Data Tools

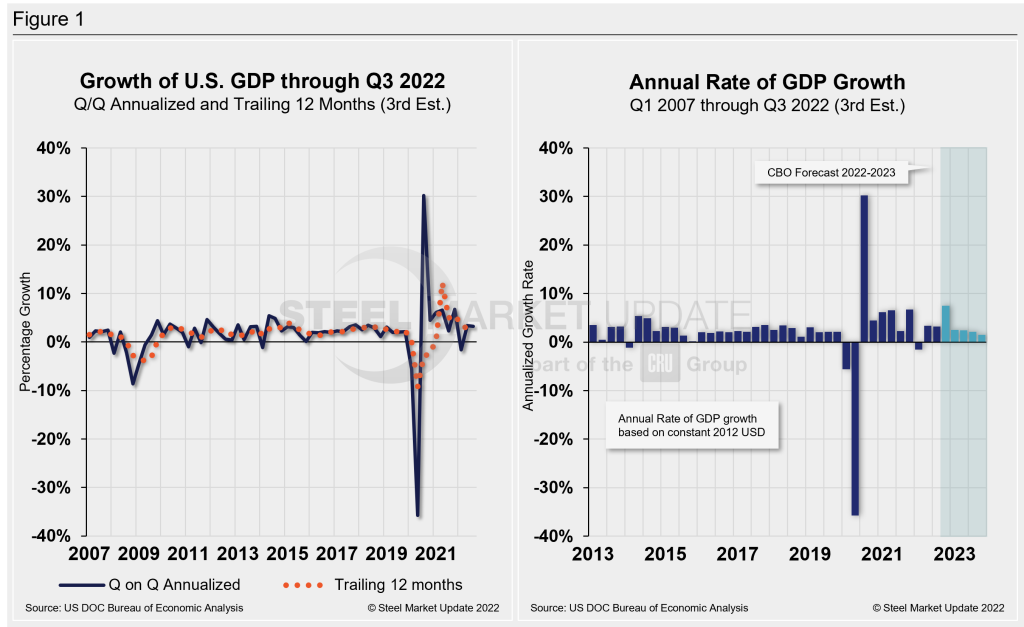

US GDP

At SMU, we report on the value and growth of the major components of gross domestic product (GDP). Our quarterly reports provide essential insights into the performance of the US economy.

Our reports are released in three versions: the first estimate is released at the end of the month following the closure of the quarter, followed by the second estimate one month later, and the final estimate one month after that. However, please note that the “final” estimate is not always truly final. Subsequent revisions may be made, sometimes going back decades, as was the case in 2013 when we revised GDP data all the way back to 1929.

GDP is a critical economic statistic and is widely used by government agencies, Wall Street, and the business community. The White House and Congress use it to prepare the federal budget, while the Federal Reserve uses it to formulate monetary policy. The business community relies on GDP data to make forecasts that inform production, investment, and employment planning.

