Domestic CRC prices hold, import tags mixed

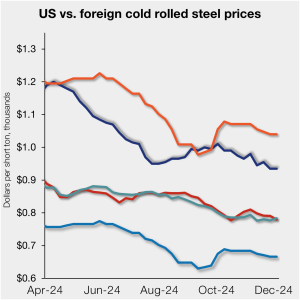

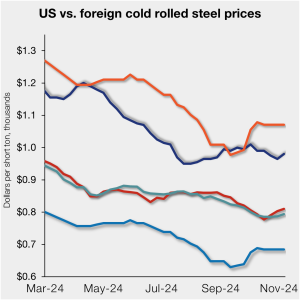

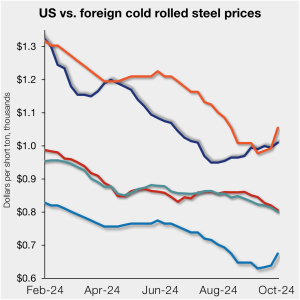

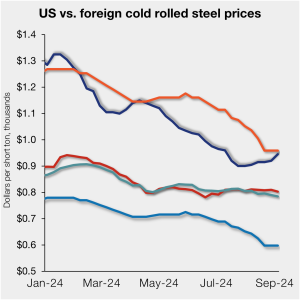

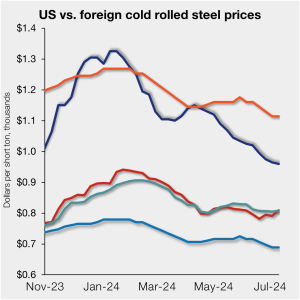

The price spread between US-produced cold-rolled (CR) coil and offshore products on a landed basis was flat in the week ended Dec. 6.

The price spread between US-produced cold-rolled (CR) coil and offshore products on a landed basis was flat in the week ended Dec. 6.

SMU's price indices saw minor fluctuations on sheet products this week, while our plate and Galvalume indices held steady.

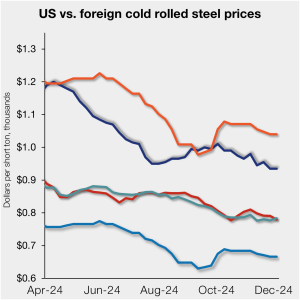

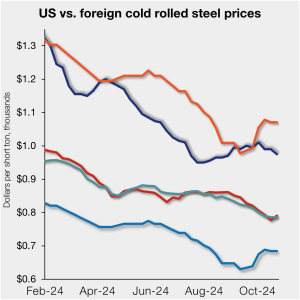

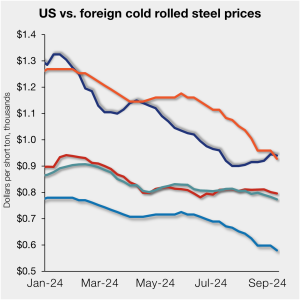

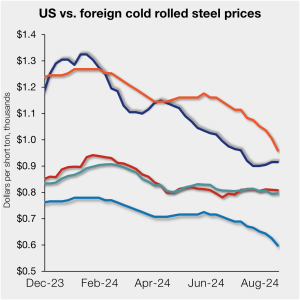

The price spread between US-produced cold-rolled (CR) coil and offshore products on a landed basis widened slightly in the week ended Nov. 22.

SMU’s flat-rolled steel prices were mixed this week with slight declines across most products and a modest increase in prices for cold-rolled coil.

The price spread between US-produced cold-rolled (CR) coil and offshore products slipped in the week ended Nov. 15, on a landed basis.

The price spread between US-produced cold-rolled (CR) coil and offshore products remained largely flat in the week ended Nov. 8, on a landed basis.

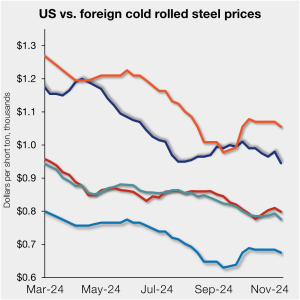

SMU price indices edged lower this week for all products but one, marking the fifth consecutive week of overall declining prices.

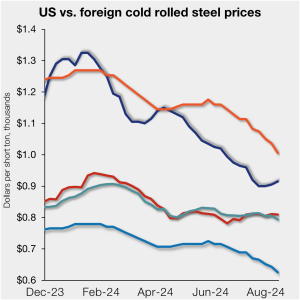

SMU price indices declined again this week for all products other than hot-rolled sheet. Our indices have trended lower across October, falling as much as $75 per short ton (st) in that time.

The price spread between US-produced cold-rolled (CR) coil and offshore products was negligibly tighter in the week ended Oct. 25, on a landed basis.

Steel prices ticked lower again this week for most of the products SMU tracks. Our indices have declined as much as $40 per short ton (st) across the last four weeks.

The price spread between US-produced cold-rolled (CR) coil and offshore products was negligibly wider in the week ended Oct. 18, on a landed basis.

