narrowing but remains elevated compared to historical levels.

The slipping lead times for flat-rolled steel were not just due to the holiday slowdown, it seems, as production times for four out of five products contracted again this week.

US hot-rolled coil (HRC) prices edged down this week while import prices moved higher on average. Domestic hot bands’ premium over cheaper imports declined as a result. But overall, US product remains substantially more expensive than overseas material. All told, US HRC prices are 21.4% more expensive than imports, a premium that is down three […]

What are people in the steel marketplace talking about this week?

Domestic buyers of steel sheet said mills were much more willing to negotiate spot pricing this week, according to our most recent survey data.

The spread between hot-rolled coil (HRC) and prime scrap prices narrowed slightly this month, according to SMU’s most recent pricing data.

US hot-rolled (HR) coil prices fell noticeably this week for the first time since late September. SMU’s hot-rolled coil price now stands at $1,025 per ton on average, down $25 per ton from last week. Cold-rolled (CR) coil was unchanged at $1,325 per ton.

US service center flat-rolled steel inventories surged in December with the seasonal slowdown in shipments. At the end of December, service centers carried 64.8 shipping days of supply, according to adjusted SMU data, up from 54 days in November.

Turkish scrap import prices increased last week with CRU’s assessment for HMS1/2 80:20 at $423 per metric ton (t) CFR, up by $7/t week over week (w/w) but down $2/t month over month (m/m). This was driven by a pickup in buying activity.

The spread between cold-rolled coil (CRC) and hot-rolled coil (HRC) prices jumped during the week of Jan. 8 as cold rolled tags continued to rise while hot rolled tags held steady.

US hot-rolled coil (HRC) prices were unchanged this week but remain significantly more expensive than offshore product. While imported hot band tags increased vs. last week, gains were marginal, keeping domestic HRC substantially more expensive than imports. All told, US HRC prices are 24.3% more expensive than imports, a premium that is down only slightly […]

Steel prices continued to move higher last month on the back of repeated mill price increases after tags reached a 2023 low of $645 per ton in late September. Hot-rolled coil (HRC) prices ended December at an average of $1,035 per ton ($51.75 per cwt), rising by $112 per ton during the month.

A Detroit-area mill entered the scrap market on Friday afternoon with the following offers: The Chicago area followed suit: Mills in the Great Lakes region sensed there was ample supply of most grades. Also, they all bought heavily last month and so had sufficient inventories to make this move, market participants said. Still, the move surprised […]

SMU polled steel buyers on a variety of subjects this past week, including purchasing practices, steel sheet prices, scrap, and the future market.

Trading slowed across the Midwest hot-rolled coil (HRC) futures curve in the final weeks of 2023, with prices drifting mostly sideways through the month of December.

Cleveland-Cliffs didn’t wait long to roll out the first price increase of the year - $1,150 per short ton (st) for hot-rolled coil. That’s up $50 per ton from the steelmaker’s last published price. Will anyone follow? I’ve heard some mills are meeting this week but that any announcement might not come until next week. We'll see.

Steel mill lead times pulled back across the board this week but are still said to be at healthy levels, according to SMU's market survey this week.

The percentage of steel buyers saying mills were willing to negotiate spot pricing on the products SMU surveys was mixed this week.

US hot-rolled coil (HRC) prices moved up again this week and remain significantly more expensive than offshore product.

Cleveland-Cliffs is now targeting base prices of $1,150 per ton for hot-rolled coil (HRC), according to a press release on Wednesday morning, Jan. 3.

Sheet prices were mixed in SMU’s first assessment of the market in the New Year.

We started 2023 with HRC spot pricing around $700 per ton and the third-month future (March ‘23) trading at $800/ton. That same future eventually settled at $1,059/ton - a $259/ton swing. Today, spot pricing is just shy of $1,100/ton for HRC, and the third-month future (March ‘24) settled at $1,091/ton. The clear takeaway: a lot can change over three months. And while future contracts are a valuable tool for hedging, they are a terrible predictor of price.

US hot-rolled coil (HRC) prices might have plateaued. But while prices for offshore product have increased in some regions, imports remain significantly cheaper that domestic material. All told, US prices are roughly 26% more expensive than imports, a premium that is down only slightly from last week.