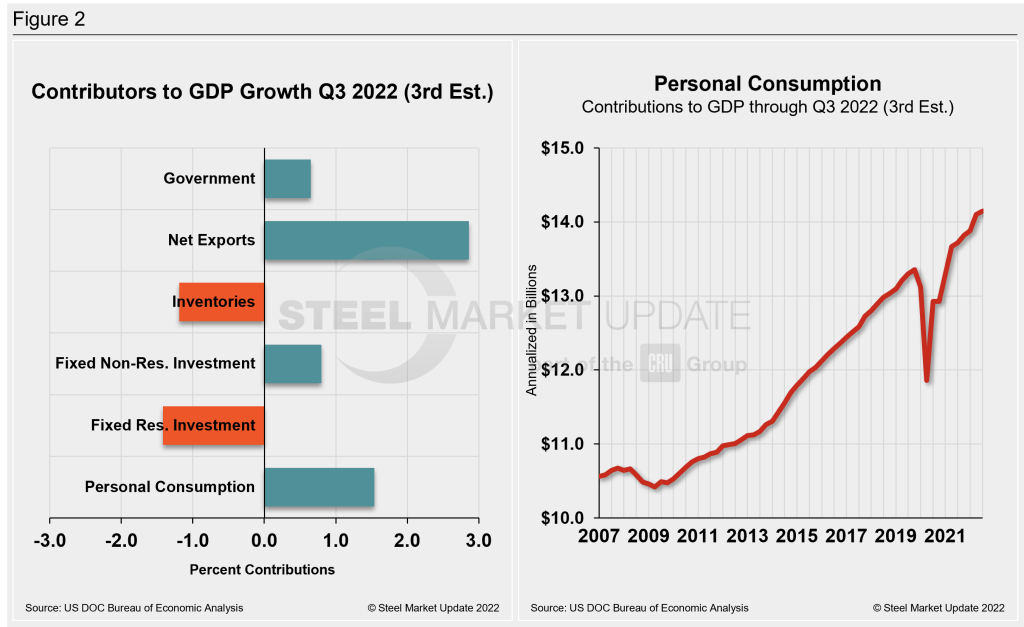

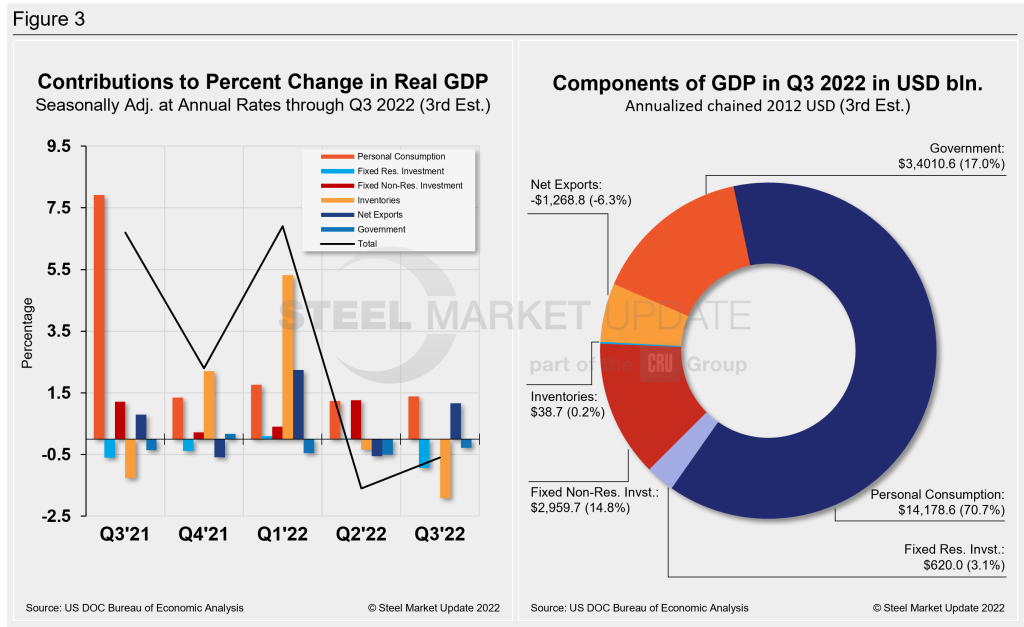

However, understanding an economy’s performance requires more than just knowing GDP. One must also consider other questions, such as how much of the increase in GDP is due to inflation versus real output, who is producing the output, what kind of output they are producing, what income is generated as a result, and how that income is used. To answer these questions, we provide two measures of GDP: nominal and real.

At the Bureau of Economic Analysis, we focus on the “real” measure of GDP, which is inflation-adjusted and reported in chained 2009 dollars. This measure provides a more accurate picture of economic growth over time.

As a premium member of SMU, you’ll have access to related articles and our analysis, which can be found on the right-hand side of this page. Stay informed and make sound decisions with the Bureau of Economic Analysis.