US CRC prices move ahead of imports

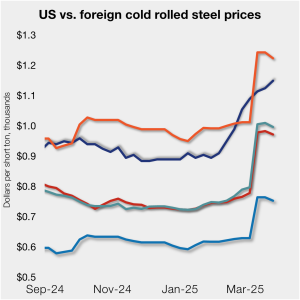

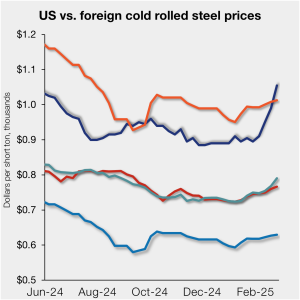

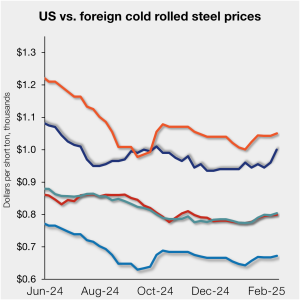

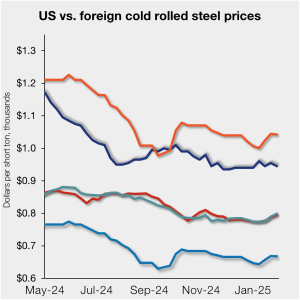

US cold-rolled (CR) coil prices moved higher again this week, while offshore prices were mixed.

US cold-rolled (CR) coil prices moved higher again this week, while offshore prices were mixed.

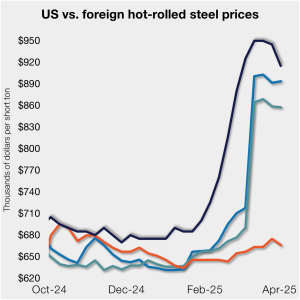

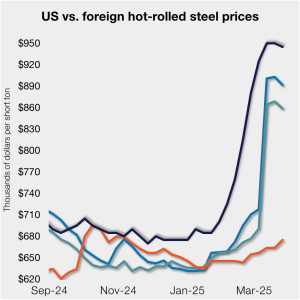

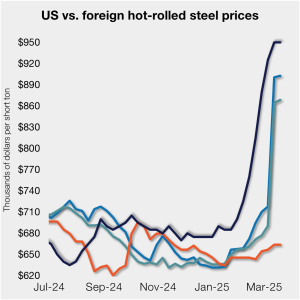

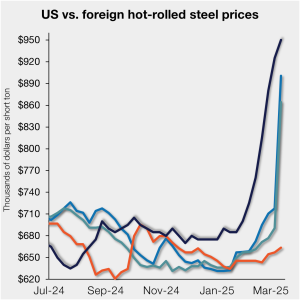

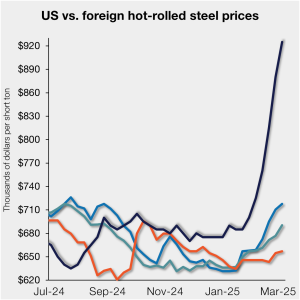

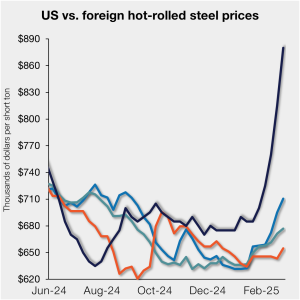

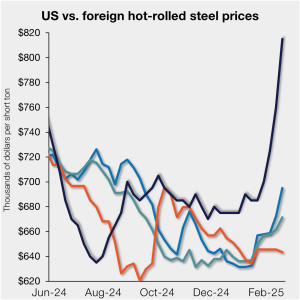

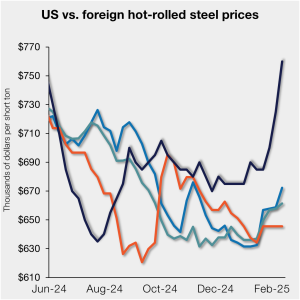

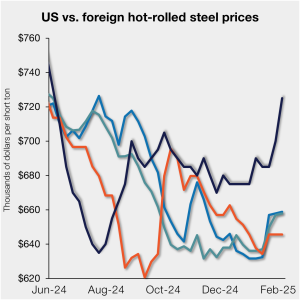

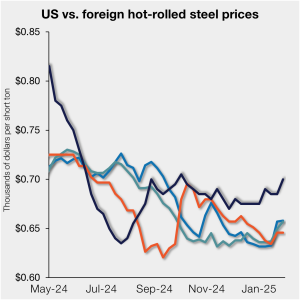

Domestic hot-rolled (HR) coil prices declined this week, a trend again reflected in most offshore markets. Despite similarities, the shifting tariff landscape has made for a wild ride in Q1.