Steel sheet prices mostly edged lower for a second week, while plate prices slipped for the third consecutive week.

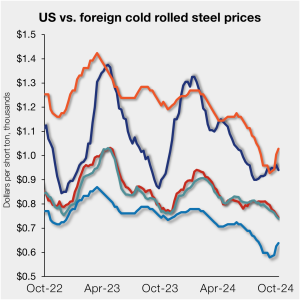

August steel imports totaled 2.38 million short tons (st) according to final data released this week by the US Commerce Departmen

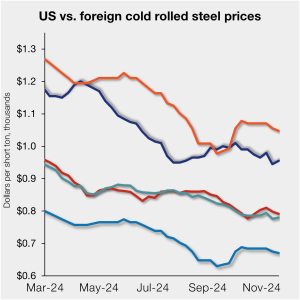

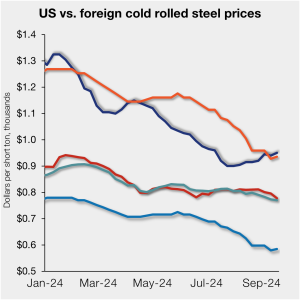

The price gap between US-produced cold-rolled (CR) coil and offshore products narrowed slightly again in the week ended Oct. 11, mainly due to a stateside price cut.

The price gap between US-produced cold-rolled (CR) coil and offshore products narrowed slightly in the week ended Oct. 4, mainly due to a price jump in Asian markets.

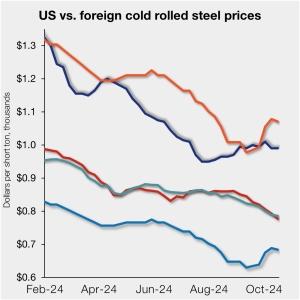

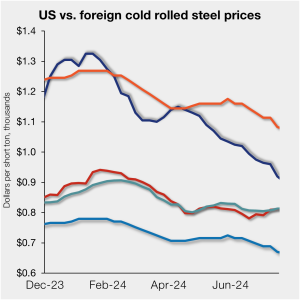

The price gap between US cold-rolled (CR) coil and offshore product has shrunk slightly this week ended Sept. 27 as stateside tags edged down. The premium slipped moderately but remains well ahead of the 10-month low from late July.

SMU’s steel price indices were mixed this week as the market seeks direction. All of our indices have fluctuated within relatively narrow ranges across September.

The price gap between US cold-rolled (CR) coil and offshore product widened this week as stateside tags inched up. The premium has been steadily increasing after falling to a 10-month low in late July.

The price gap between US cold-rolled (CR) coil and offshore product is a bit broader this week despite slightly lower tags stateside. The premium is still widening since falling to a 10-month low in late July.

SMU’s steel price indices showed mixed signals for a second consecutive week. Our hot rolled, cold rolled, and plate price indices inched lower from last week, as the galvanized index held steady and Galvalume's ticked higher.

The price gap between US cold-rolled (CR) coil and offshore product has widened again. The premium has grown repeatedly since falling to a 10-month low in late July.

SMU indices moved higher on cold rolled products this week, while galvanized prices were flat. Our indices for plate, hot rolled, and Galvalume all edged lower.

The price gap between US cold-rolled (CR) coil and imported CR has widened since falling to a 10-month low in late July.

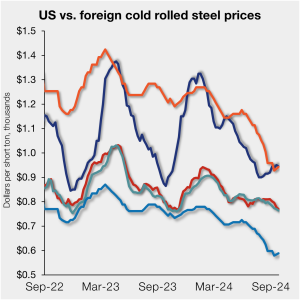

The price gap between US cold-rolled (CR) coil and imported CR widened this week after falling to a 10-month low in late July.

Steel buyers continue to report short mill lead times for both sheet and plate products, according to SMU's latest canvass of the market. Lead times for hot-rolled and plate products marginally increased from our late July survey, likely due to limited restocking in anticipation of upcoming mill outages for scheduled maintenance.

The price gap between US cold-rolled (CR) coil and imported CR tightened marginally after falling to a 10-month low in late July.

SMU’s sheet price was largely flat this week, an unusual sight for the better part of the past four months. The same trend was seen for tandem products and plate as well.

SMU’s sheet price ranges slid again this week. But the declines were more pronounced on tandem products whereas prices for hot-rolled coil held roughly steady.

SMU’s hot-rolled coil price fell to $640 per short ton (st) on average on Tuesday. That’s down $10/st from last week and marks the lowest point for HR prices since December 2022, according to our pricing archives. SMU’s HR price is now $5/ton below 2023’s low of $645/st, which occurred against the backdrop of a United Auto Workers (UAW) union strike.

Offshore cold-rolled (CR) coil remains cheaper than domestic product. The gap continues to tighten, however, as US CR coil prices slip to a nine-month low. Domestic CR coil tags averaged $960 per short ton (st) in our check of the market on Tuesday, July 9, down $5/st from the week before. CR tags are now […]