Raw steel mill output from US mills rebounded last week, according to the American Iron and Steel Institute (AISI). Production is now at the highest weekly rate recorded so far this year.

US cold-rolled (CR) coil prices increased again this week, while offshore prices declined.

The threat of tariffs over the past two months has been a springboard for US prices. But the Section 232 reinstatement on March 13 narrowed the domestic premium over imports on a landed basis.

Raw steel mill output declined last week for the second-consecutive week, according to the American Iron and Steel Institute (AISI).

US cold-rolled (CR) coil prices moved higher this week, a trend not evenly shared by offshore prices.

Domestic hot-rolled (HR) coil prices were flat this week, a trend mirrored in offshore markets.

Raw steel mill production remains at one of the higher rates recorded so far this year.

Fully restored Section 232 tariffs on steel on March 12 cut the widening premium US prices had over most imports on a landed basis.

Domestic hot-rolled (HR) coil prices moved higher this week, still largely outpacing increases seen in offshore markets. But the reinstatement of undiluted Section 232 tariffs on steel on March 12 cut the ballooning premium stateside prices had gained on most imports on a landed basis. The premium stateside tags had over prices abroad stood at […]

The volume of finished steel entering the US market in January climbed to the highest level recorded in two and a half years.

Raw steel mill output rebounded last week after falling to one of the lowest levels of the year, according to the American Iron and Steel Institute (AISI). Production is now at the second-highest weekly rate recorded so far in 2025.

US cold-rolled (CR) coil prices continued to rise this week, well ahead of offshore prices. The price spread between stateside-produced CR and imports reached a 14-month high in the week ended March 7. Steady price gains in overseas markets continue to be overshadowed by increases in domestic prices. The result? The US premium over imports […]

"We urge you to resist any requests for exceptions or exclusions and to continue standing strong on behalf of American steel," the companies wrote.

Domestic hot-rolled (HR) coil prices moved higher this week, widely outpacing increases seen in offshore markets.

The price spread between stateside-produced CR and imports reached its widest margin in over a year.

Hot-rolled (HR) coil prices continued to rally in the US this week, quickly outpacing price gains seen abroad. The result: US hot band prices have grown widely more expensive than imports on a landed basis. The premium US HR tags carry over HR prices abroad now stands at a 14-month high. SMU’s average domestic HR […]

Hot-rolled (HR) coil prices leaped in the US this week, while tags abroad saw more measured gains. The result: US hot band prices have become even more expensive than imports on a landed basis. In fact, the premium US HR prices carry over HR prices abroad now stands at a 12-month high.

US steel mills produced an estimated 1,670,000 short tons (st) of raw steel last week, according to recently released American Iron and Steel Institute (AISI) figures.

The price spread between US-produced cold-rolled (CR) coil and offshore CR products widened again in the week ended Feb. 14, as prices for US product accelerated ahead of imports. Domestic CR coil tags jumped week on week (w/w), while offshore markets moved higher at a slower pace. The result? The US premium over imports widened […]

Hot-rolled (HR) coil prices rose further in the US this week, while tags abroad saw minor gains. The result: the margin US hot band holds over imports on a landed basis increased.

US mills produced an estimated 1,675,000 short tons (st) of raw steel last week, the highest weekly rate recorded since mid-December according to data recently released by the American Iron and Steel Institute (AISI).

Hot-rolled (HR) coil prices moved up again in the US this week, while tags abroad were largely flat. The result: the margin US hot band holds over imports on a landed basis widened further.

The price spread between US-produced cold-rolled (CR) coil and offshore products narrowed again in the week ended Jan. 31, as imports edged higher and US product ticked lower.

Hot-rolled (HR) coil prices ticked up in the US this week, while tags abroad were mixed. The result: the margin US hot band holds over imports on a landed basis widened slightly.

Raw steel mill production held relatively steady last week, according to recent figures released by the American Iron and Steel Institute (AISI).

The price spread between US-produced cold-rolled (CR) coil and offshore products tightened slightly in the week ended Jan. 24, as imports edged higher than US product. Domestic CR coil tags were up week on week (w/w), a trend mirrored in offshore markets at a slightly sharper clip. The result? The US premium over imports shrank […]

US hot band margin over imports on a landed basis has narrowed further.

Weekly raw steel mill production levels have fluctuated within a relatively narrow range across the last four months, according to data released by the American Iron and Steel Institute (AISI).